Hydrofarm IPO Presentation Deck

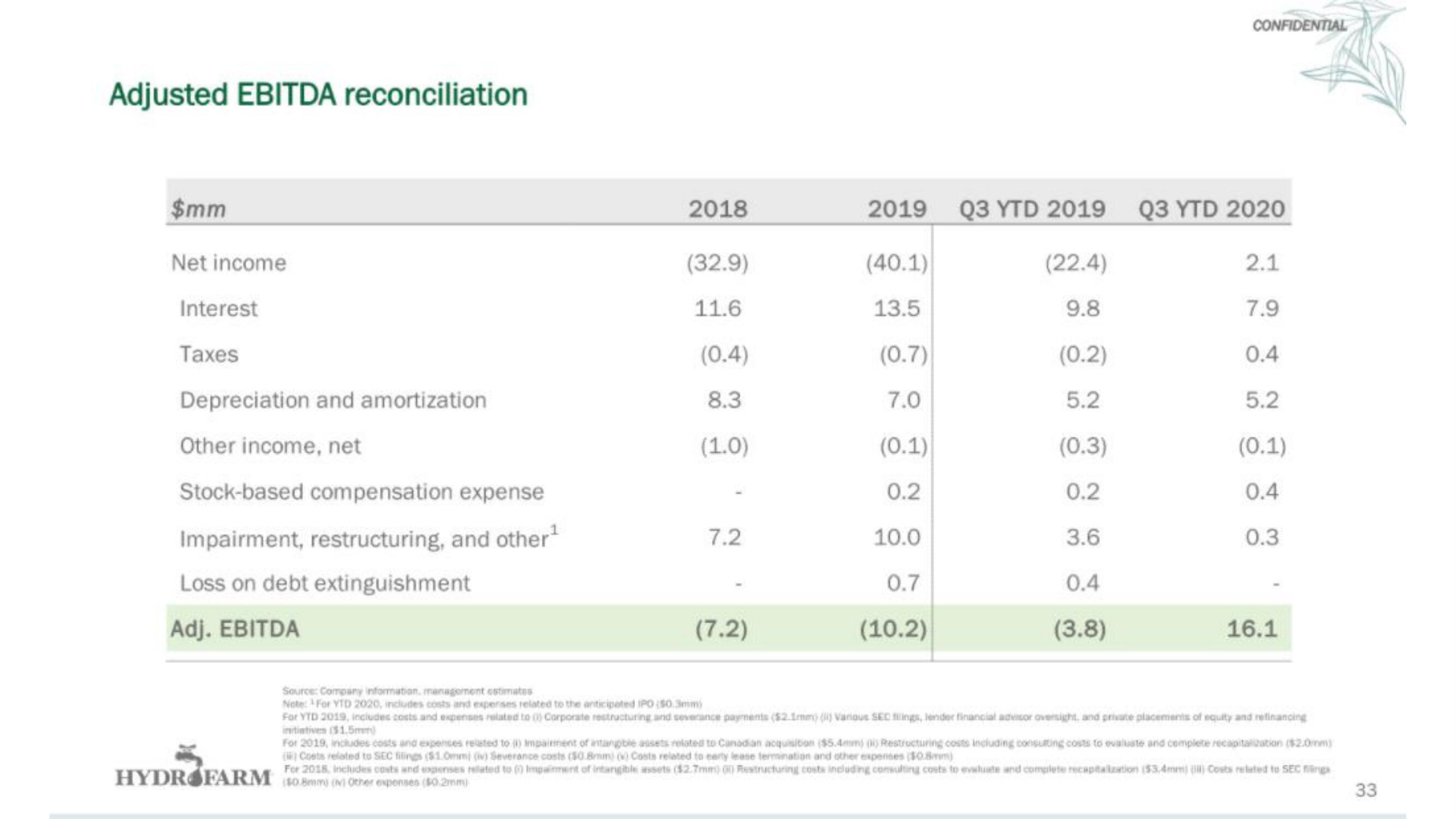

Adjusted EBITDA reconciliation

$mm

Net income

Interest

Taxes

Depreciation and amortization

Other income, net

Stock-based compensation expense

Impairment, restructuring, and other¹

Loss on debt extinguishment

Adj. EBITDA

2018

(32.9)

11.6

(0.4)

8.3

(1.0)

HYDROFARM (0.8mm (N) Other expenses ($0.2mm)

7.2

(7.2)

2019 Q3 YTD 2019

(40.1)

(22.4)

13.5

9.8

(0.2)

5.2

(0.7)

7.0

(0.1)

0.2

10.0

0.7

(10.2)

(0.3)

0.2

3.6

0.4

(3.8)

CONFIDENTIAL

Q3 YTD 2020

2.1

7.9

0.4

5.2

(0.1)

0.4

0.3

16.1

Source: Company information management estimates

Note: For YTD 2020, includes costs and expenses related to the anticipated IPO ($0.3mm)

For YTD 2019, includes costs and expenses related to 0) Corporate restructuring and severance payments ($2.1mm) (1) Various SEC filings, lender financial advisor oversight, and private placements of equity and refinancing

initiatives ($1.5mm)

For 2019, includes costs and expenses related to impairment of intangible assets related to Canadian acquisition ($5.4mm) (i) Restructuring costs including consulting costs to evaluate and complete recapitalization ($2.0mm)

() Coets related to SEC filings ($1.0mmi (iv) Severance costs (50.8mm) 0) Costs related to earty lease termination and other expenses ($0.8mm)

For 2015, Includes costs and expenses related to 0) Impairment of intangible assets ($2.7mm) 0) Restructuring costs including consulting costs to evaluate and complete recupitalization ($5,4mm) (8) Costs related to SEC fings

33View entire presentation