The Urgent Need for Change and The Superior Path Forward

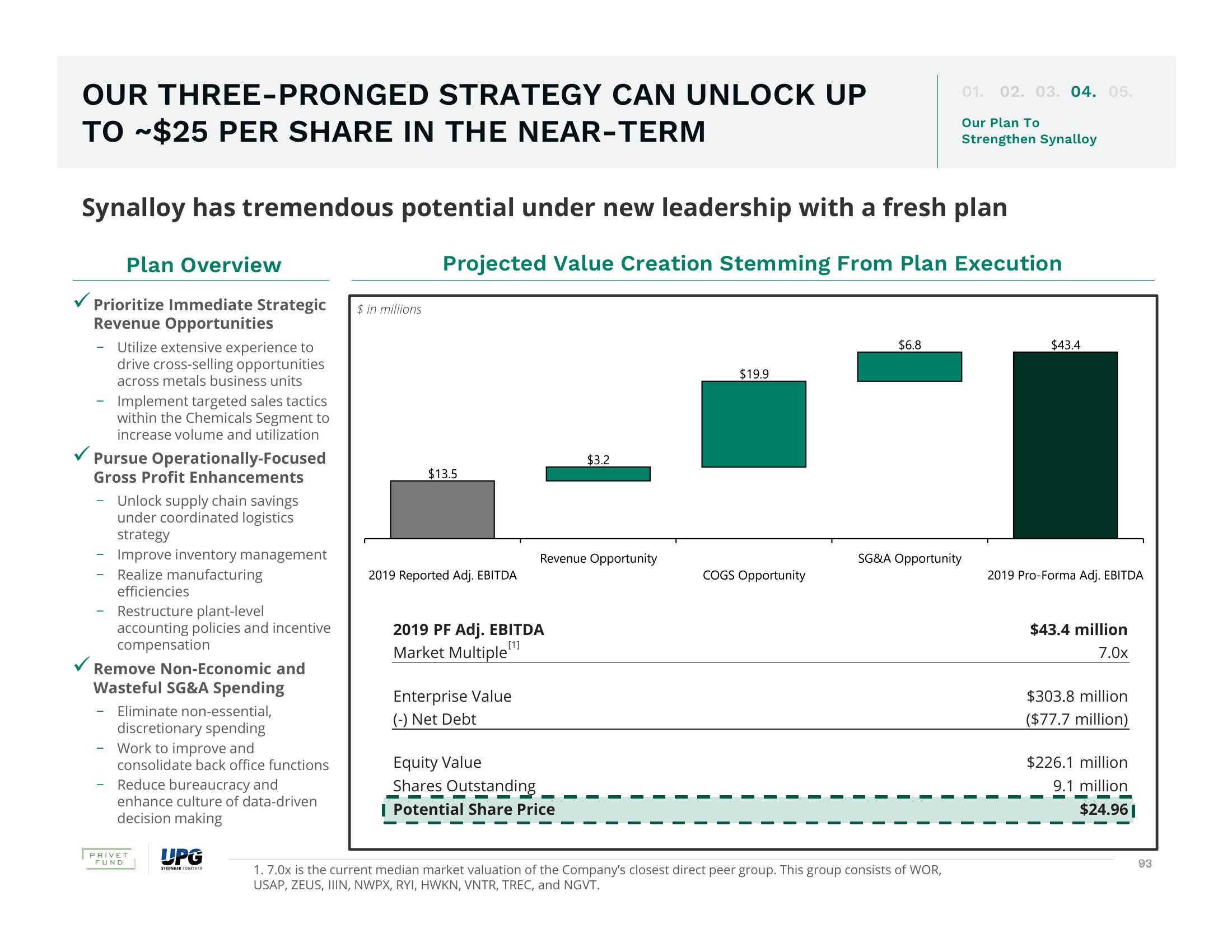

OUR THREE-PRONGED STRATEGY CAN UNLOCK UP

TO ~$25 PER SHARE IN THE NEAR-TERM

Plan Overview

Prioritize Immediate Strategic $ in millions

Revenue Opportunities

Synalloy has tremendous potential under new leadership with a fresh plan

Projected Value Creation Stemming From Plan Execution

✓

Pursue Operationally-Focused

Gross Profit Enhancements

-

Utilize extensive experience to

drive cross-selling opportunities

across metals business units

Implement targeted sales tactics

within the Chemicals Segment to

increase volume and utilization

-

Unlock supply chain savings

under coordinated logistics

strategy

Improve inventory management

Realize manufacturing

efficiencies

Restructure plant-level

accounting policies and incentive

compensation

Remove Non-Economic and

Wasteful SG&A Spending

Eliminate non-essential,

discretionary spending

Work to improve and

consolidate back office functions

Reduce bureaucracy and

enhance culture of data-driven

decision making

PRIVET

FUND

UPG

STRONGER TOGETHER

$13.5

2019 Reported Adj. EBITDA

2019 PF Adj. EBITDA

[1]

Market Multiple

Enterprise Value

(-) Net Debt

Revenue Opportunity

$3.2

Equity Value

Shares Outstanding

I Potential Share Price

I

I

$19.9

COGS Opportunity

$6.8

I

01. 02. 03. 04. 05.

Our Plan To

Strengthen Synalloy

SG&A Opportunity

1.7.0x is the current median market valuation of the Company's closest direct peer group. This group consists of WOR,

USAP, ZEUS, IIIN, NWPX, RYI, HWKN, VNTR, TREC, and NGVT.

$43.4

2019 Pro-Forma Adj. EBITDA

I

$43.4 million

7.0x

$303.8 million

($77.7 million)

$226.1 million

9.1 million

$24.961

93View entire presentation