AeroFarms SPAC Presentation Deck

Transaction Summary - Pro Forma Equity Ownership

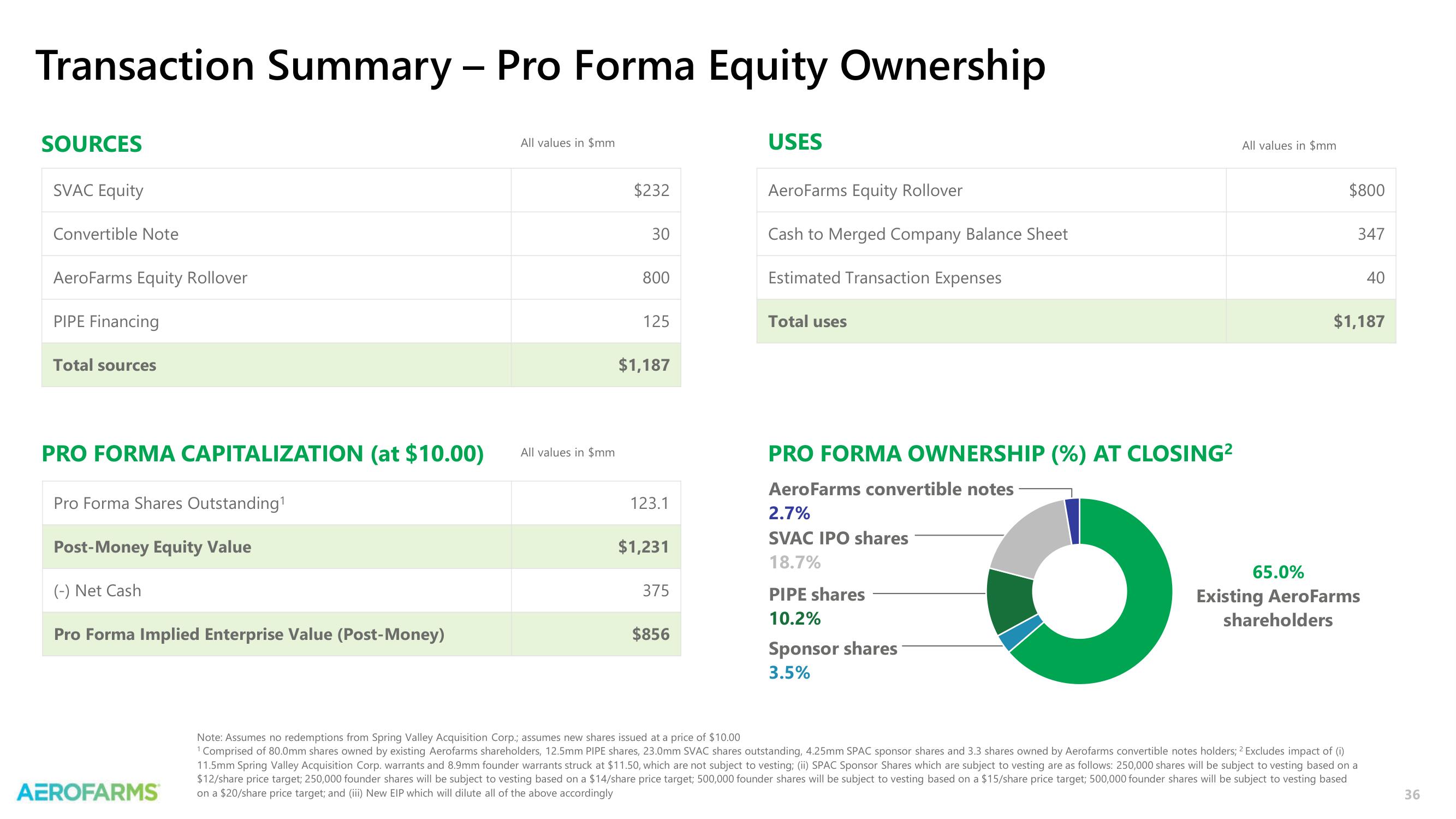

SOURCES

SVAC Equity

Convertible Note

AeroFarms Equity Rollover

PIPE Financing

Total sources

PRO FORMA CAPITALIZATION (at $10.00) All values in $mm

Pro Forma Shares Outstanding¹

Post-Money Equity Value

(-) Net Cash

Pro Forma Implied Enterprise Value (Post-Money)

All values in $mm

AEROFARMS

$232

30

800

125

$1,187

123.1

$1,231

375

$856

USES

AeroFarms Equity Rollover

Cash to Merged Company Balance Sheet

Estimated Transaction Expenses

Total uses

PRO FORMA OWNERSHIP (%) AT CLOSING²

AeroFarms convertible notes

2.7%

SVAC IPO shares

18.7%

●

PIPE shares

10.2%

Sponsor shares

3.5%

All values in $mm

65.0%

$800

347

$1,187

Existing AeroFarms

shareholders

40

Note: Assumes no redemptions from Spring Valley Acquisition Corp.; assumes new shares issued at a price of $10.00

¹ Comprised of 80.0mm shares owned by existing Aerofarms shareholders, 12.5mm PIPE shares, 23.0mm SVAC shares outstanding, 4.25mm SPAC sponsor shares and 3.3 shares owned by Aerofarms convertible notes holders; 2 Excludes impact of (i)

11.5mm Spring Valley Acquisition Corp. warrants and 8.9mm founder warrants struck at $11.50, which are not subject to vesting; (ii) SPAC Sponsor Shares which are subject to vesting are as follows: 250,000 shares will be subject to vesting based on a

$12/share price target; 250,000 founder shares will be subject to vesting based on a $14/share price target; 500,000 founder shares will be subject to vesting based on a $15/share price target; 500,000 founder shares will be subject to vesting based

on a $20/share price target; and (iii) New EIP which will dilute all of the above accordingly

36View entire presentation