Allego Investor Presentation Deck

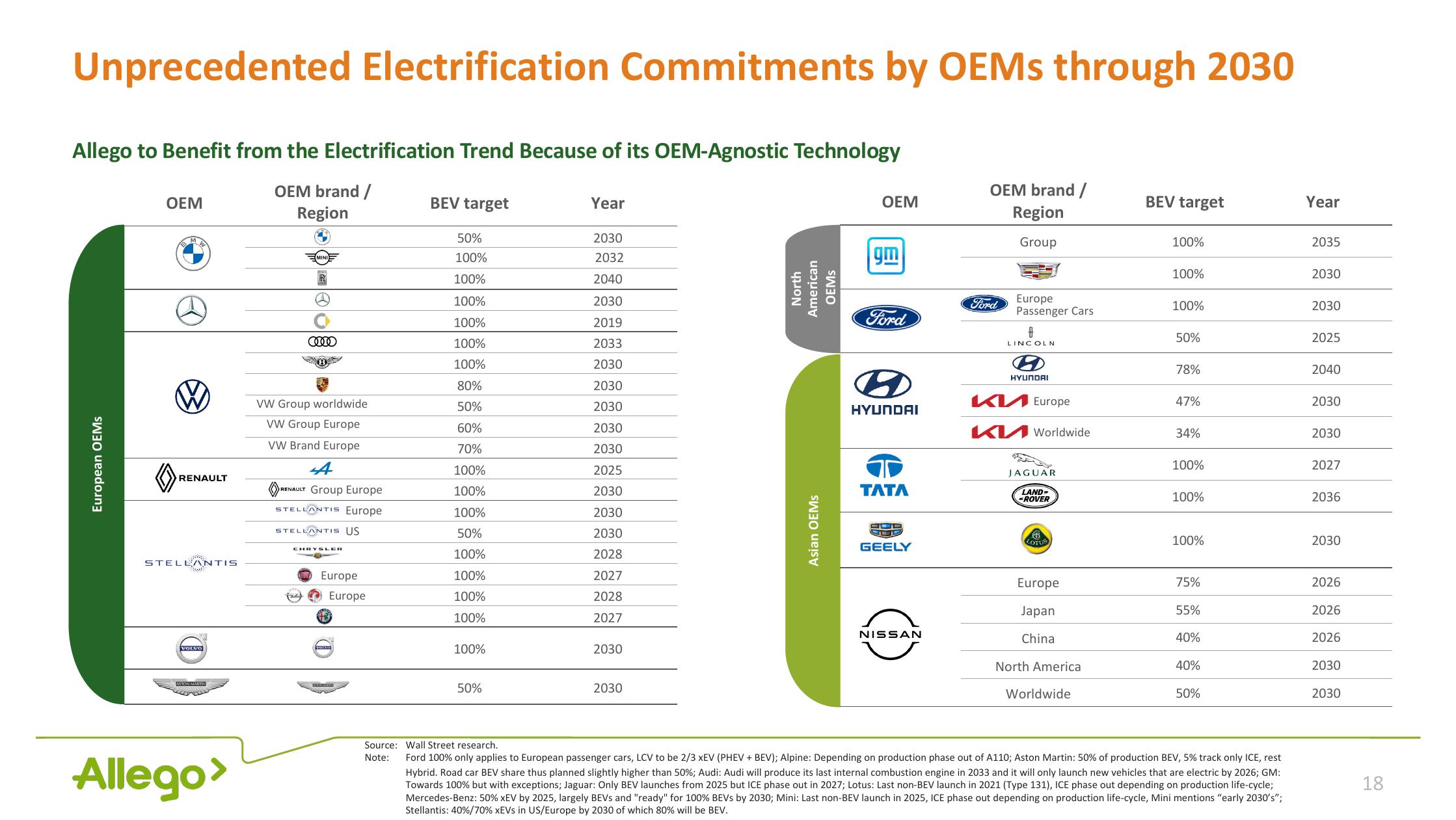

Unprecedented Electrification Commitments by OEMs through 2030

Allego to Benefit from the Electrification Trend Because of its OEM-Agnostic Technology

OEM brand /

Region

European OEMs

OEM

MW

RENAULT

STELLANTIS

Twi

VOLVO

ASTON MARTIN

Allego>

VW Group worldwide

VW Group Europe

VW Brand Europe

A

RENAULT Group Europe

STELLANTIS Europe

STELLANTIS US

CHRYSLER

Europe

43

Europe

SVESTE VID

wame

BEV target

50%

100%

100%

100%

100%

100%

100%

80%

50%

60%

70%

100%

100%

100%

50%

100%

100%

100%

100%

100%

50%

Year

2030

2032

2040

2030

2019

2033

2030

2030

2030

2030

2030

2025

2030

2030

2030

2028

2027

2028

2027

2030

2030

North

American

OEMS

Asian OEMs

OEM

gm

Ford

Ø

HYUNDAI

TATA

DOC

GEELY

NISSAN

OEM brand /

Region

Group

Ford

Europe

Passenger Cars

0

LINCOLN

8

HYUNDAI

KL Europe

KL Worldwide

JAGUAR

LAND-

-ROVER

B

LOTUS

Europe

Japan

China

North America

Worldwide

BEV target

100%

100%

100%

50%

78%

47%

34%

100%

100%

100%

75%

55%

40%

40%

50%

Source: Wall Street research.

Note: Ford 100% only applies to European passenger cars, LCV to be 2/3 xEV (PHEV + BEV); Alpine: Depending on production phase out of A110; Aston Martin: 50% of production BEV, 5% track only ICE, rest

Hybrid. Road car BEV share thus planned slightly higher than 50%; Audi: Audi will produce its last internal combustion engine in 2033 and it will only launch new vehicles that are electric by 2026; GM:

Towards 100% but with exceptions; Jaguar: Only BEV launches from 2025 but ICE phase out in 2027; Lotus: Last non-BEV launch in 2021 (Type 131), ICE phase out depending on production life-cycle;

Mercedes-Benz: 50% XEV by 2025, largely BEVs and "ready" for 100% BEVs by 2030; Mini: Last non-BEV launch in 2025, ICE phase out depending on production life-cycle, Mini mentions "early 2030's";

Stellantis: 40%/70% xEVs in US/Europe by 2030 of which 80% will be BEV.

Year

2035

2030

2030

2025

2040

2030

2030

2027

2036

2030

2026

2026

2026

2030

2030

18View entire presentation