Pathward Financial Results Presentation Deck

STRONG CAPITAL AND SOURCES OF LIQUIDITY

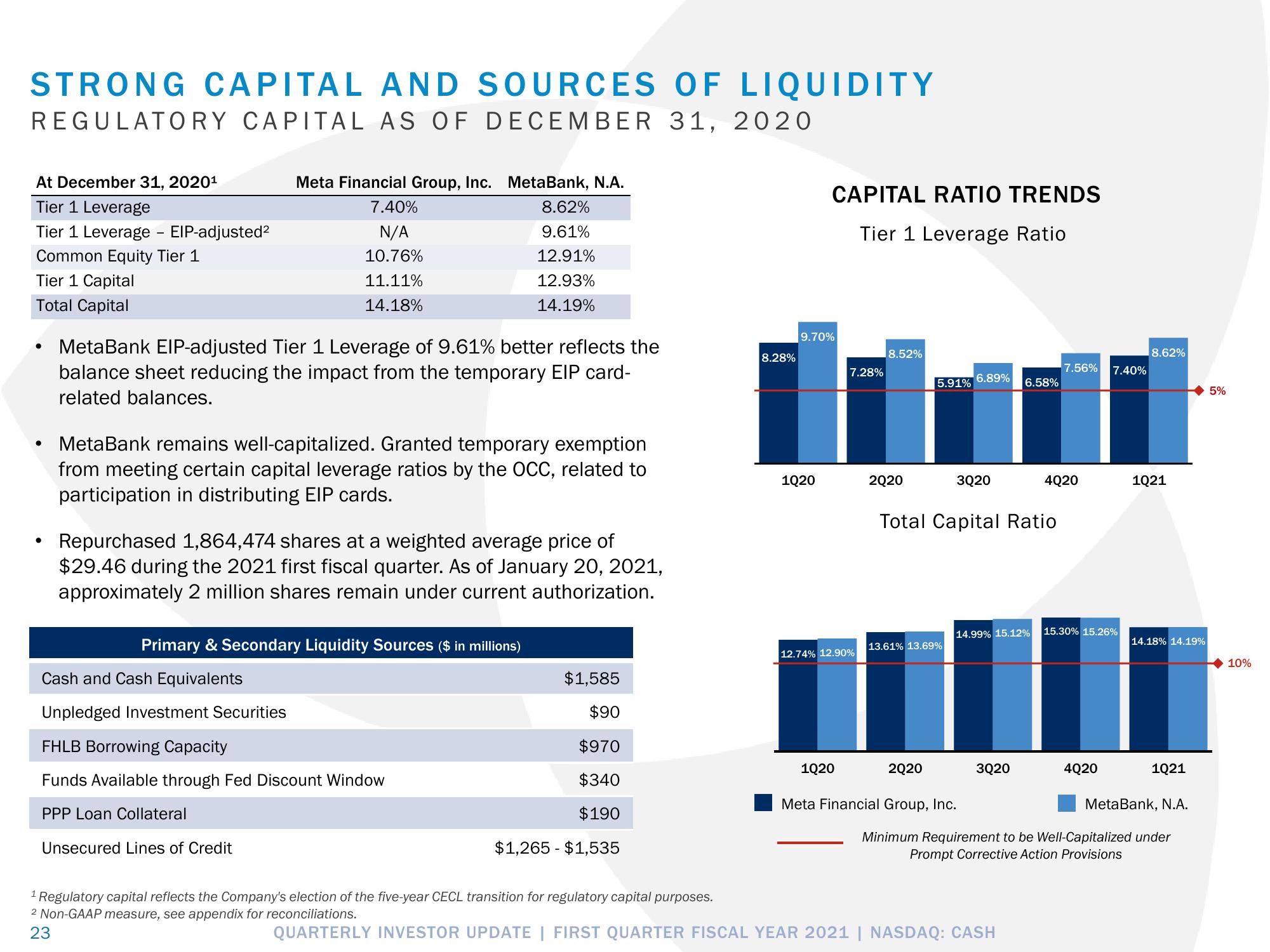

REGULATORY CAPITAL AS OF DECEMBER 31, 2020

At December 31, 2020¹

Tier 1 Leverage

Tier 1 Leverage - EIP-adjusted²

Common Equity Tier 1

Tier 1 Capital

Total Capital

●

●

●

Meta Financial Group, Inc. MetaBank, N.A.

8.62%

9.61%

12.91%

12.93%

14.19%

7.40%

N/A

10.76%

11.11%

14.18%

MetaBank EIP-adjusted Tier 1 Leverage of 9.61% better reflects the

balance sheet reducing the impact from the temporary EIP card-

related balances.

MetaBank remains well-capitalized. Granted temporary exemption

from meeting certain capital leverage ratios by the OCC, related to

participation in distributing EIP cards.

Repurchased 1,864,474 shares at a weighted average price of

$29.46 during the 2021 first fiscal quarter. As of January 20, 2021,

approximately 2 million shares remain under current authorization.

Primary & Secondary Liquidity Sources ($ in millions)

Cash and Cash Equivalents

Unpledged Investment Securities

FHLB Borrowing Capacity

Funds Available through Fed Discount Window

PPP Loan Collateral

Unsecured Lines of Credit

$1,585

$90

$970

$340

$190

$1,265 $1,535

-

1

Regulatory capital reflects the Company's election of the five-year CECL transition for regulatory capital purposes.

2 Non-GAAP measure, see appendix for reconciliations.

23

8.28%

CAPITAL RATIO TRENDS

Tier 1 Leverage Ratio

9.70%

1020

7.28%

12.74% 12.90%

1Q20

8.52%

2020

5.91%

13.61% 13.69%

2Q20

6.89%

3Q20

Total Capital Ratio

Meta Financial Group, Inc.

14.99% 15.12%

6.58%

3Q20

QUARTERLY INVESTOR UPDATE | FIRST QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

7.56%

4Q20

7.40%

15.30% 15.26%

4Q20

8.62%

1021

14.18% 14.19%

1021

MetaBank, N.A.

Minimum Requirement to be Well-Capitalized under

Prompt Corrective Action Provisions

5%

10%View entire presentation