TPG Results Presentation Deck

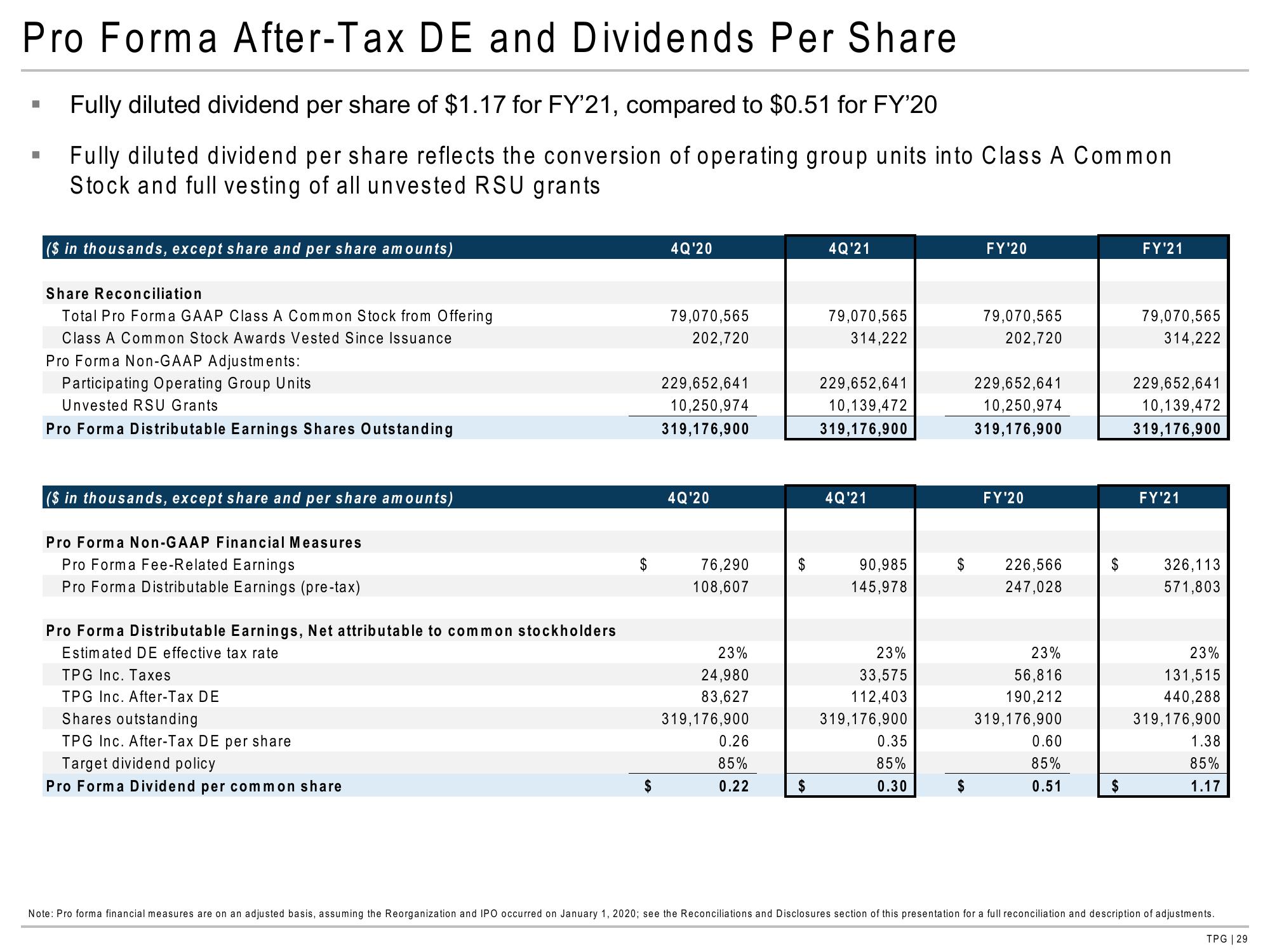

Pro Forma After-Tax DE and Dividends Per Share

Fully diluted dividend per share of $1.17 for FY'21, compared to $0.51 for FY'20

Fully diluted dividend per share reflects the conversion of operating group units into Class A Common

Stock and full vesting of all unvested RSU grants

I

I

($ in thousands, except share and per share amounts)

SI

Reconciliation

Total Pro Forma GAAP Class A Common Stock from Offering

Class A Common Stock Awards Vested Since Issuance

Pro Forma Non-GAAP Adjustments:

Participating Operating Group Units

Unvested RSU Grants

Pro Forma Distributable Earnings Shares Outstanding

($ in thousands, except share and per share amounts)

Pro Forma Non-GAAP Financial Measures

Pro Forma Fee-Related Earnings

Pro Forma Distributable Earnings (pre-tax)

Pro Forma Distributable Earnings, Net attributable to common stockholders

Estimated DE effective tax rate

TPG Inc. Taxes

TPG Inc. After-Tax DE

Shares outstanding

TPG Inc. After-Tax DE per share

Target dividend policy

Pro Forma Dividend per common share

$

$

4Q'20

79,070,565

202,720

229,652,641

10,250,974

319,176,900

4Q'20

76,290

108,607

23%

24,980

83,627

319,176,900

0.26

85%

0.22

$

$

4Q'21

79,070,565

314,222

229,652,641

10,139,472

319,176,900

4Q'21

90,985

145,978

23%

33,575

112,403

319,176,900

0.35

85%

0.30

$

$

FY¹20

79,070,565

202,720

229,652,641

10,250,974

319,176,900

FY'20

226,566

247,028

23%

56,816

190,212

319,176,900

0.60

85%

0.51

$

$

FY'21

79,070,565

314,222

229,652,641

10,139,472

319,176,900

FY'21

326,113

571,803

23%

131,515

440,288

319,176,900

1.38

85%

1.17

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO occurred on January 1, 2020; see the Reconciliations and Disclosures section of this presentation for a full reconciliation and description of adjustments.

TPG | 29View entire presentation