Fiverr Investor Presentation Deck

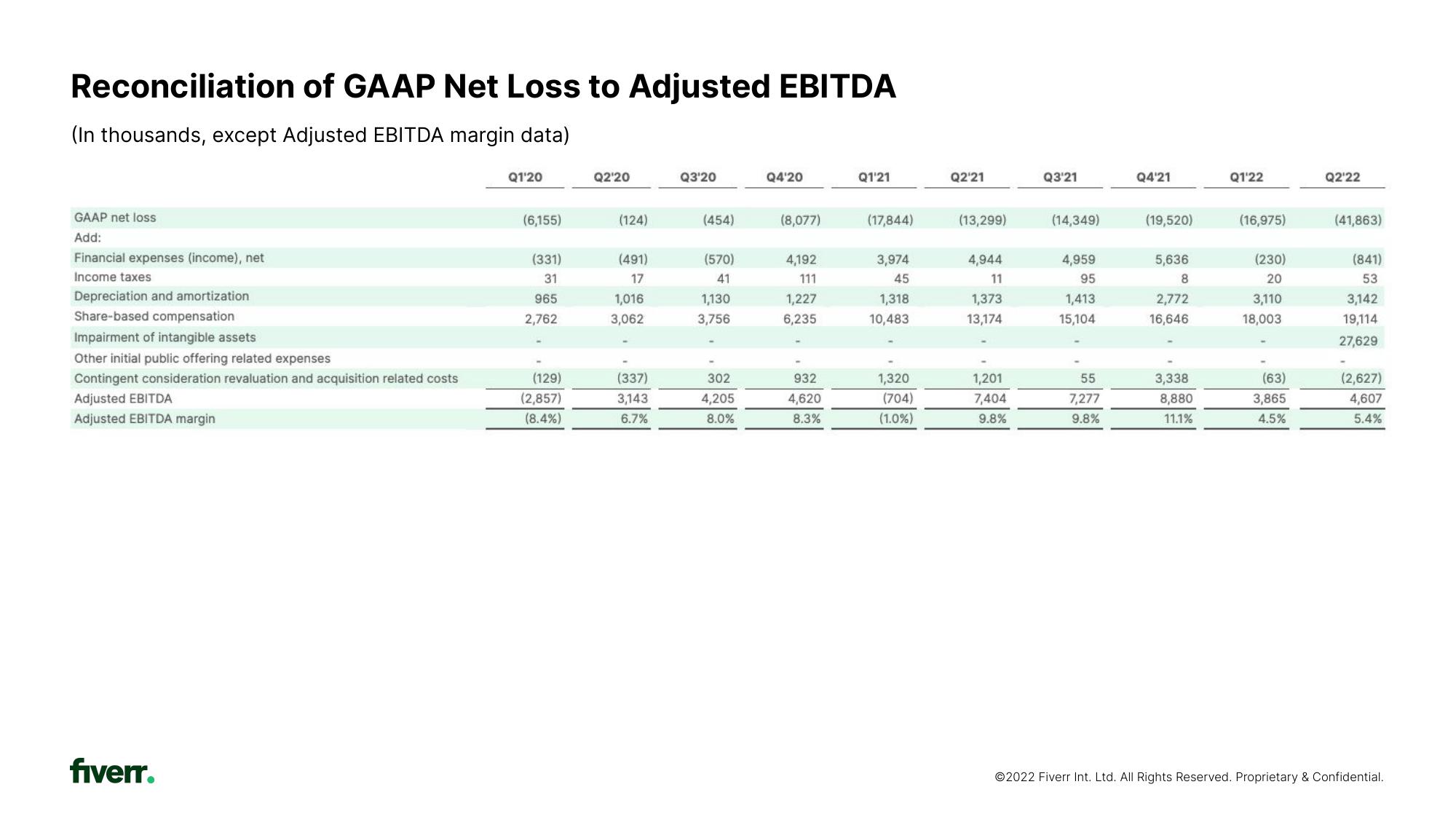

Reconciliation of GAAP Net Loss to Adjusted EBITDA

(In thousands, except Adjusted EBITDA margin data)

GAAP net loss

Add:

Financial expenses (income), net

Income taxes

Depreciation and amortization

Share-based compensation

Impairment of intangible assets

Other initial public offering related expenses

Contingent consideration revaluation and acquisition related costs

Adjusted EBITDA

Adjusted EBITDA margin

fiverr.

Q1'20

(6,155)

(331)

31

965

2,762

(129)

(2,857)

(8.4%)

Q2'20

(124)

(491)

17

1,016

3,062

(337)

3,143

6.7%

Q3'20

(454)

(570)

41

1,130

3,756

302

4,205

8.0%

Q4'20

(8,077)

4,192

111

1,227

6,235

932

4,620

8.3%

Q1'21

(17,844)

3,974

45

1,318

10,483

1,320

(704)

(1.0%)

Q2¹21

(13,299)

4,944

11

1,373

13,174

1,201

7,404

9.8%

Q3'21

(14,349)

4,959

95

1,413

15,104

55

7,277

9.8%

Q4'21

(19,520)

5,636

8

2,772

16,646

3,338

8,880

11.1%

Q1'22

(16,975)

(230)

20

3,110

18,003

(63)

3,865

4.5%

Q2'22

(41,863)

(841)

53

3,142

19,114

27,629

(2,627)

4,607

5.4%

Ⓒ2022 Fiverr Int. Ltd. All Rights Reserved. Proprietary & Confidential.View entire presentation