WeWork Investor Day Presentation Deck

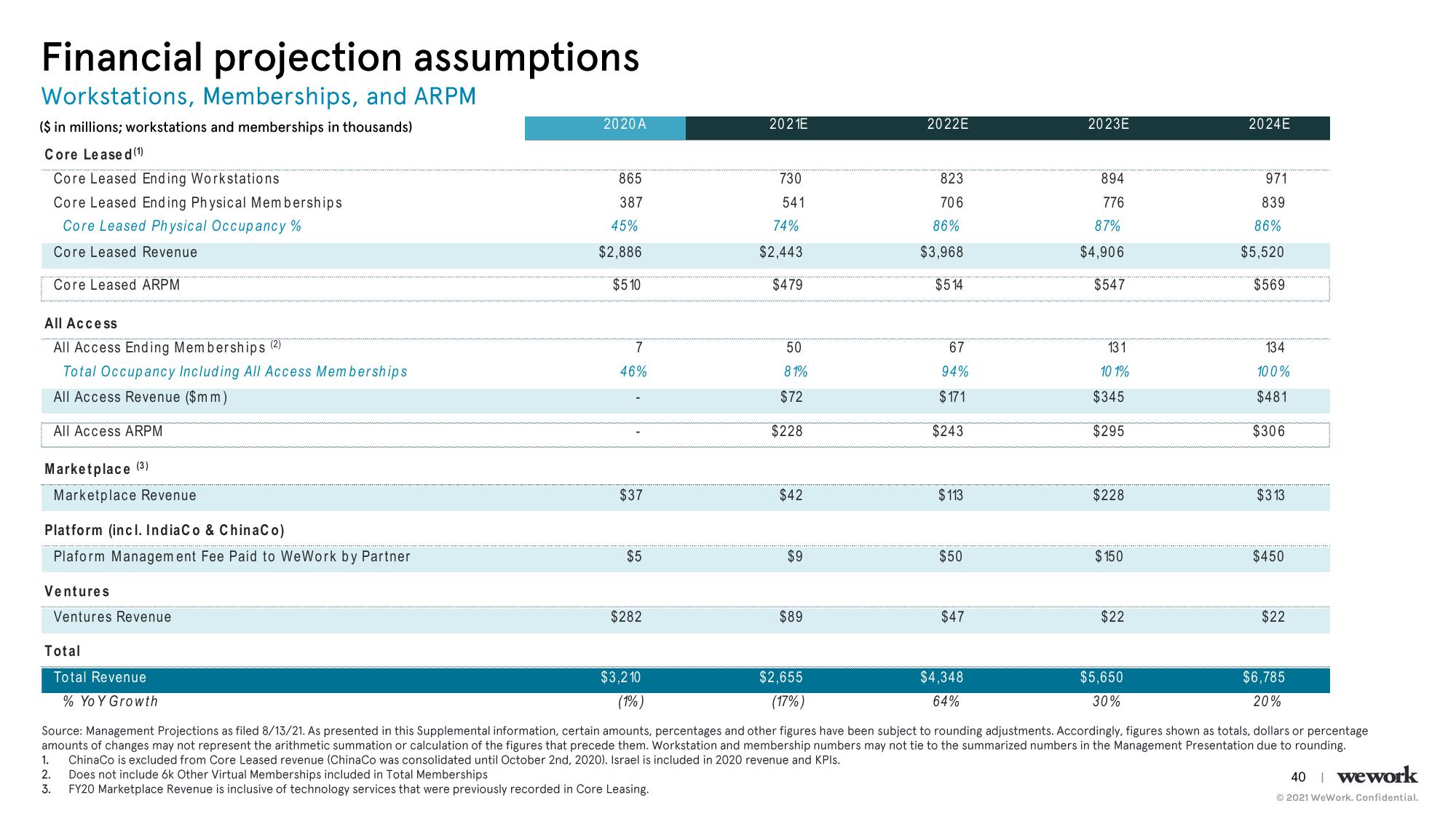

Financial projection assumptions

Workstations, Memberships, and ARPM

($ in millions; workstations and memberships in thousands)

Core Leased (1)

Core Leased Ending Workstations

Core Leased Ending Physical Memberships

Core Leased Physical Occupancy %

Core Leased Revenue

Core Leased ARPM

All Access

All Access Ending Memberships (2)

Total Occupancy Including All Access Memberships

All Access Revenue ($mm)

All Access ARPM

Marketplace (3)

Marketplace Revenue

Platform (incl. IndiaCo & ChinaCo)

Plaform Management Fee Paid to WeWork by Partner

Ventures

Ventures Revenue

Total

2020A

865

387

45%

$2,886

$510

7

46%

$37

$5

$282

2021E

$3,210

(1%)

730

541

74%

$2,443

$479

50

81%

$72

$228

$42

$9

$89

2022E

$2,655

(17%)

823

706

86%

$3,968

$514

67

94%

$171

$243

$113

$50

$47

$4,348

64%

2023E

894

776

87%

$4,906

$547

131

10 1%

$345

$295

$228

$150

$22

$5,650

30%

2024E

971

839

86%

$5,520

$569

134

100%

$481

$306

Total Revenue

% Yo Y Growth

Source: Management Projections as filed 8/13/21. As presented in this Supplemental information, certain amounts, percentages and other figures have been subject to rounding adjustments. Accordingly, figures shown as totals, dollars or percentage

amounts of changes may not represent the arithmetic summation or calculation of the figures that precede them. Workstation and membership numbers may not tie to the summarized numbers in the Management Presentation due to rounding.

1. ChinaCo is excluded from Core Leased revenue (ChinaCo was consolidated until October 2nd, 2020). Israel is included in 2020 revenue and KPIs.

2.

Does not include 6k Other Virtual Memberships included in Total Memberships.

3.

FY20 Marketplace Revenue is inclusive of technology services that were previously recorded in Core Leasing.

$313

$450

$22

$6,785

20%

40 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation