Aston Martin Results Presentation Deck

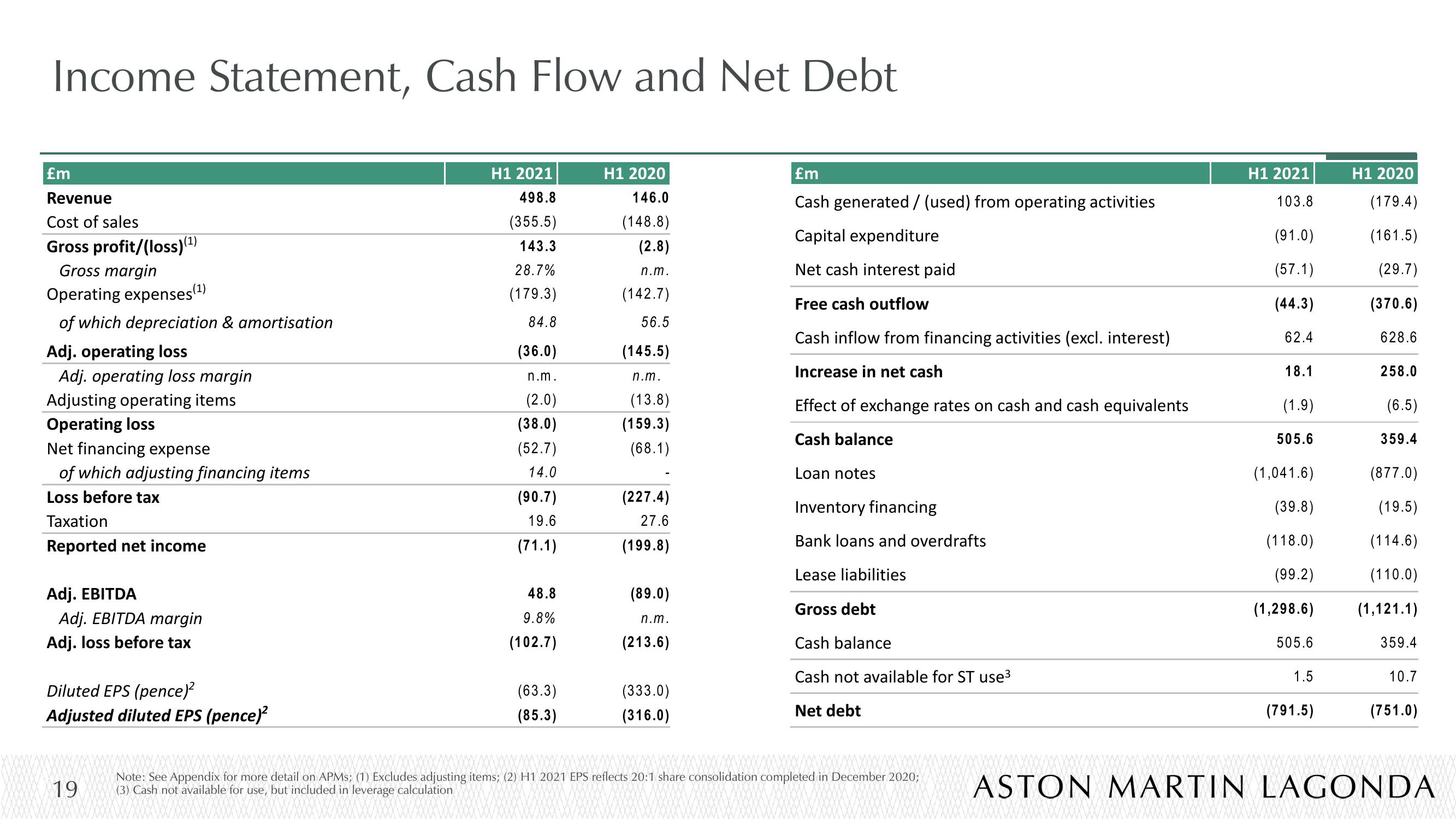

Income Statement, Cash Flow and Net Debt

£m

Revenue

Cost of sales

Gross profit/(loss) (¹)

Gross margin

Operating expenses (¹)

of which depreciation & amortisation

Adj. operating loss

Adj. operating loss margin

Adjusting operating items

Operating loss

Net financing expense

of which adjusting financing items

Loss before tax

Taxation

Reported net income

Adj. EBITDA

Adj. EBITDA margin

Adj. loss before tax

Diluted EPS (pence)²

Adjusted diluted EPS (pence)²

19

H1 2021

498.8

(355.5)

143.3

28.7%

(179.3)

84.8

(36.0)

n.m.

(2.0)

(38.0)

(52.7)

14.0

(90.7)

19.6

(71.1)

48.8

9.8%

(102.7)

(63.3)

(85.3)

H1 2020

146.0

(148.8)

(2.8)

n.m.

(142.7)

56.5

(145.5)

n.m.

(13.8)

(159.3)

(68.1)

(227.4)

27.6

(199.8)

(89.0)

n.m.

(213.6)

(333.0)

(316.0)

£m

Cash generated / (used) from operating activities

Capital expenditure

Net cash interest paid

Free cash outflow

Cash inflow from financing activities (excl. interest)

Increase in net cash

Effect of exchange rates on cash and cash equivalents

Cash balance

Loan notes

Inventory financing

Bank loans and overdrafts

Lease liabilities

Gross debt

Cash balance

Cash not available for ST use³

Net debt

Note: See Appendix for more detail on APMs; (1) Excludes adjusting items; (2) H1 2021 EPS reflects 20:1 share consolidation completed in December 2020;

(3) Cash not available for use, but included in leverage calculation

H1 2021

103.8

(91.0)

(57.1)

(44.3)

62.4

18.1

(1.9)

505.6

(1,041.6)

(39.8)

(118.0)

(99.2)

(1,298.6)

505.6

1.5

(791.5)

H1 2020

(179.4)

(161.5)

(29.7)

(370.6)

628.6

258.0

(6.5)

359.4

(877.0)

(19.5)

(114.6)

(110.0)

(1,121.1)

359.4

10.7

(751.0)

wwwwwwwwwwwwwwwwwwwwwwwwwwwwwwww

ASTON MARTIN LAGONDAView entire presentation