Summer 2023 Solar Industry Update

Executive Summary

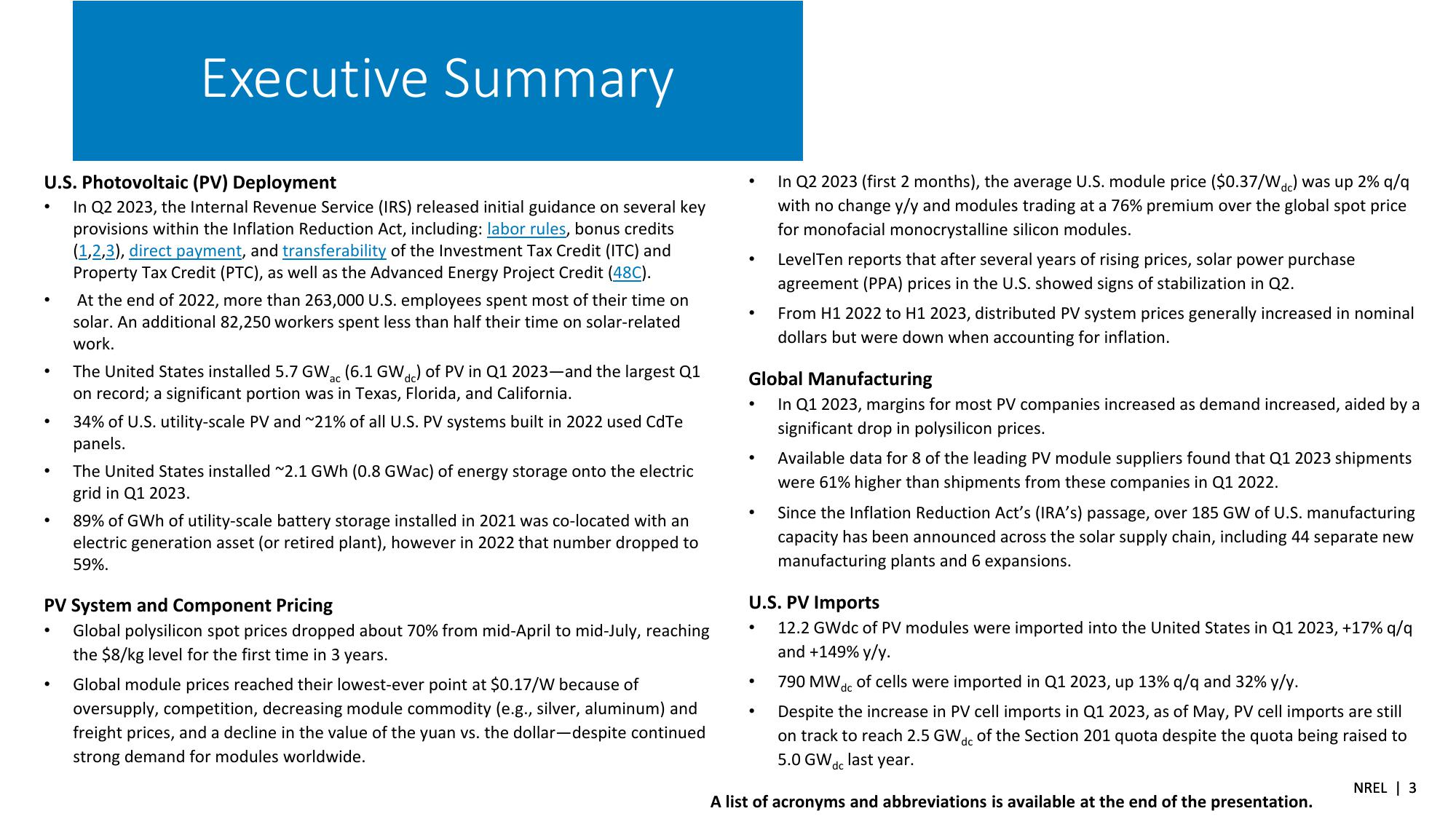

U.S. Photovoltaic (PV) Deployment

•

•

•

.

In Q2 2023, the Internal Revenue Service (IRS) released initial guidance on several key

provisions within the Inflation Reduction Act, including: labor rules, bonus credits

(1,2,3), direct payment, and transferability of the Investment Tax Credit (ITC) and

Property Tax Credit (PTC), as well as the Advanced Energy Project Credit (48C).

At the end of 2022, more than 263,000 U.S. employees spent most of their time on

solar. An additional 82,250 workers spent less than half their time on solar-related

work.

The United States installed 5.7 GWac (6.1 GW dc) of PV in Q1 2023—and the largest Q1

on record; a significant portion was in Texas, Florida, and California.

34% of U.S. utility-scale PV and ~21% of all U.S. PV systems built in 2022 used CdTe

panels.

The United States installed ~2.1 GWh (0.8 GWac) of energy storage onto the electric

grid in Q1 2023.

89% of GWh of utility-scale battery storage installed in 2021 was co-located with an

electric generation asset (or retired plant), however in 2022 that number dropped to

59%.

PV System and Component Pricing

Global polysilicon spot prices dropped about 70% from mid-April to mid-July, reaching

the $8/kg level for the first time in 3 years.

Global module prices reached their lowest-ever point at $0.17/W because of

oversupply, competition, decreasing module commodity (e.g., silver, aluminum) and

freight prices, and a decline in the value of the yuan vs. the dollar-despite continued

strong demand for modules worldwide.

In Q2 2023 (first 2 months), the average U.S. module price ($0.37/Wdc) was up 2% q/q

with no change y/y and modules trading at a 76% premium over the global spot price

for monofacial monocrystalline silicon modules.

LevelTen reports that after several years of rising prices, solar power purchase

agreement (PPA) prices in the U.S. showed signs of stabilization in Q2.

From H1 2022 to H1 2023, distributed PV system prices generally increased in nominal

dollars but were down when accounting for inflation.

Global Manufacturing

In Q1 2023, margins for most PV companies increased as demand increased, aided by a

significant drop in polysilicon prices.

Available data for 8 of the leading PV module suppliers found that Q1 2023 shipments

were 61% higher than shipments from these companies in Q1 2022.

Since the Inflation Reduction Act's (IRA's) passage, over 185 GW of U.S. manufacturing

capacity has been announced across the solar supply chain, including 44 separate new

manufacturing plants and 6 expansions.

U.S. PV Imports

12.2 GWdc of PV modules were imported into the United States in Q1 2023, +17% q/q

and +149% y/y.

790 MW dc of cells were imported in Q1 2023, up 13% q/q and 32% y/y.

Despite the increase in PV cell imports in Q1 2023, as of May, PV cell imports are still

on track to reach 2.5 GWdc of the Section 201 quota despite the quota being raised to

5.0 GWdc last year.

NREL | 3

A list of acronyms and abbreviations is available at the end of the presentation.View entire presentation