J.P.Morgan Investment Banking Pitch Book

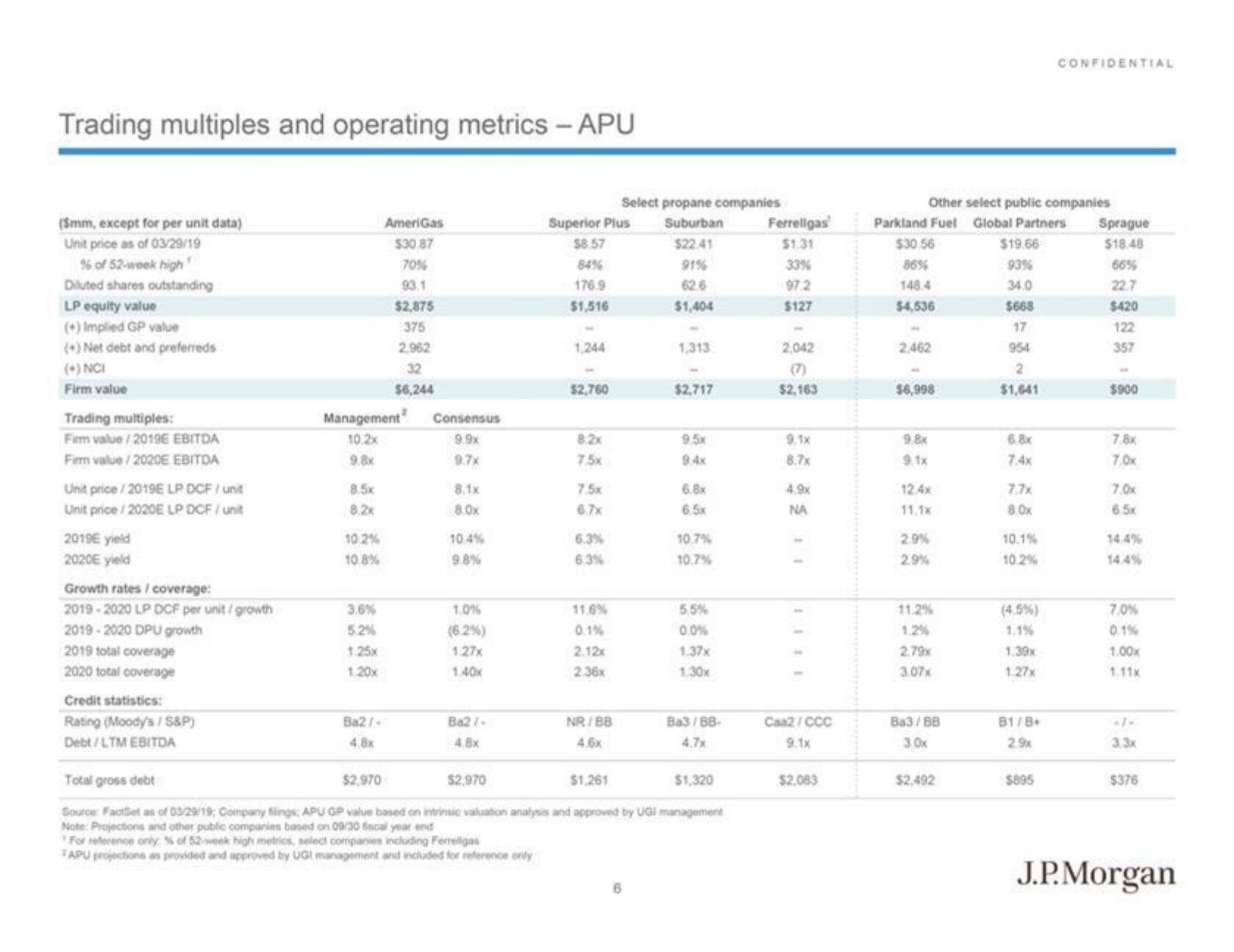

Trading multiples and operating metrics - APU

($mm, except for per unit data)

Unit price as of 03/29/19

% of 52-week high

Diluted shares outstanding

LP equity value

(+) Implied GP value

(+) Net debt and preferreds

(+) NCI

Firm value

Trading multiples:

Firm value/2019€ EBITDA

Firm value/2020E EBITDA

Unit price/2019E LP DCF / unit

Unit price / 2020E LP DCF / unit

2019€ yield

2020 yield

Growth rates / coverage:

2019-2020 LP DCF per unit / growth

2019-2020 DPU growth

2019 total coverage

2020 total coverage

Credit statistics:

Rating (Moody's / S&P)

Debt/LTM EBITDA

Management

10,2x

9.8x

8.5x

8.2x

10.2%

10.8%

3.6%

5.2%

1.25x

1,20x

Ba2/

4.8x

AmeriGas

$30.87

70%

93,1

$2,875

375

2,962

32

$6,244

$2,970

Consensus

9.9x

9.7x

8.1x

8.0x

10.4%

9.8%

1.0%

(6.2%)

1.27x

1.40x

Ba2 / ->

4.8x

$2,970

For reference only % of 52-week high metrics, select companies including Ferrellgas

APU projections as provided and approved by UGI management and included for reference only

Superior Plus

$8.57

84%

176.9

$1,516

1,244

$2,760

8.2x

7.5x

7.5x

6.7x

6.3%

6.3%

11.6%

0.1%

2.12x

2.36x

Select propane companies

Suburban

$22.41

91%

62.6

$1,404

NR/BB

4.6x

1,313

$2,717

9.5x

9.4x

6.8x

6.5x

10.7%

10.7%

5.5%

0.0%

Total gross debt

$1,261

$1,320

Source: FactSet as of 03/29/19; Company filings; APU GP value based on intrinsic valuation analysis and approved by UGI management

Note: Projections and other public companies based on 09/30 fiscal year end

1.37x

1.30x

Ba3/88-

4.7x

Ferrellgas

$1.31

33%

97.2

$127

2,042

$2,163

9.1x

8.7x

4.9x

NA

Caa2/CCC

9.1x

$2.083

Other select public companies

Parkland Fuel Global Partners

$30.56

86%

148.4

$4,536

2,462

$6,998

9.8x

9.1x

12.4x

11.1x

2.9%

2.9%

11.2%

1.2%

2.79x

3.07x

Ba3/BB

3.0x

$2,492

$19.66

93%

34.0

$668

17

954

2

$1,641

6.8x

7.4x

7.7x

8.0x

10.1%

10.2%

1.1%

1.39x

1.27x

81/8+

2.9x

CONFIDENTIAL

$895

Sprague

$18.48

66%

22.7

$420

122

357

$900

7.8x

7.0x

7.0x

6.5x

14.4%

7.0%

0.1%

1.00x

1.11x

3.3x

$376

J.P. MorganView entire presentation