jetBlue Mergers and Acquisitions Presentation Deck

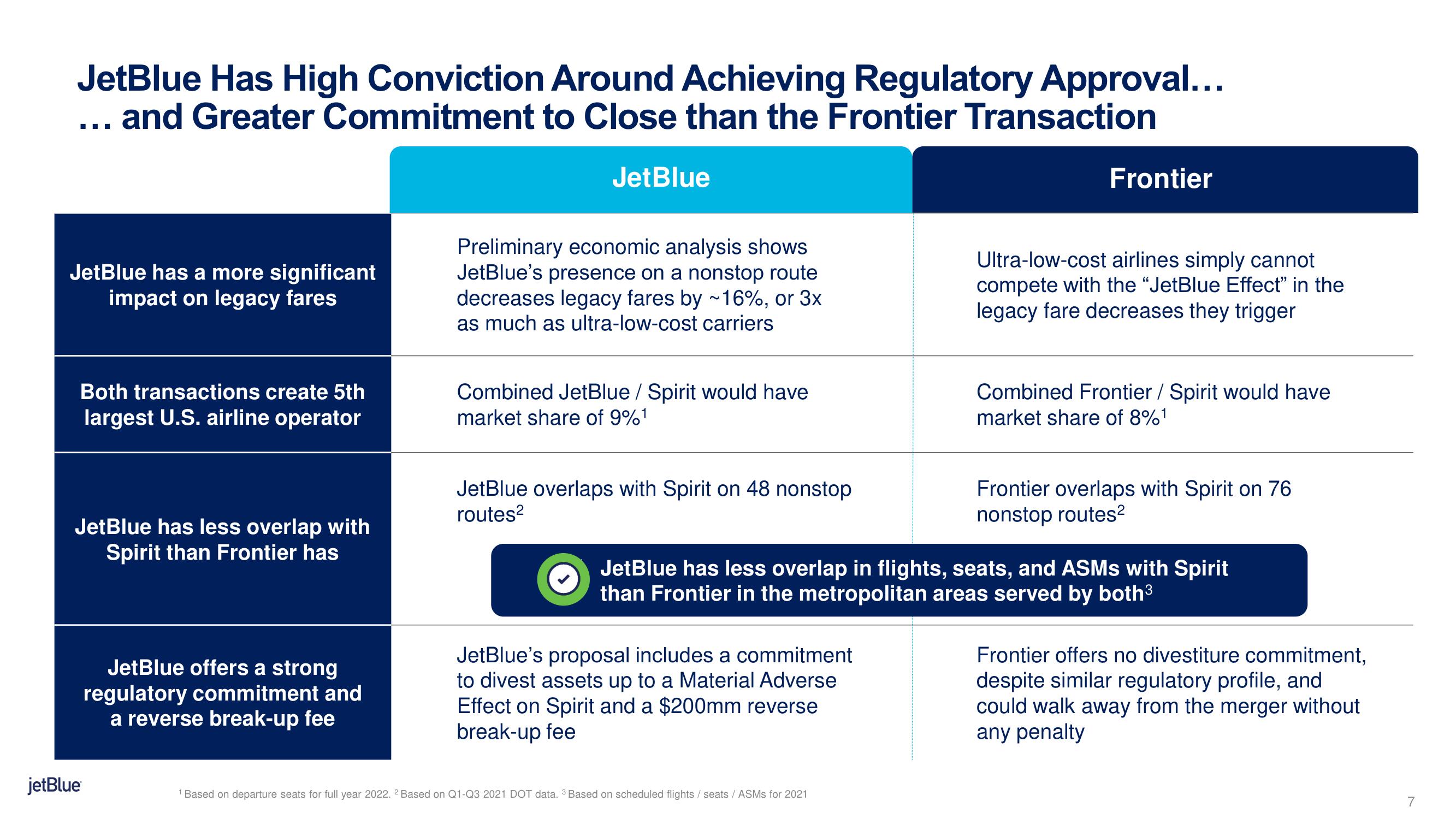

JetBlue Has High Conviction Around Achieving Regulatory Approval...

... and Greater Commitment to Close than the Frontier Transaction

JetBlue has a more significant

impact on legacy fares

Both transactions create 5th

largest U.S. airline operator

JetBlue has less overlap with

Spirit than Frontier has

jetBlue

JetBlue offers a strong

regulatory commitment and

a reverse break-up fee

JetBlue

Preliminary economic analysis shows

JetBlue's presence on a nonstop route

decreases legacy fares by ~16%, or 3x

as much as ultra-low-cost carriers

Combined JetBlue / Spirit would have

market share of 9%¹

JetBlue overlaps with Spirit on 48 nonstop

routes²

JetBlue's proposal includes a commitment

to divest assets up to a Material Adverse

Effect on Spirit and a $200mm reverse

break-up fee

Frontier

¹ Based on departure seats for full year 2022. 2 Based on Q1-Q3 2021 DOT data. 3 Based on scheduled flights / seats / ASMS for 2021

Ultra-low-cost airlines simply cannot

compete with the "JetBlue Effect" in the

legacy fare decreases they trigger

Combined Frontier / Spirit would have

market share of 8%¹

JetBlue has less overlap in flights, seats, and ASMS with Spirit

than Frontier in the metropolitan areas served by both³

Frontier overlaps with Spirit on 76

nonstop routes²

Frontier offers no divestiture commitment,

despite similar regulatory profile, and

could walk away from the merger without

any penalty

7View entire presentation