Bank of America Investment Banking Pitch Book

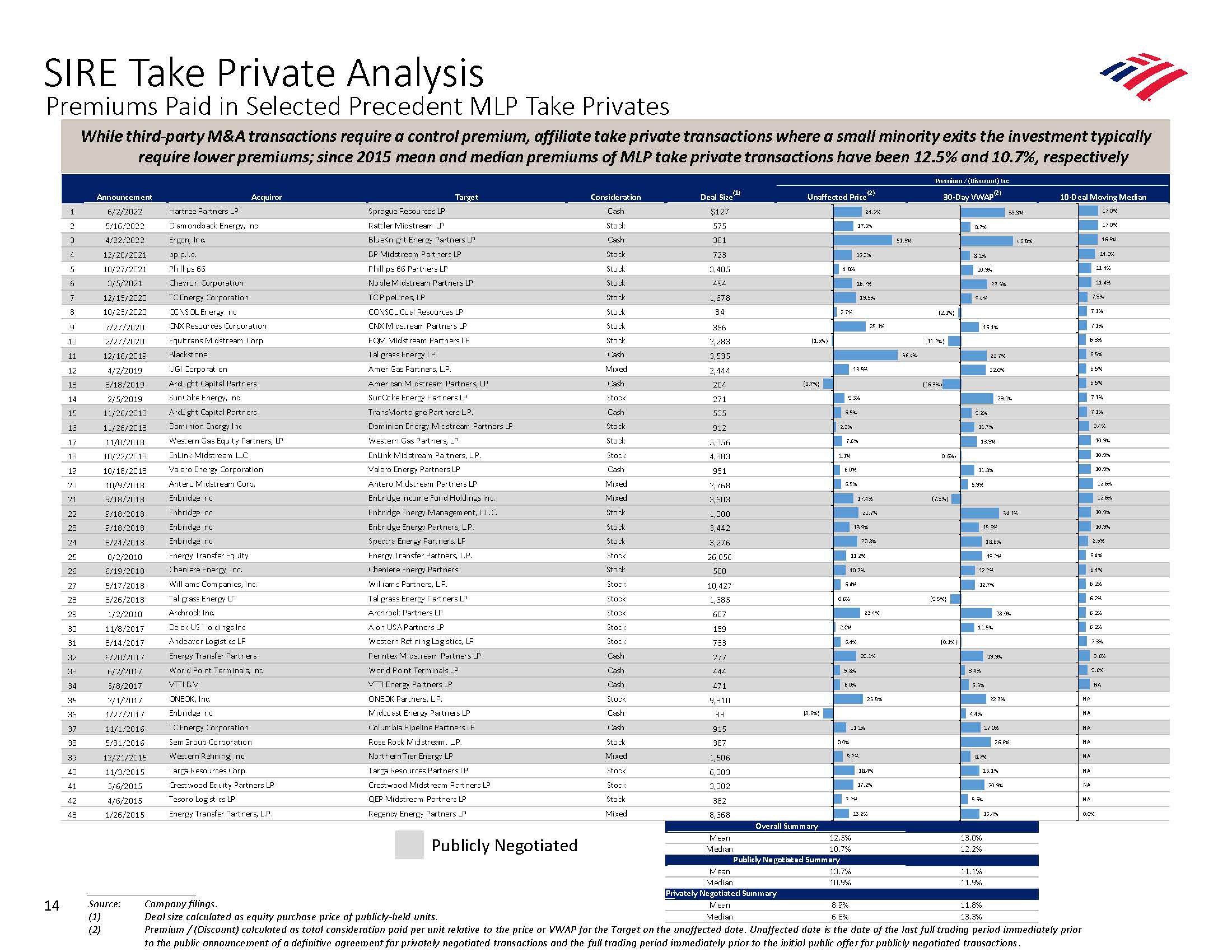

SIRE Take Private Analysis

Premiums Paid in Selected Precedent MLP Take Privates

14

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

While third-party M&A transactions require a control premium, affiliate take private transactions where a small minority exits the investment typically

require lower premiums; since 2015 mean and median premiums of MLP take private transactions have been 12.5% and 10.7%, respectively

Announcement

6/2/2022

5/16/2022

4/22/2022

12/20/2021

10/27/2021

3/5/2021

12/15/2020

10/23/2020

7/27/2020

2/27/2020

12/16/2019

4/2/2019

3/18/2019

2/5/2019

11/26/2018

11/26/2018

11/8/2018

10/22/2018

10/18/2018

10/9/2018

9/18/2018

9/18/2018

9/18/2018

8/24/2018

8/2/2018

6/19/2018

5/17/2018

3/26/2018

1/2/2018

11/8/2017

8/14/2017

6/20/2017

6/2/2017

5/8/2017

2/1/2017

1/27/2017

11/1/2016

5/31/2016

12/21/2015

11/3/2015

5/6/2015

4/6/2015

1/26/2015

Source:

(1)

(2)

Hartree Partners LP

Diamondback Energy, Inc.

Ergon, Inc.

bp p.l.c.

Phillips 66

Chevron Corporation

TC Energy Corporation

CONSOL Energy Inc

CNX Resources Corporation

Equitrans Midstream Corp.

Blackstone

Acquiror

UGI Corporation

ArcLight Capital Partners

Sun Coke Energy, Inc.

ArcLight Capital Partners

Dominion Energy Inc

Western Gas Equity Partners, LP

EnLink Midstream LLC

Valero Energy Corporation

Antero Midstream Corp.

Enbridge Inc.

Enbridge Inc.

Enbridge Inc.

Enbridge Inc.

Energy Transfer Equity

Cheniere Energy, Inc.

Williams Companies, Inc.

Tallgrass Energy LP

Archrock Inc.

Delek US Holdings Inc

Andeavor Logistics LP

Energy Transfer Partners

World Point Terminals, Inc.

VTTI B.V.

ONEOK, Inc.

Enbridge Inc.

TC Energy Corporation

Sem Group Corporation

Western Refining, Inc.

Targa Resources Corp.

Crest wood Equity Partners LP

Tesoro Logistics LP

Energy Transfer Partners, L.P.

Target

Sprague Resources LP

Rattler Midstream LP

BlueKnight Energy Partners LP

BP Midstream Partners LP

Phillips 66 Partners LP

Noble Midstream Partners LP

TC Pipelines, LP

CONSOL Coal Resources LP

CNX Midstream Partners LP

EQM Midstream Partners LP

Tallgrass Energy LP

AmeriGas Partners, L.P.

American Midstream Partners, LP

SunCoke Energy Partners LP

TransMontaigne Partners LP.

Dominion Energy Midstream Partners LP

Western Gas Partners, LP

EnLink Midstream Partners, L.P.

Valero Energy Partners LP

Antero Midstream Partners LP

Enbridge Income Fund Holdings Inc.

Enbridge Energy Management, L.L.C

Enbridge Energy Partners, L.P.

Spectra Energy Partners, LP

Energy Transfer Partners, LP.

Cheniere Energy Partners

Williams Partners, LP.

Tallgrass Energy Partners LP

Archrock Partners LP

Alon USA Partners LP

Western Refining Logistics, LP

Pennt ex Midstream Partners LP

World Point Terminals LP

VTTI Energy Partners LP

ONEOK Partners, LP.

Midcoast Energy Partners LP

Columbia Pipeline Partners LP

Rose Rock Midstream, LP.

Northern Tier Energy LP

Targa Resources Partners LP

Crestwood Midstream Partners LP

QEP Midstream Partners LP

Regency Energy Partners LP

Publicly Negotiated

Consideration

Cash

Stock

Cash

Stock

Stock

Stock

Stock

Stock

Stock

Stock

Cash

Mixed

Cash

Stock

Cash

Stock

Stock

Stock

Cash

Mixed

Mixed

Stock

Stock

Stock

Stock

Stock

Stock

Stock

Stock

Stock

Stock

Cash

Cash

Cash

Stock

Cash

Cash

Stock

Mixed

Stock

Stock

Stock

Mixed

Deal Size (1)

$127

575

301

723

3,485

494

1,678

34

356

2,283

3,535

2,444

204

271

535

912

5,056

4,883

951

2,768

3,603

1,000

3,442

3,276

26,856

580

10,427

1,685

607

159

733

277

444

471

9,310

83

915

387

1,506

6,083

3,002

382

8,668

Mean

Median

Unaffected Price (2)

(1.5%)

Mean

Median

Privately Negotiated Summary

Mean

Median

(8.7%)

(8.6%)

Overall Summary

4.8%

2.7%

2.2%

6.5%

1.1%

9.3%

7.6%

0.6%

6.0%

6.5%

2.0%

6.4%

16.2%

13.5%

0.0%

17.3%

6.4%

5.8%

16.7%

6.0%

Publicly Negotiated Summary

13.7%

10.9%

11.2%

10.7%

12.5%

10.7%

13.9%

24.3%

19.5%

17.4%

8.2%

7,2%

21.7%

20.8%

11.1%

28.1%

23.4%

20.1%

25.8%

18.4%

17.2%

13.2 %

51.5%

56.4%

Premium/(Discount) to:

30-Day VWAPⓇ)

(2.1%)

(11.2%)

(16.3%)

(0.6%)

(7.9%)

(9.5%)

(0.2%)

8.7%

8.1%

10.9%

9.4%

5.9%

11.7%

13.9%

16.1%

11.8%

3.4%

23.5%

6.5%

22.7%

12.2%

13.0%

12.2%

22.0%

15.9%

12,7%

11.1%

11.9%

11.5%

8.7%

5.6%

11.8%

13.3%

18.6%

19.2%

29.1%

19.9%

28.0%

17.0%

22.3%

16.1%

38.8%

34.1%

26.6%

20.9%

16.4%

46.3%

10-Deal Moving Median

17.0%

6.3%

NA

8.9%

Company filings.

6.8%

De al size calculated as equity purchase price of publicly-held units.

Premium / (Discount) calculated as total consideration paid per unit relative to the price or VWAP for the Target on the unaffected date. Unaffected date is the date of the last full trading period immediately prior

to the public announcement of a definitive agreement for privately negotiated transactions and the full trading period immediately prior to the initial public offer for publicly negotiated transactions.

NA

NA

16.5%

14.9%

6.5%

11.4%

7.1%

6.5%

6.5%

NA

11.4%

7.9%

7.1%

NA

NA

17.0%

NA

7.1%

7.1%

NA

9.4%

10.9%

6.4%

6.2%

10.9%

6.2%

10.9%

6.4%

12.6%

6.2%

6.2%

12.6%

0.0%

10.9%

10.9%

8.6%

7.3%

9.6%

9.6%

NAView entire presentation