Morgan Stanley Investment Banking Pitch Book

Project Roosevelt

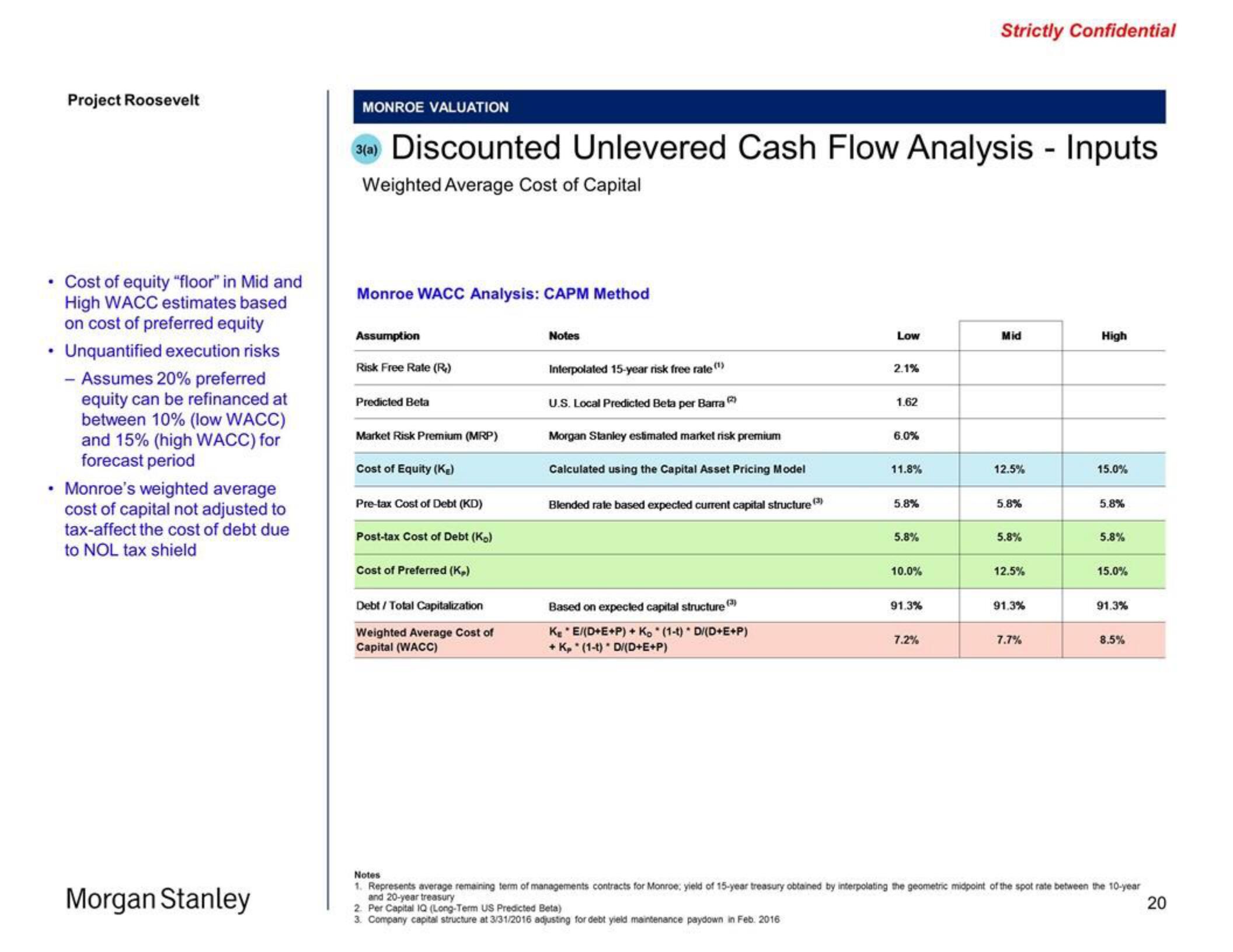

Cost of equity "floor" in Mid and

High WACC estimates based

on cost of preferred equity

.

• Unquantified execution risks

- Assumes 20% preferred

equity can be refinanced at

between 10% (low WACC)

and 15% (high WACC) for

forecast period

• Monroe's weighted average

cost of capital not adjusted to

tax-affect the cost of debt due

to NOL tax shield

Morgan Stanley

MONROE VALUATION

3(a) Discounted Unlevered Cash Flow Analysis - Inputs

Weighted Average Cost of Capital

Monroe WACC Analysis: CAPM Method

Assumption

Risk Free Rate (R₂)

Predicted Beta

Market Risk Premium (MRP)

Cost of Equity (K₂)

Pre-tax Cost of Debt (KD)

Post-tax Cost of Debt (Kg)

Cost of Preferred (K₂)

Debt/Total Capitalization

Weighted Average Cost of

Capital (WACC)

Notes

Interpolated 15-year risk free rate (¹)

U.S. Local Predicted Beta per Barra

Morgan Stanley estimated market risk premium

Calculated using the Capital Asset Pricing Model

Blended rate based expected current capital structure (3)

Based on expected capital structure (3)

K₂ *E/(D+E+P) + K, *(1-1) * D/(D+E+P)

+ K, *(1-1) D/(D+E+P)

Low

2.1%

1.62

6.0%

11.8%

5.8%

5.8%

10.0%

91.3%

Strictly Confidential

7.2%

Mid

12.5%

5.8%

5.8%

12.5%

91.3%

7.7%

High

15.0%

5.8%

5.8%

15.0%

91.3%

8.5%

Notes

1. Represents average remaining term of managements contracts for Monroe; yield of 15-year treasury obtained by interpolating the geometric midpoint of the spot rate between the 10-year

and 20-year treasury

2. Per Capital IQ (Long-Term US Predicted Beta)

3. Company capital structure at 3/31/2016 adjusting for debt yield maintenance paydown in Feb. 2016

20View entire presentation