Inovalon Results Presentation Deck

2018 Adjusted

EBITDA Margin

Bridge

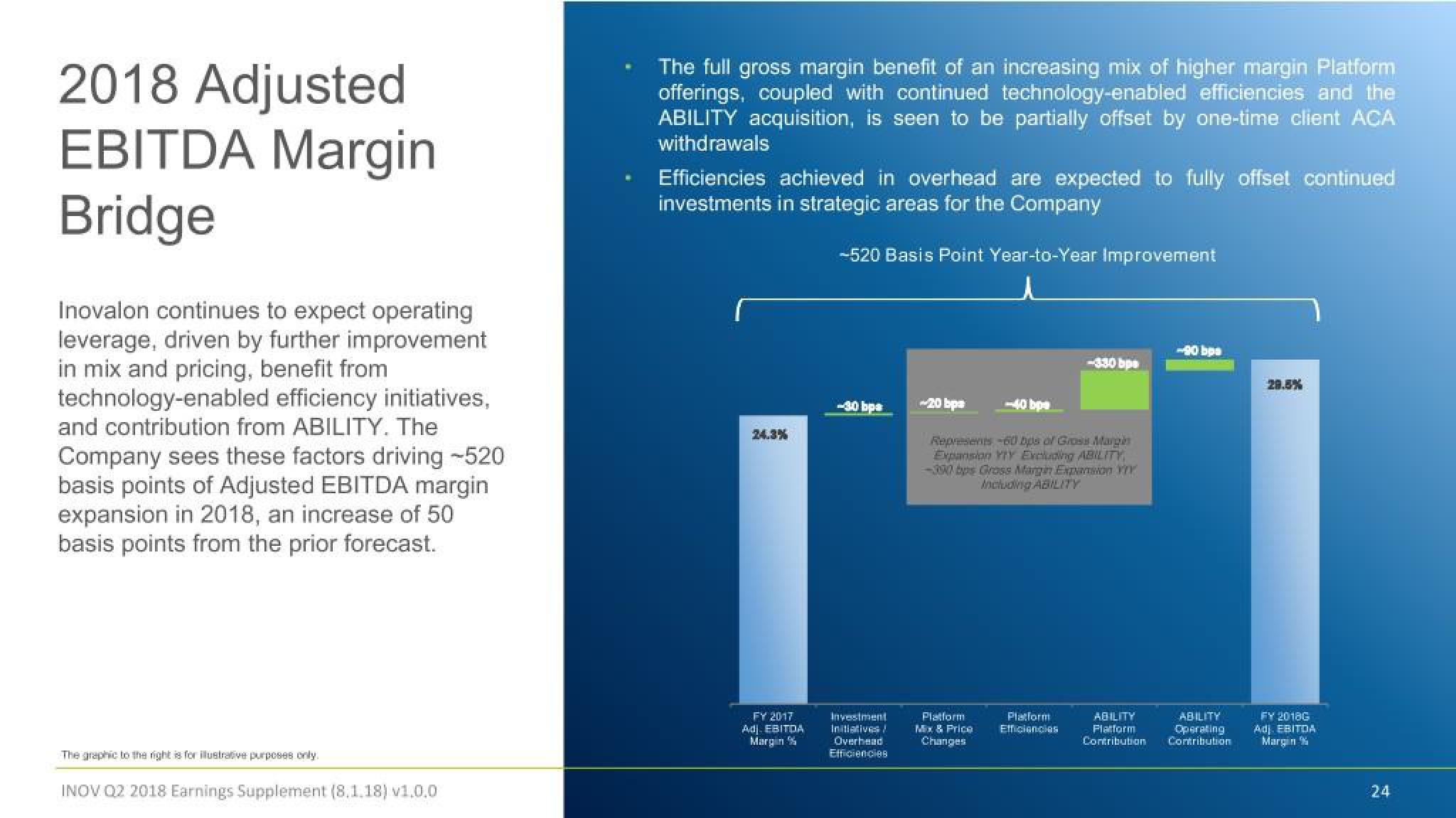

Inovalon continues to expect operating

leverage, driven by further improvement

in mix and pricing, benefit from

technology-enabled efficiency initiatives,

and contribution from ABILITY. The

Company sees these factors driving -520

basis points of Adjusted EBITDA margin

expansion in 2018, an increase of 50

basis points from the prior forecast.

The graphic to the right is for illustrative purposes only.

INOV Q2 2018 Earnings Supplement (8.1.18) v1.0.0

The full gross margin benefit of an increasing mix of higher margin Platform

offerings, coupled with continued technology-enabled efficiencies and the

ABILITY acquisition, is seen to be partially offset by one-time client ACA

withdrawals

Efficiencies achieved in overhead are expected to fully offset continued

investments in strategic areas for the Company

-520 Basis Point Year-to-Year Improvement

FY 2017

Adj. EBITDA

Margin

-30 bps

Investment

Initiatives/

Overhead

Efficiencies

-20 bps

-40 bps

Represents 60 bps of Grosu Marg

Expansion YTY Excluding ABILITY

-300 bps Gross Margin Expansion m

including ABILITY

Platform

Mx & Price

Changes

-330 bps

Platform

Efficiencies

-90 bpa

ABILITY

ABILITY

Flatform

Operating

Contribution Contribution

29.5%

FY 2018G

Adj. EBITDA

Margin

24View entire presentation