Evercore Investment Banking Pitch Book

Executive Summary

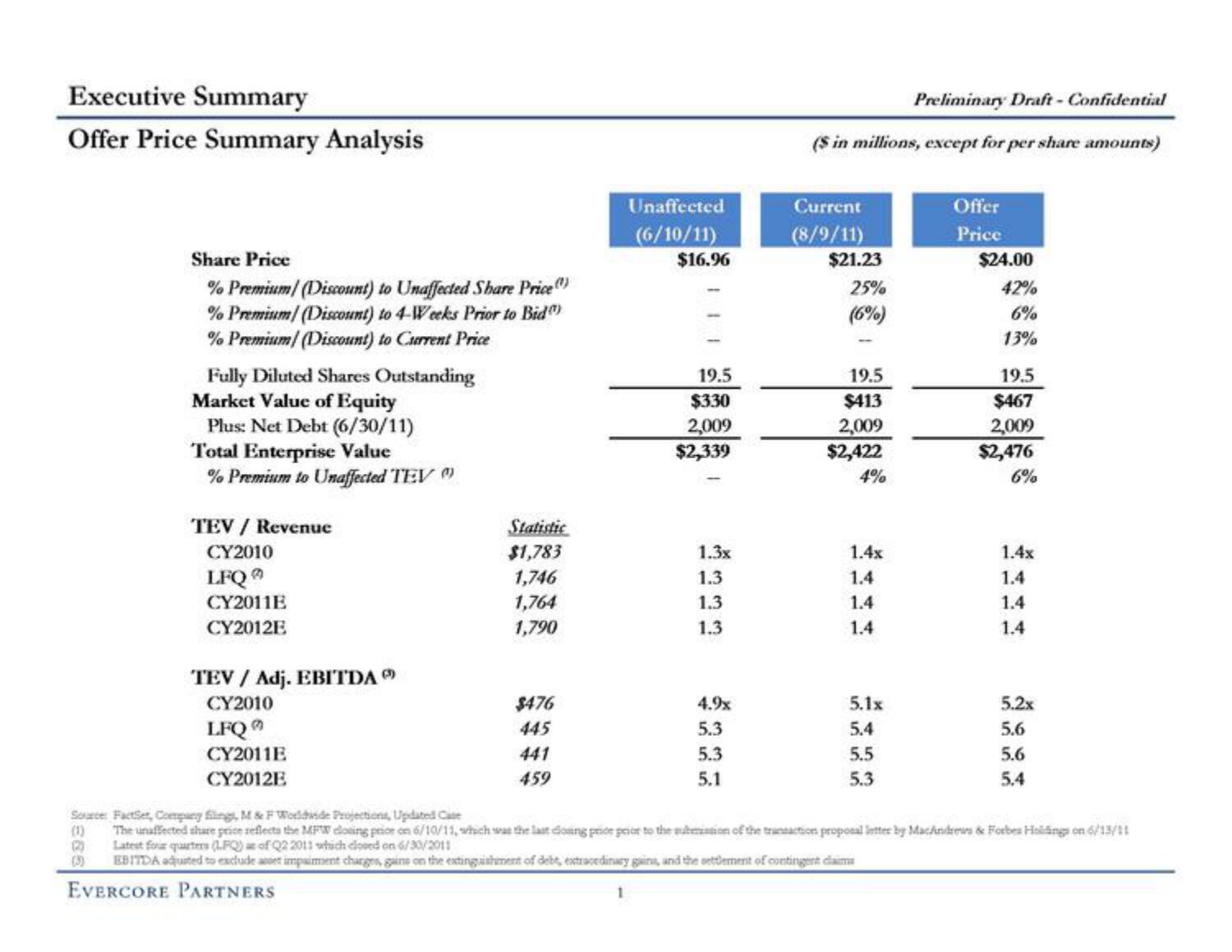

Offer Price Summary Analysis

Share Price

% Premium/ (Discount) to Unaffected Share Price

% Premium/ (Discount) to 4-Weeks Prior to Bid

% Premium/ (Discount) to Current Price

(1)

(

Fully Diluted Shares Outstanding

Market Value of Equity

Plus: Net Debt (6/30/11)

Total Enterprise Value

% Premium to Unaffected TEV

TEV / Revenue

CY2010

LFQ

CY2011E

CY2012E

TEV / Adj. EBITDA

CY2010

LFQ

CY2011E

CY2012E

Statistic

$1,783

1,746

1,764

1,790

$476

445

441

459

Unaffected

(6/10/11)

$16.96

19.5

$330

2,009

$2,339

1

1.3x

1.3

1.3

1.3

4.9x

5.3

5.3

5.1

Preliminary Draft-Confidential

($ in millions, except for per share amounts)

Current

(8/9/11)

$21.23

25%

(6%)

19.5

$413

2,009

$2,422

4%

1.4x

1.4

1.4

1.4

5.1x

5.4

5.5

5.3

Offer

Price

$24.00

42%

6%

13%

19.5

$467

2,009

$2,476

6%

1.4x

1.4

1.4

1.4

5.2x

5.6

5.6

5.4

Source: FactSet, Company filings, M & F Worldhinde Projections, Updated Case

The unaffected share price reflects the MFW eloning price on 6/10/11, which was the last doing price prior to the submission of the transaction proposal letter by MacAndrews & Forbes Holdings on 6/13/11

Latest four quarters (LFQ) of Q2 2011 which dooed on 6/30/2011

EBITDA adjusted to exclude art impaiment charges, gains on the extinguishment of debt, extracedinary gains, and the settlement of contingent claims

EVERCORE PARTNERSView entire presentation