Maersk Investor Presentation Deck

●

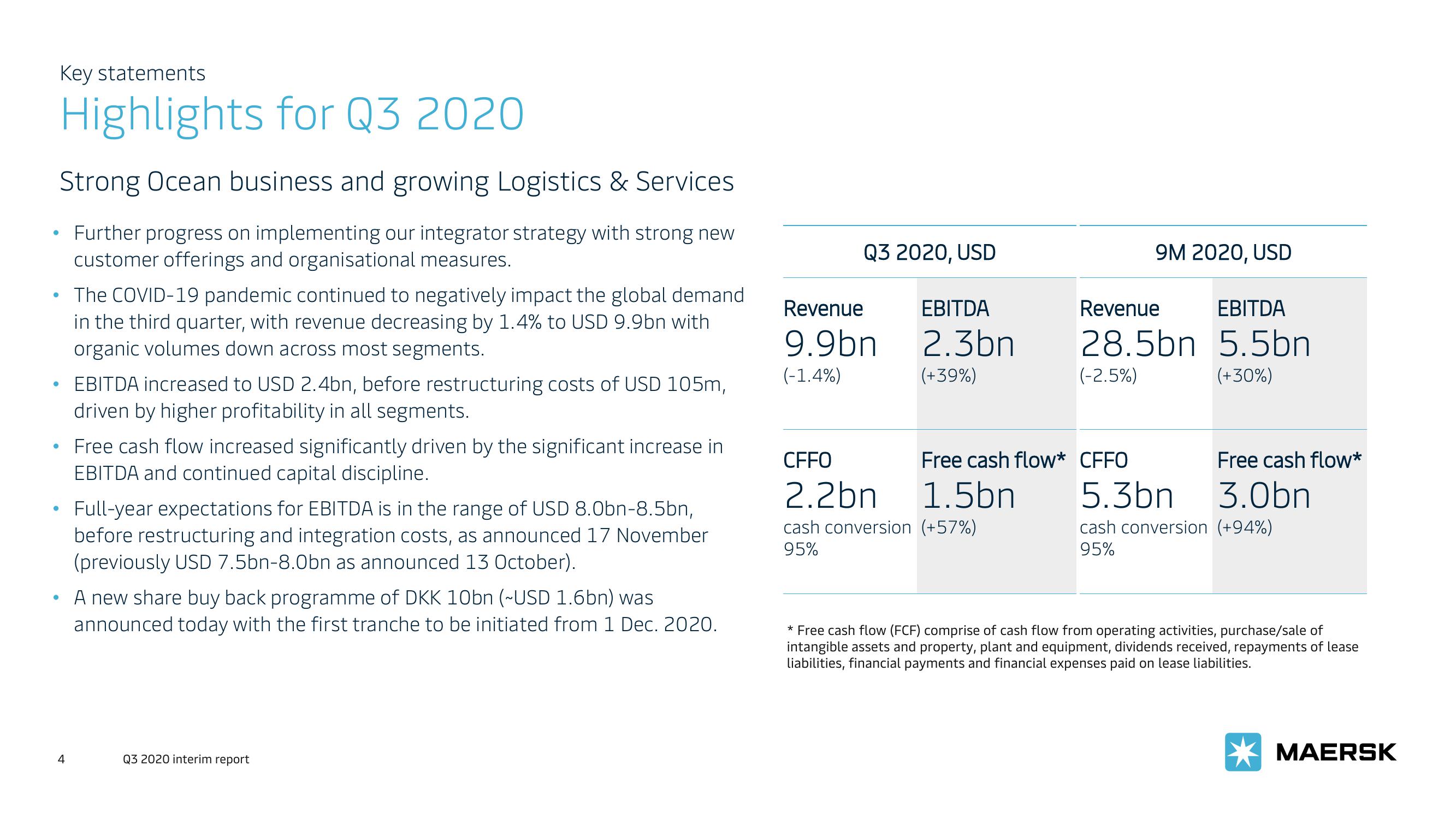

Strong Ocean business and growing Logistics & Services

Further progress on implementing our integrator strategy with strong new

customer offerings and organisational measures.

Key statements

Highlights for Q3 2020

• The COVID-19 pandemic continued to negatively impact the global demand

in the third quarter, with revenue decreasing by 1.4% to USD 9.9bn with

organic volumes down across most segments.

●

●

4

EBITDA increased to USD 2.4bn, before restructuring costs of USD 105m,

driven by higher profitability in all segments.

Free cash flow increased significantly driven by the significant increase in

EBITDA and continued capital discipline.

Full-year expectations for EBITDA is in the range of USD 8.0bn-8.5bn,

before restructuring and integration costs, as announced 17 November

(previously USD 7.5bn-8.0bn as announced 13 October).

A new share buy back programme of DKK 10bn (~USD 1.6bn) was

announced today with the first tranche to be initiated from 1 Dec. 2020.

Q3 2020 interim report

Q3 2020, USD

Revenue

9.9bn

(-1.4%)

EBITDA

2.3bn

(+39%)

CFFO

2.2bn

cash conversion (+57%)

95%

9M 2020, USD

Revenue

EBITDA

28.5bn 5.5bn

(-2.5%)

(+30%)

Free cash flow* CFFO

1.5bn

5.3bn

Free cash flow*

3.0bn

cash conversion (+94%)

95%

* Free cash flow (FCF) comprise of cash flow from operating activities, purchase/sale of

intangible assets and property, plant and equipment, dividends received, repayments of lease

liabilities, financial payments and financial expenses paid on lease liabilities.

MAERSKView entire presentation