Credit Suisse Investment Banking Pitch Book

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

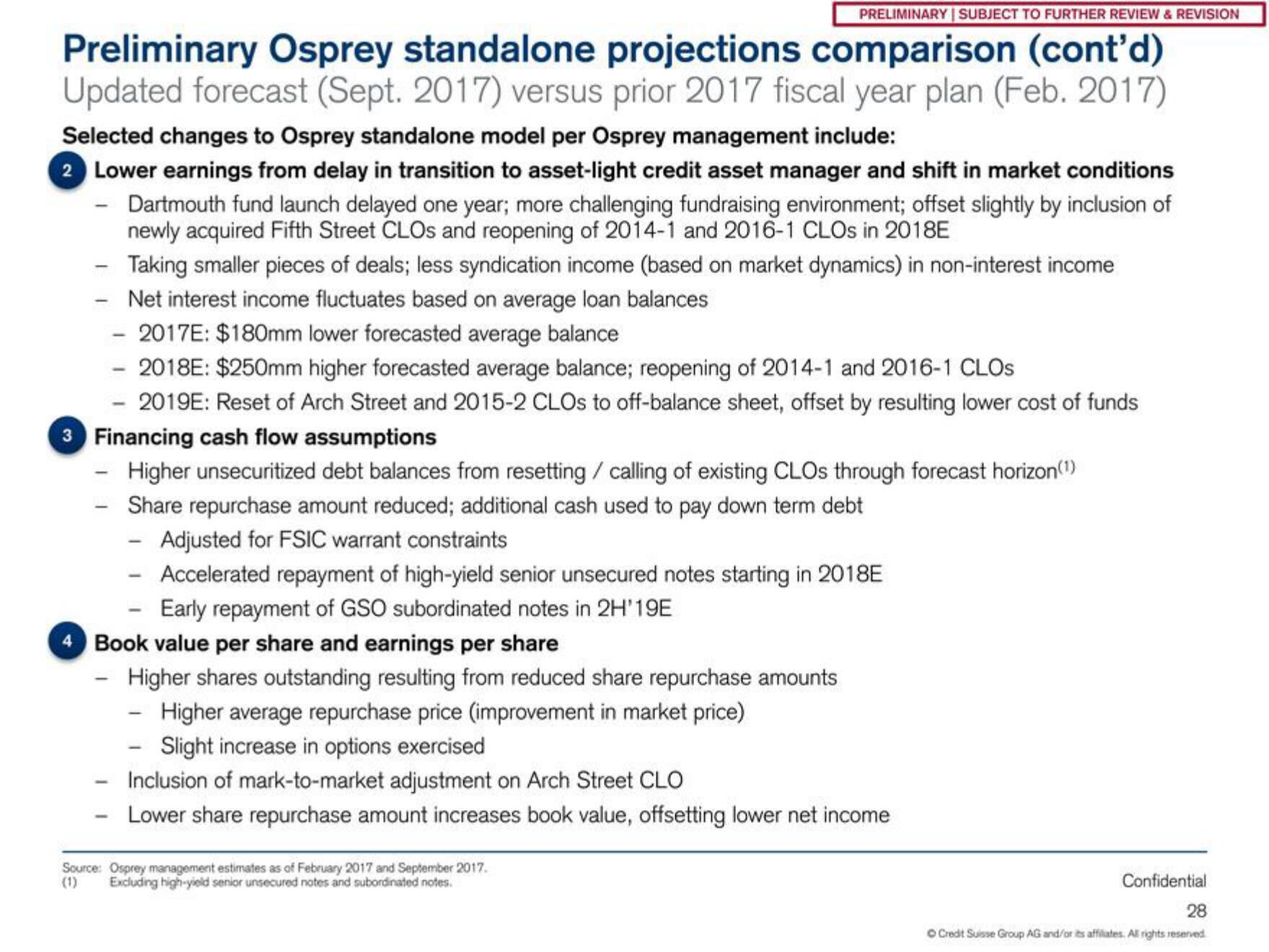

Preliminary Osprey standalone projections comparison (cont'd)

Updated forecast (Sept. 2017) versus prior 2017 fiscal year plan (Feb. 2017)

Selected changes to Osprey standalone model per Osprey management include:

2 Lower earnings from delay in transition to asset-light credit asset manager and shift in market conditions

Dartmouth fund launch delayed one year; more challenging fundraising environment; offset slightly by inclusion of

newly acquired Fifth Street CLOs and reopening of 2014-1 and 2016-1 CLOs in 2018E

- Taking smaller pieces of deals; less syndication income (based on market dynamics) in non-interest income

Net interest income fluctuates based on average loan balances

- 2017E: $180mm lower forecasted average balance

- 2018E: $250mm higher forecasted average balance; reopening of 2014-1 and 2016-1 CLOS

2019E: Reset of Arch Street and 2015-2 CLOS to off-balance sheet, offset by resulting lower cost of funds

3 Financing cash flow assumptions

- Higher unsecuritized debt balances from resetting / calling of existing CLOs through forecast horizon(¹)

- Share repurchase amount reduced; additional cash used to pay down term debt

- Adjusted for FSIC warrant constraints

Accelerated repayment of high-yield senior unsecured notes starting in 2018E

Early repayment of GSO subordinated notes in 2H'19E

Book value per share and earnings per share

- Higher shares outstanding resulting from reduced share repurchase amounts

- Higher average repurchase price (improvement in market price)

- Slight increase in options exercised

Inclusion of mark-to-market adjustment on Arch Street CLO

Lower share repurchase amount increases book value, offsetting lower net income

-

Source: Osprey management estimates as of February 2017 and September 2017.

Excluding high-yield senior unsecured notes and subordinated notes.

Confidential

28

Credit Suisse Group AG and/or its affiliates. Al rights reservedView entire presentation