Sema4 SPAC

29

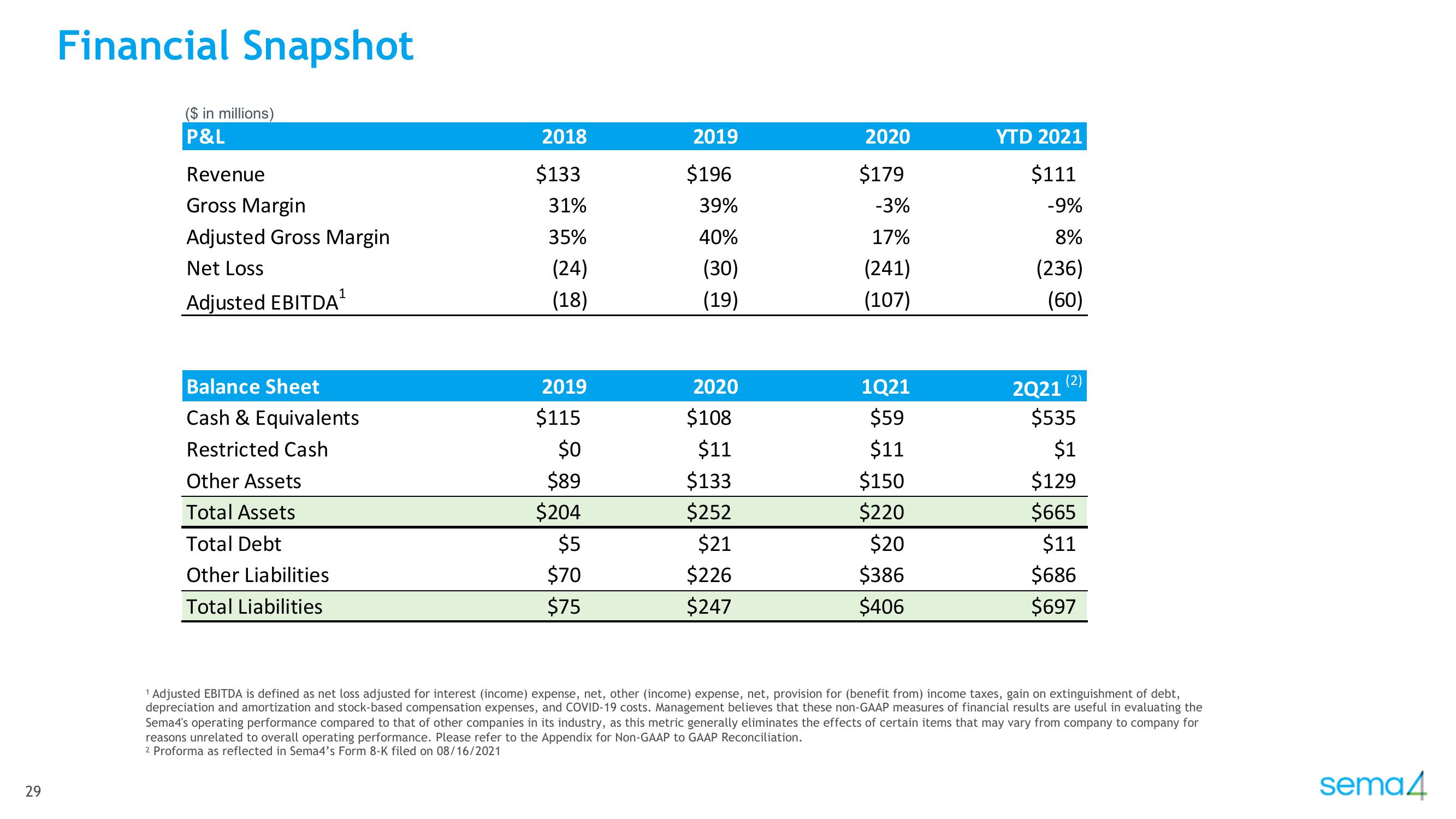

Financial Snapshot

($ in millions)

P&L

Revenue

Gross Margin

Adjusted Gross Margin

Net Loss

1

Adjusted EBITDA ¹

Balance Sheet

Cash & Equivalents

Restricted Cash

Other Assets

Total Assets

Total Debt

Other Liabilities

Total Liabilities

2018

$133

31%

35%

(24)

(18)

2019

$115

$0

$89

$204

$5

$70

$75

2019

$196

39%

40%

(30)

(19)

2020

$108

$11

$133

$252

$21

$226

$247

2020

$179

-3%

17%

(241)

(107)

1Q21

$59

$11

$150

$220

$20

$386

$406

YTD 2021

$111

-9%

8%

(236)

(60)

2Q21

(2)

$535

$1

$129

$665

$11

$686

$697

¹ Adjusted EBITDA is defined as net loss adjusted for interest (income) expense, net, other (income) expense, net, provision for (benefit from) income taxes, gain on extinguishment of debt,

depreciation and amortization and stock-based compensation expenses, and COVID-19 costs. Management believes that these non-GAAP measures of financial results are useful in evaluating the

Sema4's operating performance compared to that of other companies in its industry, as this metric generally eliminates the effects of certain items that may vary from company to company for

reasons unrelated to overall operating performance. Please refer to the Appendix for Non-GAAP to GAAP Reconciliation.

2 Proforma as reflected in Sema4's Form 8-K filed on 08/16/2021

sema4View entire presentation