KKR Real Estate Finance Trust Results Presentation Deck

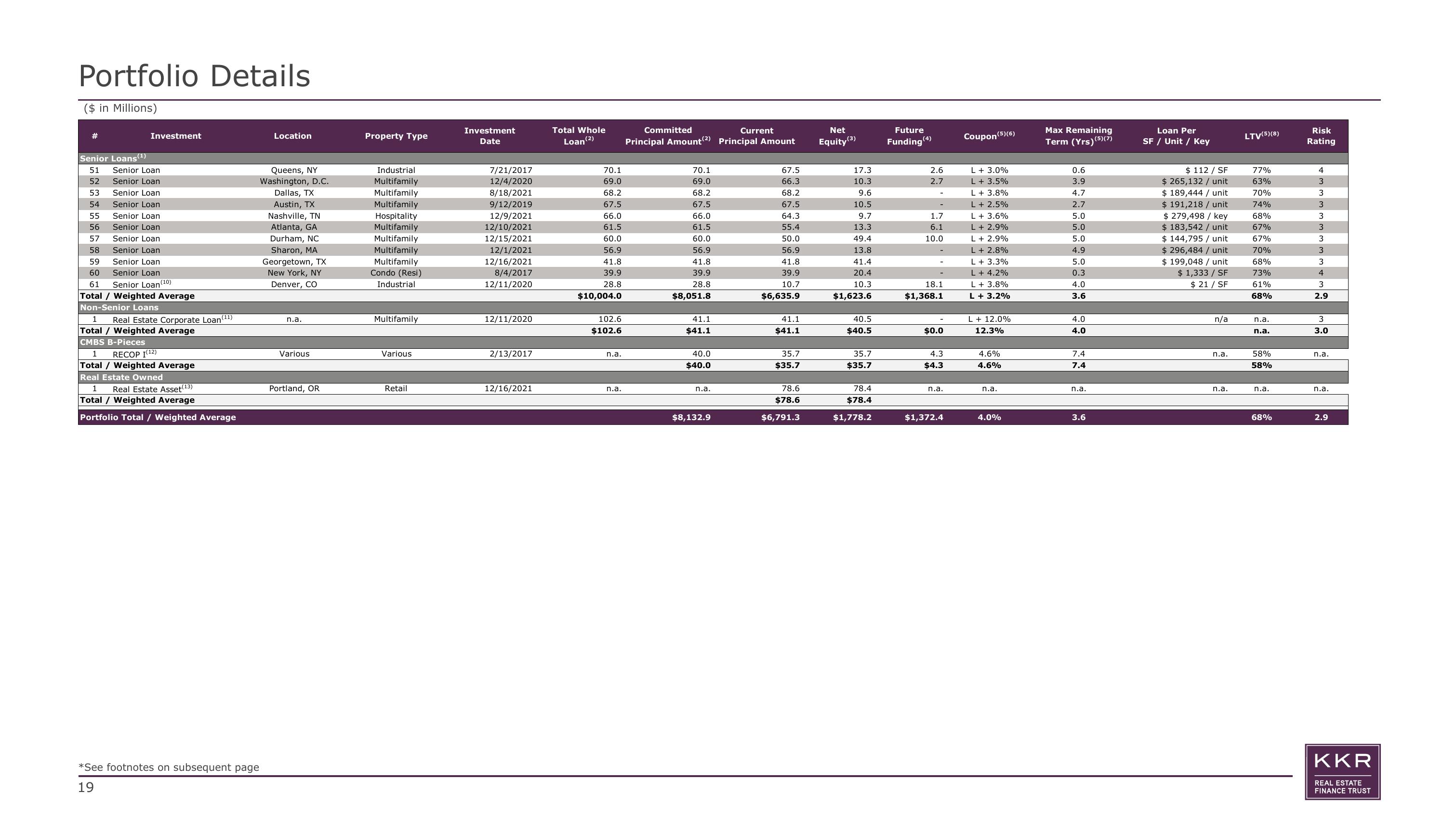

Portfolio Details

($ in Millions)

#

Senior Loans (1)

Investment

51 Senior Loan

52

Senior Loan

53 Senior Loan

54 Senior Loan

55

Senior Loan

56

Senior Loan

57

Senior Loan

58

Senior Loan

59

Senior Loan

60

Senior Loan

61 Senior Loan (10)

Total / Weighted Average

Non-Senior Loans

1

Total / Weighted Average

CMBS B-Pieces

Real Estate Corporate Loan (¹1)

1 RECOP I(¹2)

Total / Weighted Average

Real Estate Owned

1 Real Estate Asset (13)

Total / Weighted Average

Portfolio Total / Weighted Average

Location

Queens, NY

Washington, D.C.

Dallas, TX

Austin, TX

Nashville, TN

Atlanta, GA

Durham, NC

Sharon, MA

Georgetown, TX

New York, NY

Denver, CO

*See footnotes on subsequent page

19

n.a.

Various

Portland, OR

Property Type

Industrial

Multifamily

Multifamily

Multifamily

Hospitality

Multifamily

Multifamily

Multifamily

Multifamily

Condo (Resi)

Industrial

Multifamily

Various

Retail

Investment

Date

7/21/2017

12/4/2020

8/18/2021

9/12/2019

12/9/2021

12/10/2021

12/15/2021

12/1/2021

12/16/2021

8/4/2017

12/11/2020

12/11/2020

2/13/2017

12/16/2021

Total Whole

Loan (2)

70.1

69.0

68.2

67.5

66.0

61.5

60.0

56.9

41.8

39.9

28.8

$10,004.0

102.6

$102.6

n.a.

n.a.

Committed

Principal Amount (2) Principal Amount

70.1

69.0

68.2

67.5

66.0

61.5

60.0

56.9

41.8

39.9

28.8

$8,051.8

41.1

$41.1

40.0

$40.0

n.a.

$8,132.9

Current

67.5

66.3

68.2

67.5

64.3

55.4

50.0

56.9

41.8

39.9

10.7

$6,635.9

41.1

$41.1

35.7

$35.7

78.6

$78.6

$6,791.3

Net

Equity (3)

17.3

10.3

9.6

10.5

9.7

13.3

49.4

13.8

41.4

20.4

10.3

$1,623.6

40.5

$40.5

35.7

$35.7

78.4

$78.4

$1,778.2

Future

Funding (4)

2.6

2.7

1.7

6.1

10.0

18.1

$1,368.1

$0.0

4.3

$4.3

n.a.

$1,372.4

Coupon (5) (6)

L + 3.0%

L + 3.5%

L + 3.8%

L + 2.5%

L + 3.6%

L + 2.9%

L + 2.9%

L + 2.8%

L + 3.3%

L + 4.2%

L + 3.8%

L + 3.2%

L + 12.0%

12.3%

4.6%

4.6%

n.a.

4.0%

Max Remaining

Term (Yrs) (5) (7)

0.6

3.9

4.7

2.7

5.0

5.0

5.0

4.9

5.0

0.3

4.0

3.6

4.0

4.0

7.4

7.4

n.a.

3.6

Loan Per

SF / Unit / Key

$ 112 / SF

$ 265,132 / unit

$ 189,444 / unit

$191,218 / unit

$ 279,498 key

$ 183,542 / unit

$ 144,795 / unit

$ 296,484 / unit

$ 199,048 / unit

$ 1,333 / SF

$ 21 / SF

n/a

n.a.

n.a.

LTV (5)(8)

77%

63%

70%

74%

68%

67%

67%

70%

68%

73%

61%

68%

n.a.

n.a.

58%

58%

n.a.

68%

Risk

Rating

4

3

3

3

3

3

3

3

3

4

3

2.9

3

3.0

n.a.

n.a.

2.9

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation