SoftBank Results Presentation Deck

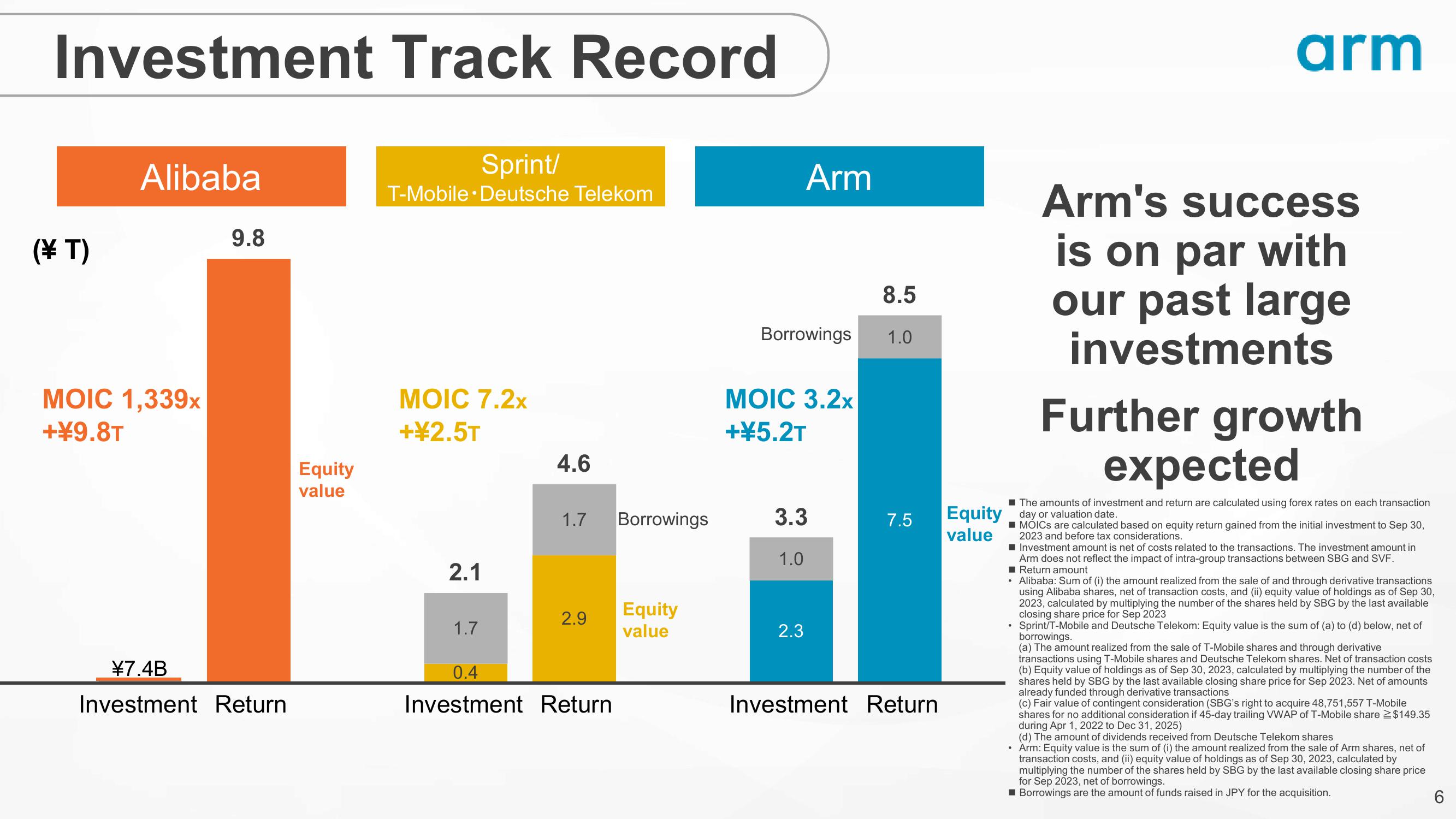

Investment Track Record

(¥T)

Alibaba

MOIC 1,339x

+¥9.8T

9.8

¥7.4B

Investment Return

Equity

value

Sprint/

T-Mobile Deutsche Telekom

MOIC 7.2x

+¥2.5T

2.1

1.7

4.6

1.7

2.9

0.4

Investment Return

Borrowings

Equity

value

Borrowings

Arm

MOIC 3.2x

+¥5.2T

3.3

1.0

2.3

8.5

1.0

7.5

Investment Return

arm

Arm's success

is on par with

our past large

investments

Equity day or valuation date.

value

Further growth

expected

The amounts of investment and return are calculated using forex rates on each transaction

■ MOICs are calculated based on equity return gained from the initial investment to Sep 30,

2023 and before tax considerations.

.

■ Investment amount is net of costs related to the transactions. The investment amount in

Arm does not reflect the impact of intra-group transactions between SBG and SVF.

■ Return amount

Alibaba: Sum of (i) the amount realized from the sale of and through derivative transactions

using Alibaba shares, net of transaction costs, and (ii) equity value of holdings as of Sep 30,

2023, calculated by multiplying the number of the shares held by SBG by the last available

closing share price for Sep 2023

• Sprint/T-Mobile and Deutsche Telekom: Equity value is the sum of (a) to (d) below, net of

borrowings.

(a) The amount realized from the sale of T-Mobile shares and through derivative

transactions using T-Mobile shares and Deutsche Telekom shares. Net of transaction costs

(b) Equity value of holdings as of Sep 30, 2023, calculated by multiplying the number of the

shares held by SBG by the last available closing share price for Sep 2023. Net of amounts

already funded through derivative transactions

(c) Fair value of contingent consideration (SBG's right to acquire 48,751,557 T-Mobile

shares for no additional consideration if 45-day trailing VWAP of T-Mobile share $149.35

during Apr 1, 2022 to Dec 31, 2025)

(d) The amount of dividends received from Deutsche Telekom shares

• Arm: Equity value is the sum of (i) the amount realized from the sale of Arm shares, net of

transaction costs, and (ii) equity value of holdings as of Sep 30, 2023, calculated by

multiplying the number of the shares held by SBG by the last available closing share price

for Sep 2023, net of borrowings.

■ Borrowings are the amount of funds raised in JPY for the acquisition.

6View entire presentation