Apollo Global Management Investor Day Presentation Deck

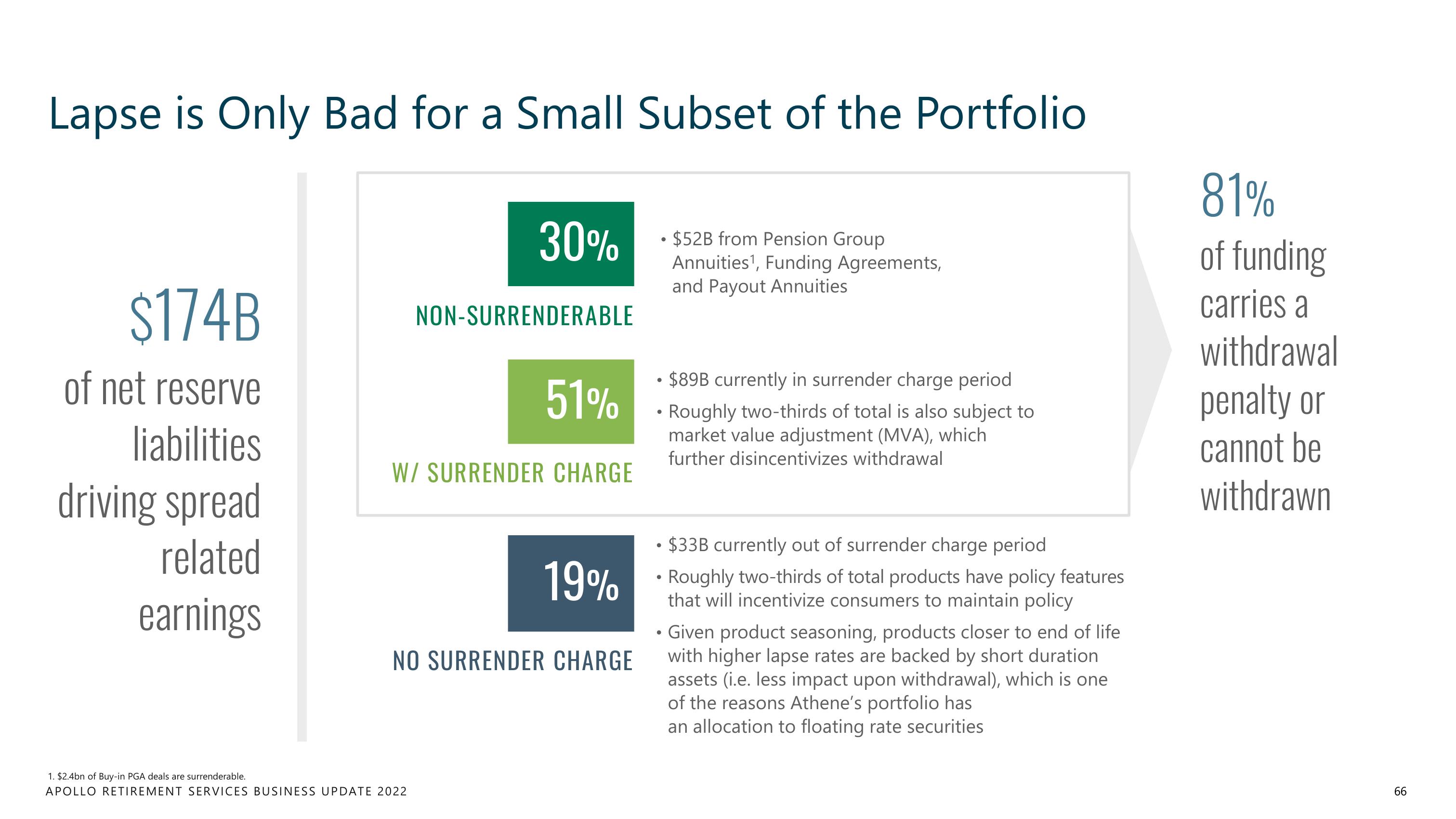

Lapse is Only Bad for a Small Subset of the Portfolio

$174B

of net reserve

liabilities

driving spread

related

earnings

30%

NON-SURRENDERABLE

1. $2.4bn of Buy-in PGA deals are surrenderable.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

51%

W/ SURRENDER CHARGE

19%

NO SURRENDER CHARGE

• $52B from Pension Group

Annuities¹, Funding Agreements,

and Payout Annuities

• $89B currently in surrender charge period.

• Roughly two-thirds of total is also subject to

market value adjustment (MVA), which

further disincentivizes withdrawal

$33B currently out of surrender charge period

• Roughly two-thirds of total products have policy features

that will incentivize consumers to maintain policy

• Given product seasoning, products closer to end of life

with higher lapse rates are backed by short duration

assets (i.e. less impact upon withdrawal), which is one

of the reasons Athene's portfolio has

an allocation to floating rate securities

81%

of funding

carries a

withdrawal

penalty or

cannot be

withdrawn

66View entire presentation