LegalZoom.com Investor Presentation Deck

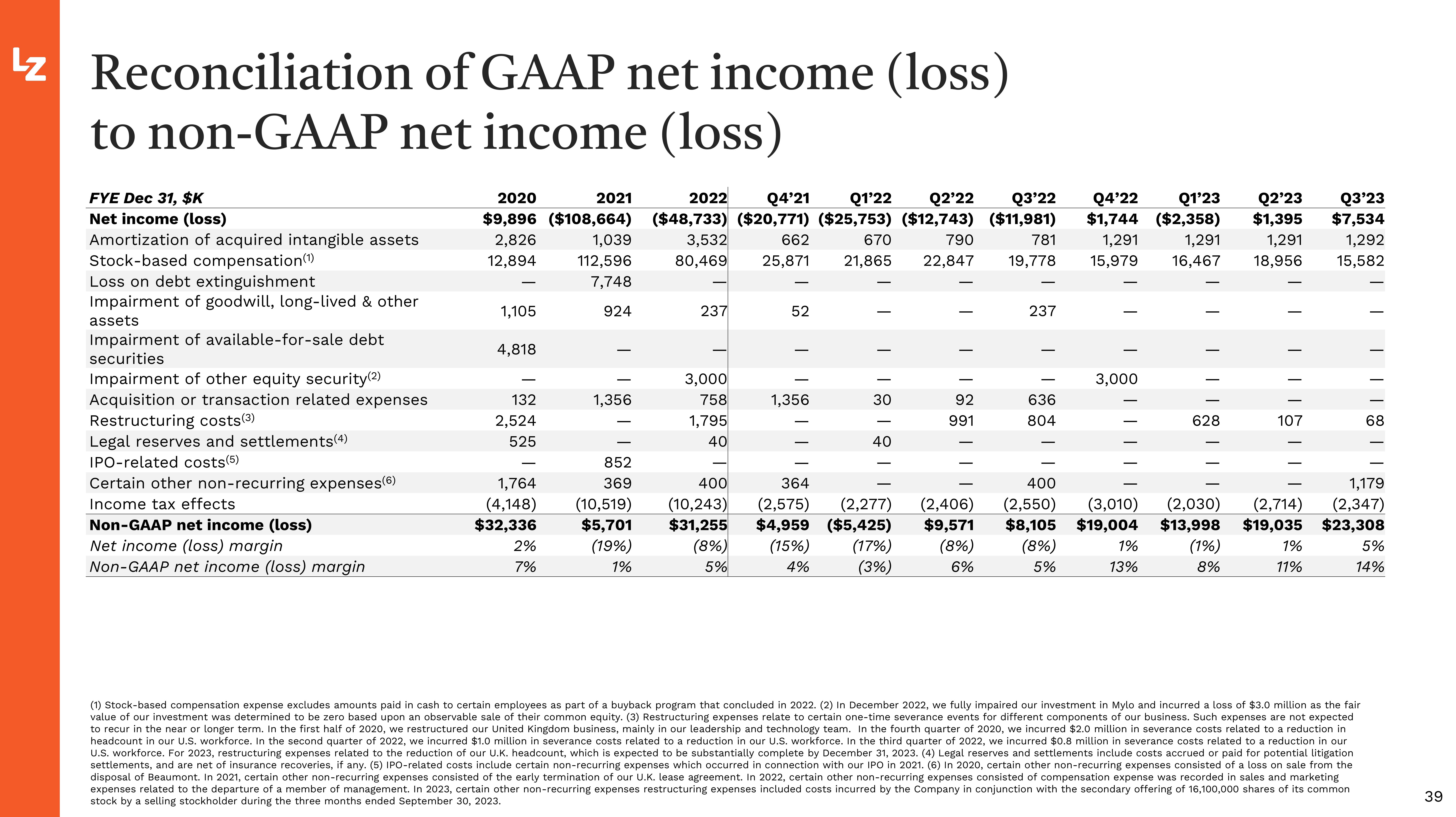

Lz Reconciliation of GAAP net income (loss)

to non-GAAP net income (loss)

FYE Dec 31, $K

Net income (loss)

Amortization of acquired intangible assets

Stock-based compensation (¹)

Loss on debt extinguishment

Impairment of goodwill, long-lived & other

assets

Impairment of available-for-sale debt

securities

Impairment of other equity security (2)

Acquisition or transaction related expenses

Restructuring costs(³)

Legal reserves and settlements (4)

IPO-related costs (5)

Certain other non-recurring expenses(6)

Income tax effects

Non-GAAP net income (loss)

Net income (loss) margin

Non-GAAP net income (loss) margin

2020

$9,896 ($108,664)

2,826

1,039

12,894 112,596

7,748

924

1,105

4,818

132

2,524

525

1,764

(4,148)

$32,336

2%

7%

2021

1,356

852

369

(10,519)

$5,701

(19%)

1%

2022 Q4'21 Q1'22 Q2'22 Q3'22

($48,733) ($20,771) ($25,753) ($12,743) ($11,981)

3,532

662

670

790

781

80,469 25,871 21,865 22,847 19,778

237

3,000

758

1,795

40

400

(10,243)

$31,255

(8%)

5%

52

1,356

|

T

T

18181

30

40

I

I

92

991

364

(2,575) (2,277) (2,406)

$4,959 ($5,425) $9,571

(15%) (17%) (8%)

4%

(3%)

6%

237

|

636

804

Q4'22 Q1'23 Q2'23

$1,744 ($2,358) $1,395

1,291 1,291

15,979 16,467

1,291

1,292

18,956 15,582

|81|||||

3,000

T

628

| |

T

107

Q3'23

$7,534

T

(1) Stock-based compensation expense excludes amounts paid in cash to certain employees as part of a buyback program that concluded in 2022. (2) In December 2022, we fully impaired our investment in Mylo and incurred a loss of $3.0 million as the fair

value of our investment was determined to be zero based upon an observable sale of their common equity. (3) Restructuring expenses relate to certain one-time severance events for different components of our business. Such expenses are not expected

to recur in the near or longer term. In the first half of 2020, we restructured our United Kingdom business, mainly in our leadership and technology team. In the fourth quarter of 2020, we incurred $2.0 million in severance costs related to a reduction in

headcount in our U.S. workforce. In the second quarter of 2022, we incurred $1.0 million in severance costs related to a reduction in our U.S. workforce. In the third quarter of 2022, we incurred $0.8 million in severance costs related to a reduction in our

U.S. workforce. For 2023, restructuring expenses related to the reduction of our U.K. headcount, which is expected to be substantially complete by December 31, 2023. (4) Legal reserves and settlements include costs accrued or paid for potential litigation

settlements, and are net of insurance recoveries, if any. (5) IPO-related costs include certain non-recurring expenses which occurred in connection with our IPO in 2021. (6) In 2020, certain other non-recurring expenses consisted of a loss on sale from the

disposal of Beaumont. In 2021, certain other non-recurring expenses consisted of the early termination of our U.K. lease agreement. In 2022, certain other non-recurring expenses consisted of compensation expense was recorded in sales and marketing

expenses related to the departure of a member of management. In 2023, certain other non-recurring expenses restructuring expenses included costs incurred by the Company in conjunction with the secondary offering of 16,100,000 shares of its common

stock by a selling stockholder during the three months ended September 30, 2023.

| | |

68

400

1,179

(2,550) (3,010) (2,030) (2,714) (2,347)

$8,105 $19,004 $13,998 $19,035 $23,308

(8%)

1%

(1%)

1%

5%

5%

13%

8%

11%

14%

39View entire presentation