LONGi Solar Company Presentation

Propelling the transformation

Leadership

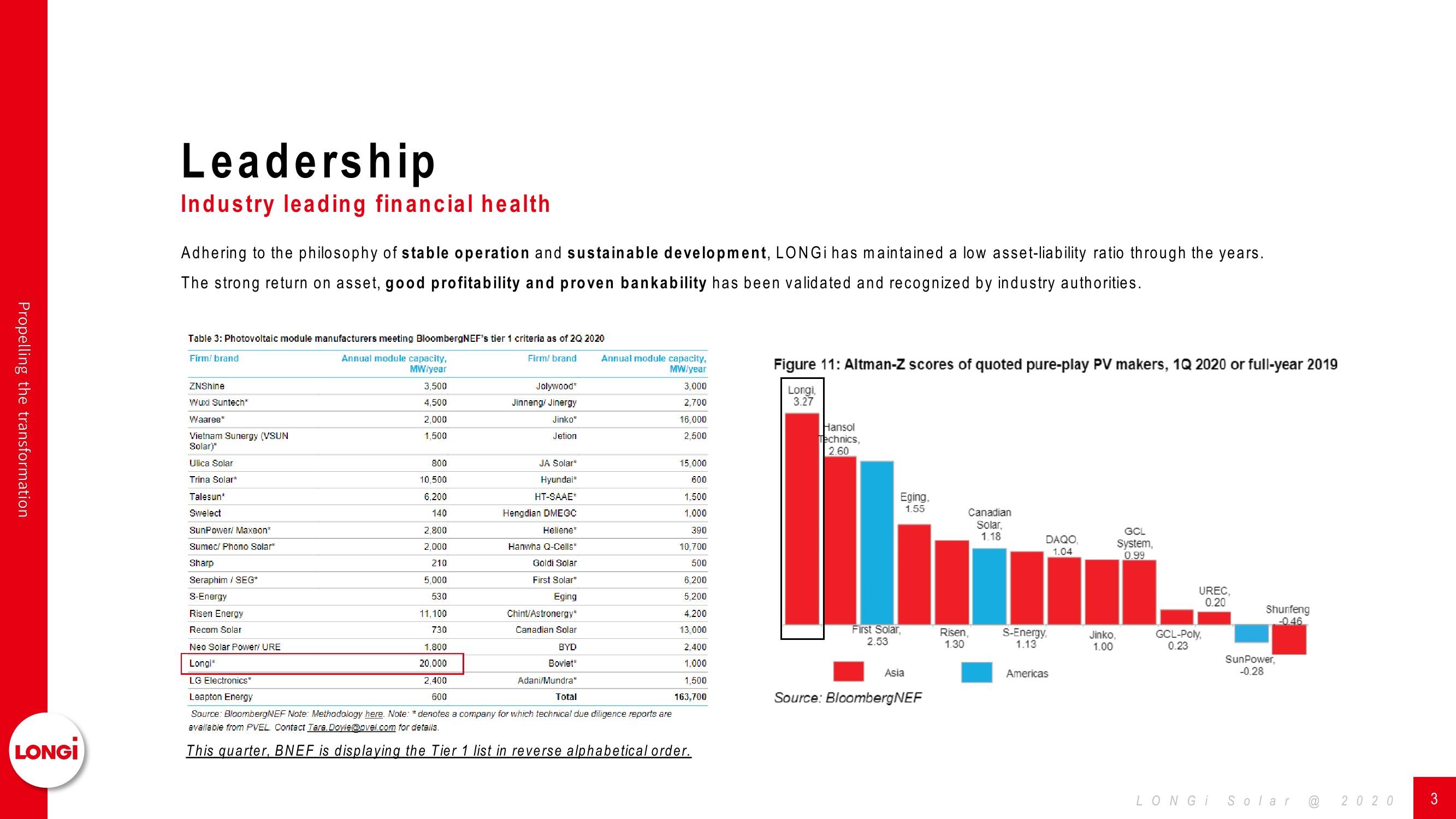

Industry leading financial health

Adhering to the philosophy of stable operation and sustainable development, LONGi has maintained a low asset-liability ratio through the years.

The strong return on asset, good profitability and proven bankability has been validated and recognized by industry authorities.

LONGI

Annual module capacity,

Table 3: Photovoltaic module manufacturers meeting BloombergNEF's tier 1 criteria as of 2Q 2020

Firm/ brand

Firm/ brand

Annual module capacity,

MW/year

MW/year

ZNShine

Wuxi Suntech*

3,500

Jolywood*

3,000

Figure 11: Altman-Z scores of quoted pure-play PV makers, 1Q 2020 or full-year 2019

Longi,

4,500

Jinneng/ Jinergy

2,700

Waaree*

2,000

Jinko*

16.000

Vietnam Sunergy (VSUN

Solar)*

1,500

Jetion

2,500

3.27

Hansol

Technics,

2.60

Ulica Solar

800

JA Solar*

15,000

Trina Solar*

10,500

Hyundai*

600

Talesun*

6,200

HT-SAAE*

1,500

Swelect

140

Hengdian DMEGC

1,000

SunPower/ Maxeon*

2,800

Heliene*

390

Sumec/ Phono Solar*

2,000

Hanwha Q-Cells*

10,700

Eging,

1.55

Canadian

Solar,

1.18

GCL

DAQO

1.04

System,

0.99

Sharp

210

Goldi Solar

500

Seraphim / SEG*

5,000

First Solar*

6,200

S-Energy

530

Eging

5,200

Risen Energy

11,100

Chint/Astronergy*

4,200

UREC,

0.20

Shunfeng

-0.46

Recom Solar

730

Canadian Solar

13,000

Neo Solar Power/ URE

1,800

BYD

2,400

Longi*

20,000

Boviet*

1,000

First Solar,

2.53

Risen,

1.30

S-Energy,

1.13

Jinko,

1.00

GCL-Poly,

0.23

Asia

Americas

SunPower,

-0.28

LG Electronics*

2,400

Adani/Mundra*

1,500

Leapton Energy

600

Total

163,700

Source: BloombergNEF

Source: Bloomberg NEF Note: Methodology here. Note: * denotes a company for which technical due diligence reports are

available from PVEL. Contact [email protected] for details.

This quarter, BNEF is displaying the Tier 1 list in reverse alphabetical order.

LONGI

Solar @ 2020

3View entire presentation