Lightspeed Results Presentation Deck

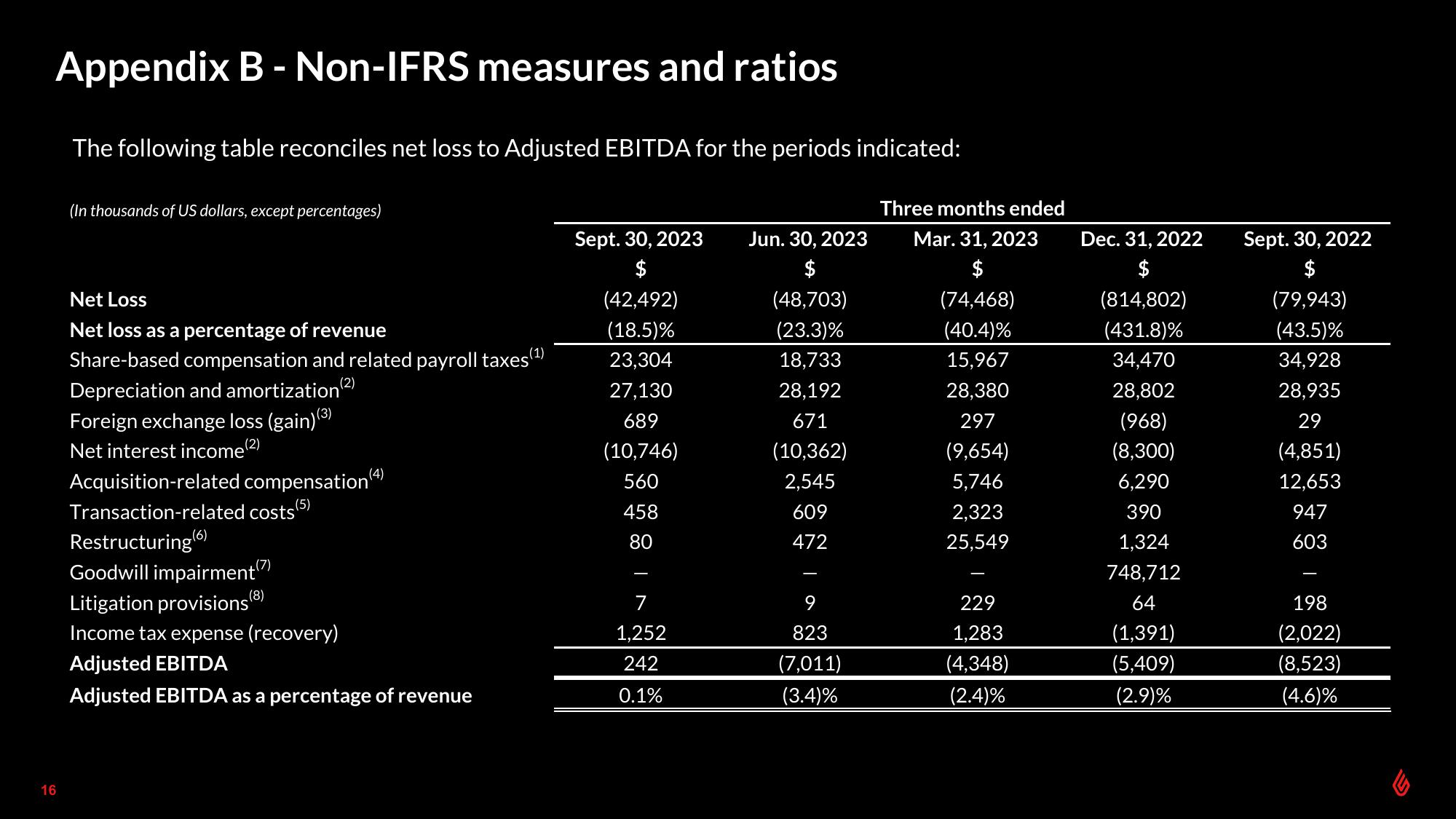

Appendix B - Non-IFRS measures and ratios

16

The following table reconciles net loss to Adjusted EBITDA for the periods indicated:

(In thousands of US dollars, except percentages)

Net Loss

Net loss as a percentage of revenue

Share-based compensation and related payroll taxes(¹)

Depreciation and amortization (²)

Foreign exchange loss (gain) (3)

Net interest income (2)

Acquisition-related compensation (4)

(5)

Transaction-related costs

Restructuring (6)

Goodwill impairment(7)

Litigation provisions (8)

Income tax expense (recovery)

Adjusted EBITDA

Adjusted EBITDA as a percentage of revenue

Sept. 30, 2023

$

(42,492)

(18.5)%

23,304

27,130

689

(10,746)

560

458

80

7

1,252

242

0.1%

Jun. 30, 2023

$

(48,703)

(23.3)%

18,733

28,192

671

(10,362)

2,545

609

472

9

823

(7,011)

(3.4)%

Three months ended

Mar. 31, 2023

$

(74,468)

(40.4)%

15,967

28,380

297

(9,654)

5,746

2,323

25,549

229

1,283

(4,348)

(2.4)%

Dec. 31, 2022

$

(814,802)

(431.8)%

34,470

28,802

(968)

(8,300)

6,290

390

1,324

748,712

64

(1,391)

(5,409)

(2.9)%

Sept. 30, 2022

$

(79,943)

(43.5)%

34,928

28,935

29

(4,851)

12,653

947

603

198

(2,022)

(8,523)

(4.6)%View entire presentation