Investing in Private Credit

Residential real estate lending

Newly-originated residential loan acquisition

Theme: Continued Pullback in Capital Availability

Investment background

PIMCO has been active acquiring newly originated non-Qualified mortgage loans with strict criteria to prime borrowers with conservative LTVs

PIMCO has also been active in other more idiosyncratic forms of new issue residential lending such as bridge loans or 2nd charge mortgage loans

The U.S. non-QM market is poised for growth driven by strong fundamentals and regulatory / policy changes

• PIMCO has partnered with a variety of originators since 2014 for purchases of non-QM loans

Valuations today supported by rising homeowner equity over the last decade and improved consumer credit profiles

●

●

●

Seattle Wa

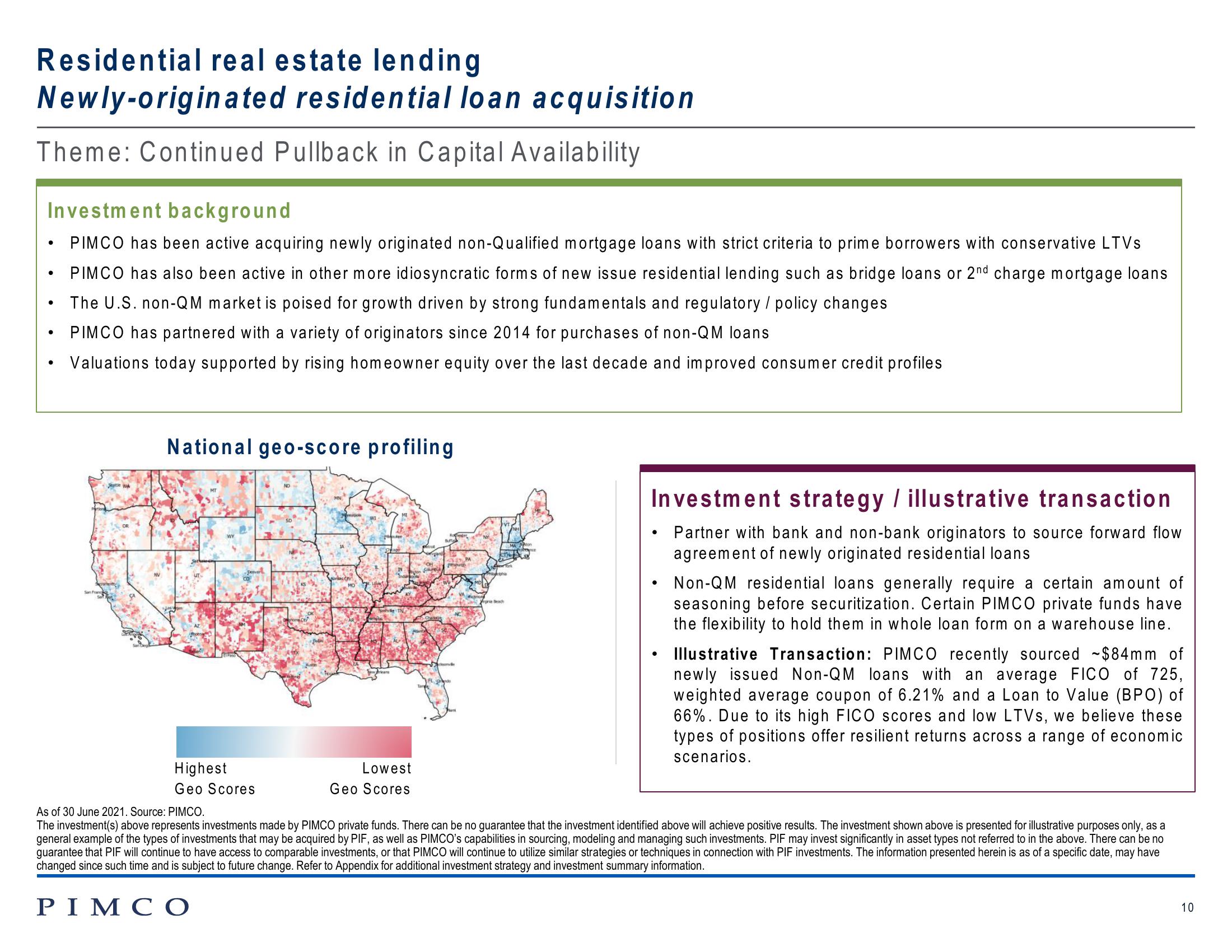

National geo-score profiling

Highest

Geo Scores

Lowest

Geo Scores

OH

Staros

perputh

csom

VA

26 Jense Beach

Investment strategy / illustrative transaction

Partner with bank and non-bank originators to source forward flow

agreement of newly originated residential loans

●

.

.

Non-QM residential loans generally require a certain amount of

seasoning before securitization. Certain PIMCO private funds have

the flexibility to hold them in whole loan form on a warehouse line.

Illustrative Transaction: PIMCO recently sourced $84mm of

newly issued Non-QM loans with an average FICO of 725,

weighted average coupon of 6.21% and a Loan to Value (BPO) of

66%. Due to its high FICO scores and low LTVs, we believe these

types of positions offer resilient returns across a range of economic

scenarios.

As of 30 June 2021. Source: PIMCO.

The investment(s) above represents investments made by PIMCO private funds. There can be no guarantee that the investment identified above will achieve positive results. The investment shown above is presented for illustrative purposes only, as a

general example of the types of investments that may be acquired by PIF, as well as PIMCO's capabilities in sourcing, modeling and managing such investments. PIF may invest significantly in asset types not referred to in the above. There can be no

guarantee that PIF will continue to have access to comparable investments, or that PIMCO will continue to utilize similar strategies or techniques in connection with PIF investments. The information presented herein is as of a specific date, may have

changed since such time and is subject to future change. Refer to Appendix for additional investment strategy and investment summary information.

PIMCO

10View entire presentation