Zegna Results Presentation Deck

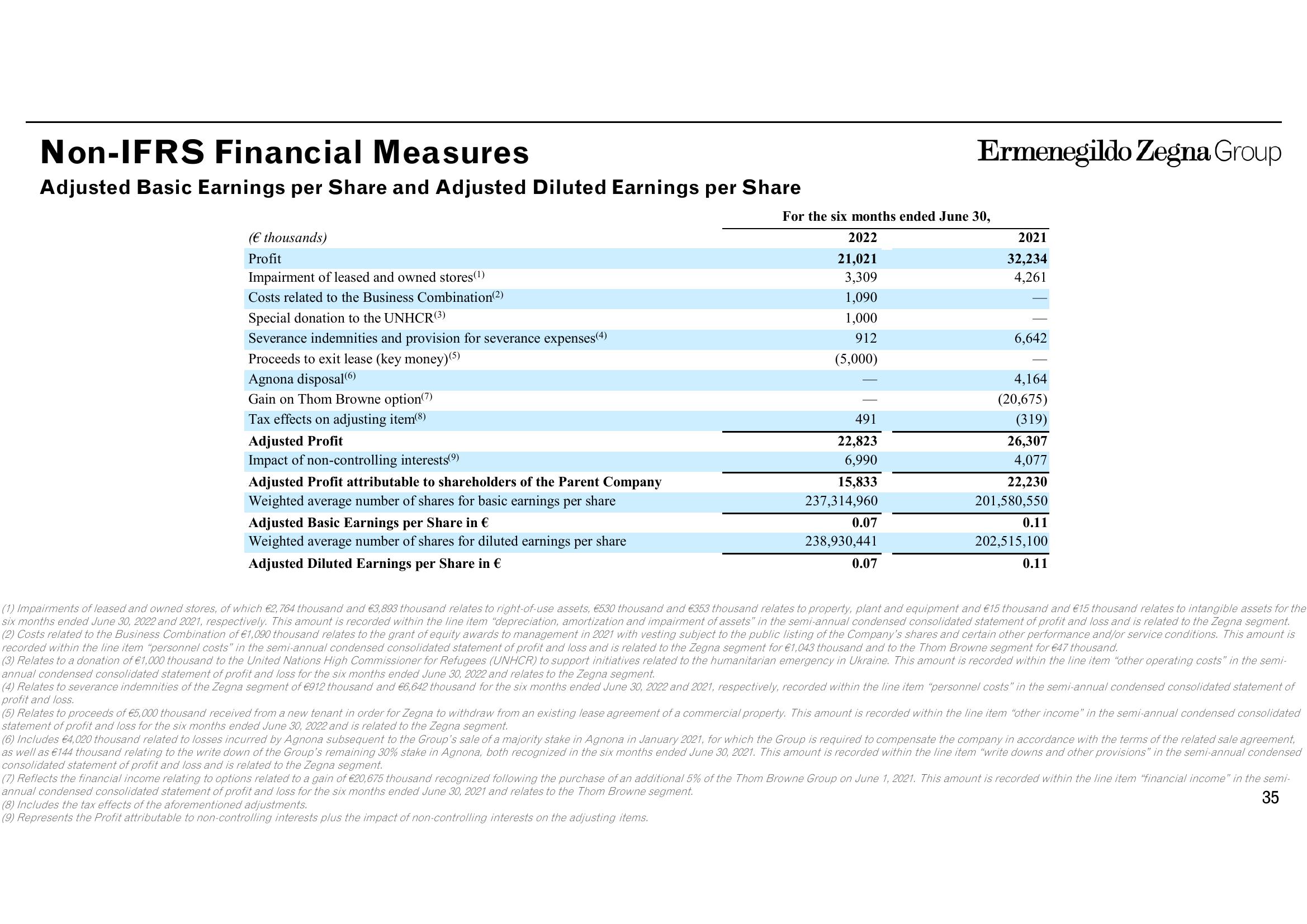

Non-IFRS Financial Measures

Adjusted Basic Earnings per Share and Adjusted Diluted Earnings per Share

(€ thousands)

Profit

Impairment of leased and owned stores(1)

Costs related to the Business Combination (2)

Special donation to the UNHCR (3)

Severance indemnities and provision for severance expenses(4)

Proceeds to exit lease (key money)(5)

Agnona disposal(6)

Gain on Thom Browne option(7)

Tax effects on adjusting item(8)

Adjusted Profit

Impact of non-controlling interests(⁹)

Adjusted Profit attributable to shareholders of the Parent Company

Weighted average number of shares for basic earnings per share

Adjusted Basic Earnings per Share in €

Weighted average number of shares for diluted earnings per share

Adjusted Diluted Earnings per Share in €

For the six months ended June 30,

2022

21,021

3,309

1,090

1,000

912

(5,000)

491

22,823

6,990

15,833

237,314,960

0.07

238,930,441

Ermenegildo Zegna Group

0.07

2021

32,234

4,261

6,642

4,164

(20,675)

(319)

26,307

4,077

22,230

201,580,550

0.11

202,515,100

0.11

(1) Impairments of leased and owned stores, of which €2,764 thousand and €3,893 thousand relates to right-of-use assets, €530 thousand and €353 thousand relates to property, plant and equipment and €15 thousand and €15 thousand relates to intangible assets for the

six months ended June 30, 2022 and 2021, respectively. This amount is recorded within the line item "depreciation, amortization and impairment of assets" in the semi-annual condensed consolidated statement of profit and loss and is related to the Zegna segment.

(2) Costs related to the Business Combination of €1,090 thousand relates to the grant of equity awards to management in 2021 with vesting subject to the public listing of the Company's shares and certain other performance and/or service conditions. This amount is

recorded within the line item "personnel costs" in the semi-annual condensed consolidated statement of profit and loss and is related to the Zegna segment for €1,043 thousand and to the Thom Browne segment for €47 thousand.

(3) Relates to a donation of €1,000 thousand to the United Nations High Commissioner for Refugees (UNHCR) to support initiatives related to the humanitarian emergency in Ukraine. This amount is recorded within the line item "other operating costs" in the semi-

annual condensed consolidated statement of profit and loss for the six months ended June 30, 2022 and relates to the Zegna segment.

(4) Relates to severance indemnities of the Zegna segment of €912 thousand and €6,642 thousand for the six months ended June 30, 2022 and 2021, respectively, recorded within the line item "personnel costs" in the semi-annual condensed consolidated statement of

profit and loss.

(5) Relates to proceeds of €5,000 thousand received from a new tenant in order for Zegna to withdraw from an existing lease agreement of a commercial property. This amount is recorded within the line item "other income" in the semi-annual condensed consolidated

statement of profit and loss for the six months ended June 30, 2022 and is related to the Zegna segment.

(6) Includes €4,020 thousand related to losses incurred by Agnona subsequent to the Group's sale of a majority stake in Agnona in January 2021, for which the Group is required to compensate the company in accordance with the terms of the related sale agreement,

as well as €144 thousand relating to the write down of the Group's remaining 30% stake in Agnona, both recognized in the six months ended June 30, 2021. This amount is recorded within the line item "write downs and other provisions" in the semi-annual condensed

consolidated statement of profit and loss and is related to the Zegna segment.

(7) Reflects the financial income relating to options related to a gain of €20,675 thousand recognized following the purchase of an additional 5% of the Thom Browne Group on June 1, 2021. This amount is recorded within the line item "financial income" in the semi-

annual condensed consolidated statement of profit and loss for the six months ended June 30, 2021 and relates to the Thom Browne segment.

35

(8) Includes the tax effects of the aforementioned adjustments.

(9) Represents the Profit attributable to non-controlling interests plus the impact of non-controlling interests on the adjusting items.View entire presentation