Telia Company Mergers and Acquisitions Presentation Deck

TRANSACTION HIGHLIGHTS

3

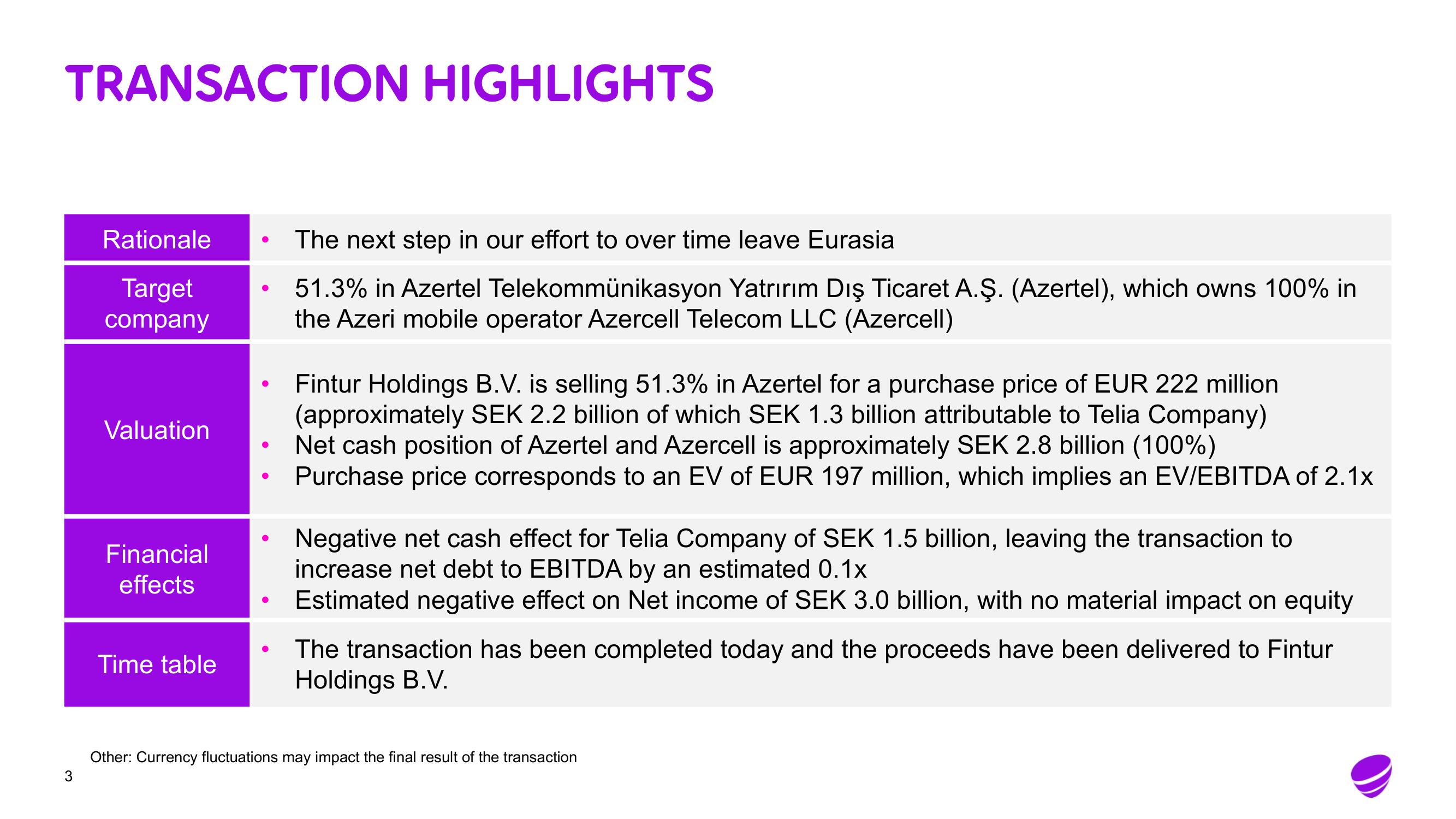

Rationale

Target

company

Valuation

Financial

effects

Time table

●

●

●

The next step in our effort to over time leave Eurasia

51.3% in Azertel Telekommünikasyon Yatrırım Dış Ticaret A.Ş. (Azertel), which owns 100% in

the Azeri mobile operator Azercell Telecom LLC (Azercell)

Fintur Holdings B.V. is selling 51.3% in Azertel for a purchase price of EUR 222 million

(approximately SEK 2.2 billion of which SEK 1.3 billion attributable to Telia Company)

Net cash position of Azertel and Azercell is approximately SEK 2.8 billion (100%)

Purchase price corresponds to an EV of EUR 197 million, which implies an EV/EBITDA of 2.1x

Negative net cash effect for Telia Company of SEK 1.5 billion, leaving the transaction to

increase net debt to EBITDA by an estimated 0.1x

Estimated negative effect on Net income of SEK 3.0 billion, with no material impact on equity

The transaction has been completed today and the proceeds have been delivered to Fintur

Holdings B.V.

Other: Currency fluctuations may impact the final result of the transactionView entire presentation