OpenText Investor Presentation Deck

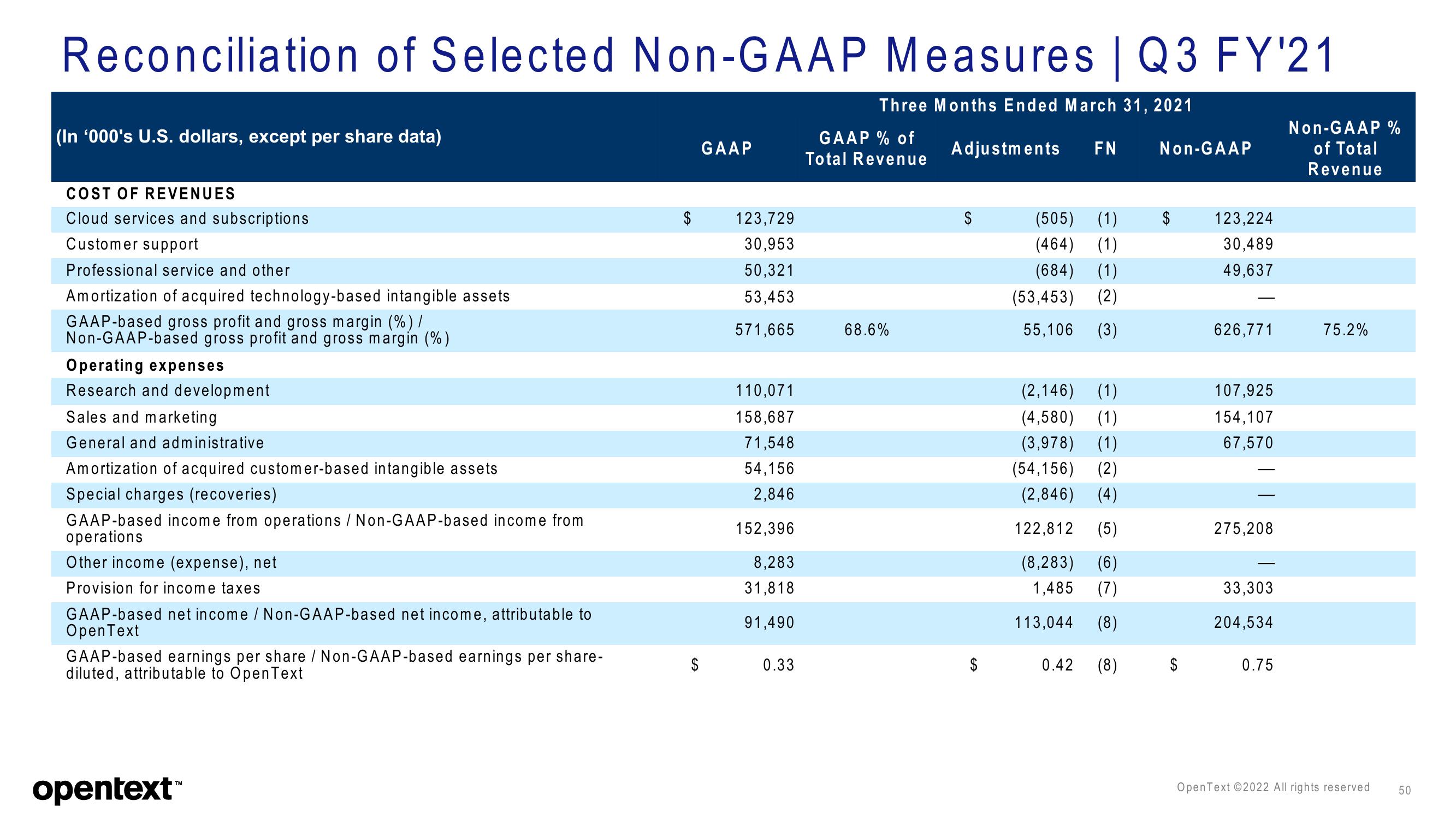

Reconciliation of Selected Non-GAAP Measures | Q3 FY'21

Three Months Ended March 31, 2021

Adjustments FN

(In '000's U.S. dollars, except per share data)

COST OF REVENUES

Cloud services and subscriptions

Customer support

Professional service and other

Amortization of acquired technology-based intangible assets

GAAP-based gross profit and gross margin (%)/

Non-GAAP-based gross profit and gross margin (%)

Operating expenses

Research and development

Sales and marketing

General and administrative

Amortization of acquired customer-based intangible assets

Special charges (recoveries)

GAAP-based income from operations / Non-GAAP-based income from

operations

Other income (expense), net

Provision for income taxes

GAAP-based net income / Non-GAAP-based net income, attributable to

OpenText

GAAP-based earnings per share / Non-GAAP-based earnings per share-

diluted, attributable to OpenText

opentext™

$

$

GAAP

123,729

30,953

50,321

53,453

571,665

110,071

158,687

71,548

54,156

2,846

152,396

8,283

31,818

91,490

0.33

GAAP % of

Total Revenue

68.6%

(505) (1)

(464) (1)

(684) (1)

(53,453) (2)

55,106 (3)

(2,146) (1)

(4,580) (1)

(3,978) (1)

(54,156) (2)

(2,846) (4)

122,812

(5)

(8,283) (6)

1,485

(7)

113,044 (8)

(8)

0.42

Non-GAAP

123,224

30,489

49,637

626,771

107,925

154,107

67,570

275,208

33,303

204,534

0.75

Non-GAAP %

of Total

Revenue

75.2%

Open Text ©2022 All rights reserved

50View entire presentation