Eos Energy Investor Presentation Deck

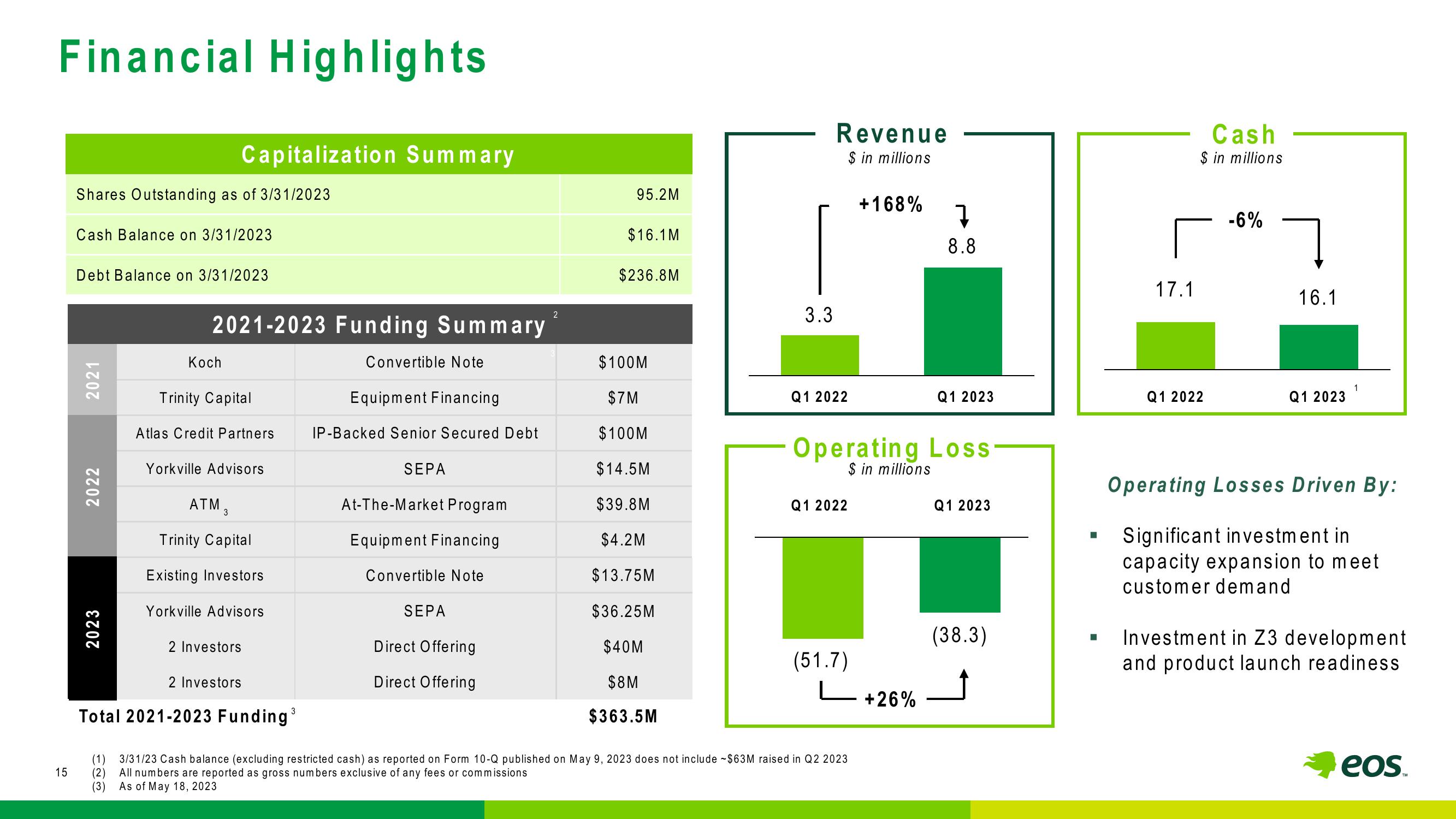

Financial Highlights

15

Shares Outstanding as of 3/31/2023

Cash Balance on 3/31/2023

Debt Balance on 3/31/2023

2021

Capitalization Summary

2022

2023

2021-2023 Funding Summary

Koch

Trinity Capital

Atlas Credit Partners

Yorkville Advisors

ATM 3

Trinity Capital

Existing Investors

Yorkville Advisors

2 Investors

2 Investors

3

Total 2021-2023 Funding ³

Convertible Note

Equipment Financing

IP-Backed Senior Secured Debt

SEPA

At-The-Market Program

Equipment Financing

Convertible Note

SEPA

Direct Offering

Direct Offering

2

95.2M

$16.1M

$236.8M

$100M

$7M

$100M

$14.5M

$39.8M

$4.2M

$13.75M

$36.25M

$40M

$8M

$363.5M

3.3

Revenue

$ in millions

Q1 2022

Q1 2022

(51.7)

L

+168%

Operating Loss

$ in millions

(1) 3/31/23 Cash balance (excluding restricted cash) as reported on Form 10-Q published on May 9, 2023 does not include ~$63M raised in Q2 2023

All numbers are reported gross numbers exclusive of any fees or commissions.

(2)

(3)

As of May 18, 2023

7

8.8

+26%

Q1 2023

Q1 2023

(38.3)

■

■

17.1

Cash

$ in millions

Q1 2022

-6%

16.1

Q1 2023

1

Operating Losses Driven By:

Significant investment in

capacity expansion to meet

customer demand

Investment in Z3 development

and product launch readiness

eos.View entire presentation