Ready Capital Investor Presentation Deck

6.0

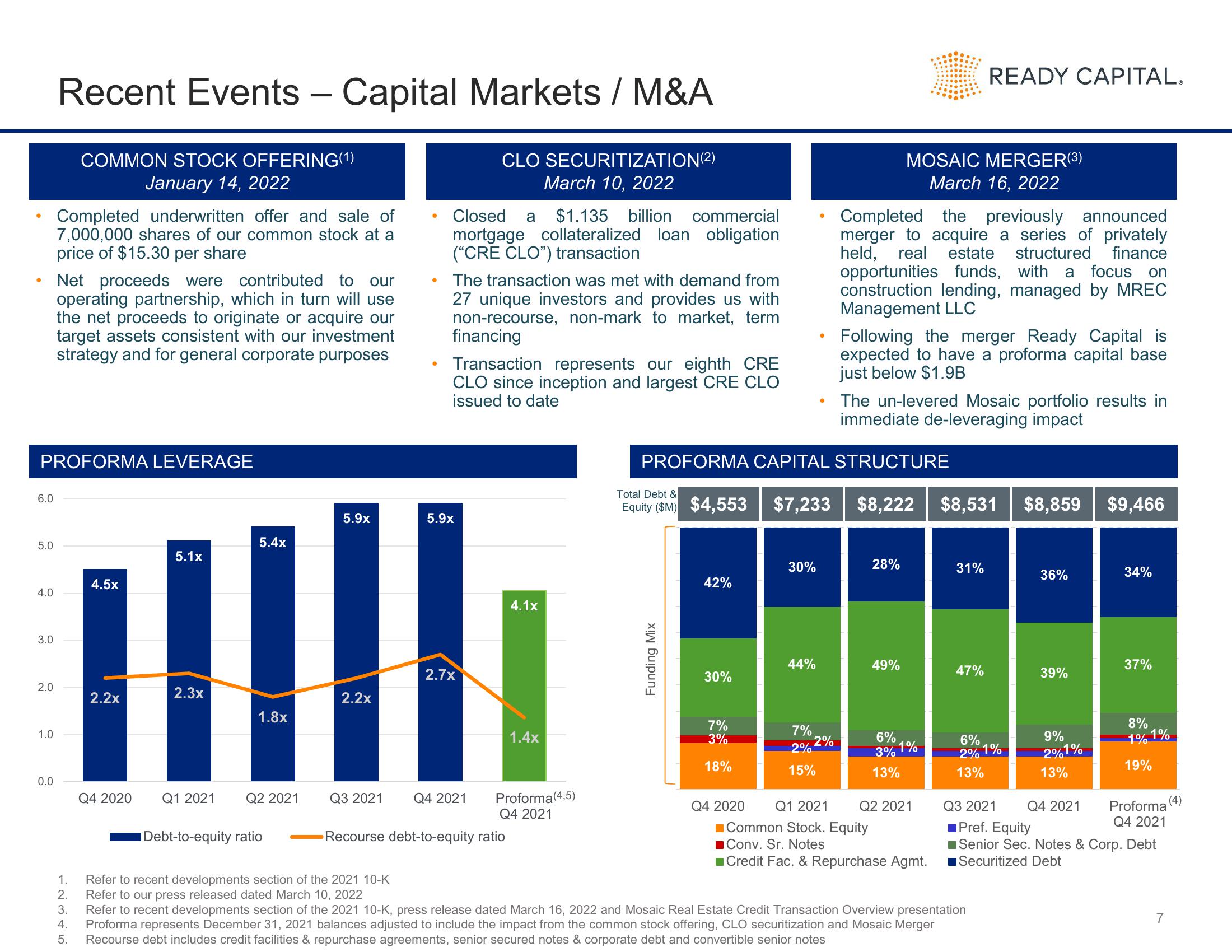

PROFORMA LEVERAGE

5.0

4.0

3.0

2.0

1.0

Recent Events - Capital Markets / M&A

COMMON STOCK OFFERING(1)

January 14, 2022

CLO SECURITIZATION (2)

March 10, 2022

Completed underwritten offer and sale of

7,000,000 shares of our common stock at a

price of $15.30 per share

0.0

Net proceeds were contributed to our

operating partnership, which in turn will use

the net proceeds to originate or acquire our

target assets consistent with our investment

strategy and for general corporate purposes

4.5x

2.2x

Q4 2020

5.1x

2.3x

Q1 2021

5.4x

1.8x

Q2 2021

Debt-to-equity ratio

5.9x

2.2x

Q3 2021

Closed a $1.135 billion commercial

mortgage collateralized loan obligation

("CRE CLO") transaction

1.

Refer to recent developments section of the 2021 10-K

2. Refer to our press released dated March 10, 2022

The transaction was met with demand from

27 unique investors and provides us with

non-recourse, non-mark to market, term

financing

Transaction represents our eighth CRE

CLO since inception and largest CRE CLO

issued to date

5.9x

2.7x

Q4 2021

Recourse debt-to-equity ratio

4.1x

1.4x

Proforma (4,5)

Q4 2021

Total Debt &

Equity ($M) $4,553

Funding Mix

42%

PROFORMA CAPITAL STRUCTURE

30%

7%

3%

18%

Q4 2020

30%

44%

7%

2%

15%

2%

Completed the previously announced

merger to acquire a series of privately

held, real estate structured finance

opportunities funds, with a focus on

construction lending, managed by MREC

Management LLC

$7,233 $8,222 $8,531 $8,859

Following the merger Ready Capital is

expected to have a proforma capital base

just below $1.9B

MOSAIC MERGER(3)

March 16, 2022

The un-levered Mosaic portfolio results in

immediate de-leveraging impact

28%

49%

6%

3%

13%

1%

Q1 2021 Q2 2021

Common Stock. Equity

■Conv. Sr. Notes

■Credit Fac. & Repurchase Agmt.

READY CAPITAL.

31%

47%

6%

2%

13%

3. Refer to recent developments section of the 2021 10-K, press release dated March 16, 2022 and Mosaic Real Estate Credit Transaction Overview presentation

4. Proforma represents December 31, 2021 balances adjusted to include the impact from the common stock offering, CLO securitization and Mosaic Merger

Recourse debt includes credit facilities & repurchase agreements, senior secured notes & corporate debt and convertible senior notes

5.

1%

36%

39%

9%

2%1%

13%

$9,466

Q4 2021

34%

37%

Q3 2021

Proforma

Q4 2021

■Pref. Equity

Senior Sec. Notes & Corp. Debt

Securitized Debt

8%

1% 1%

19%

7

(4)View entire presentation