Snap Inc Results Presentation Deck

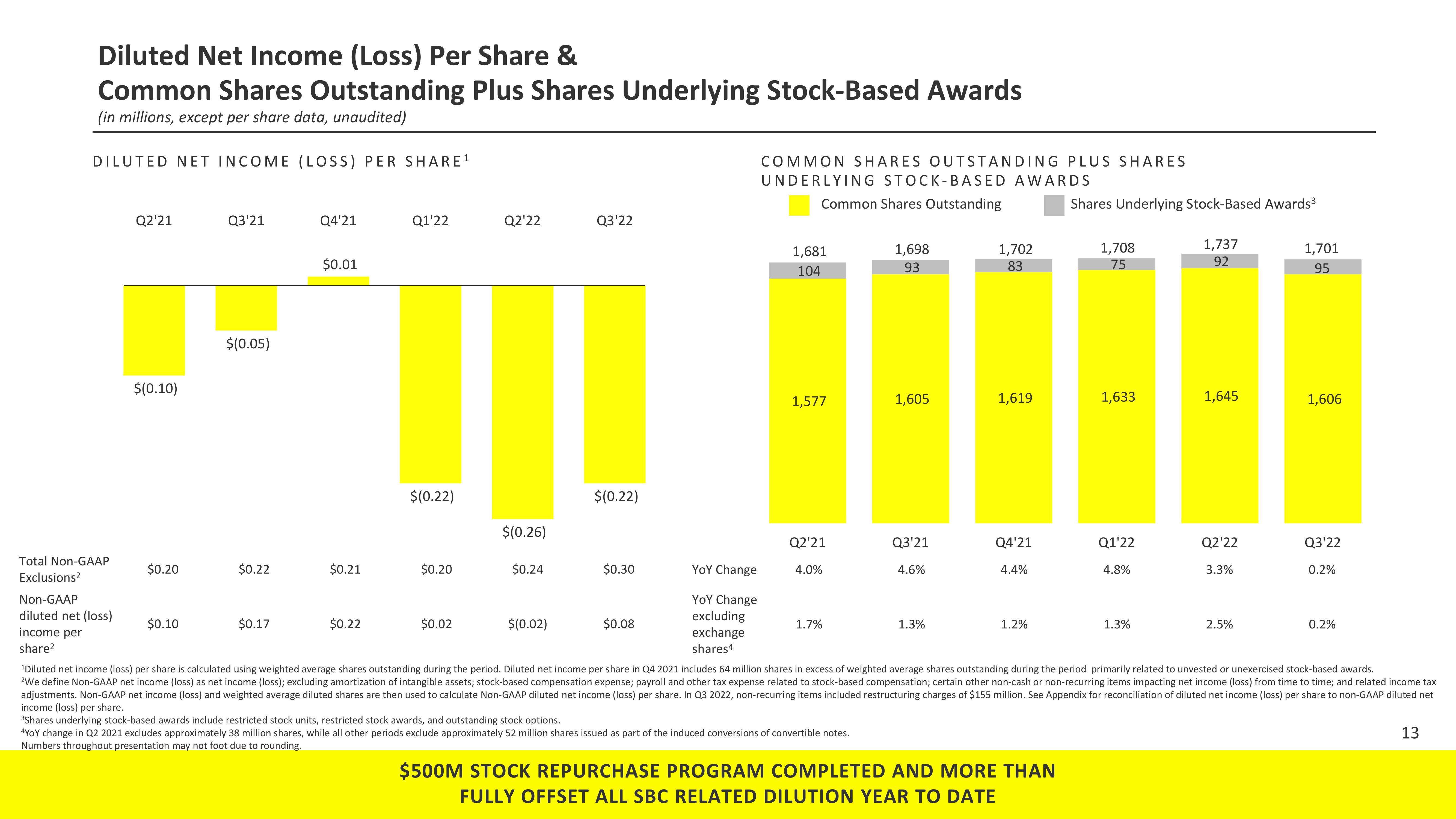

Diluted Net Income (Loss) Per Share &

Common Shares Outstanding Plus Shares Underlying Stock-Based Awards

(in millions, except per share data, unaudited)

DILUTED NET INCOME (LOSS) PER SHARE ¹

Q2'21

$(0.10)

$0.20

Q3'21

$0.10

$(0.05)

$0.22

Q4'21

$0.17

$0.01

$0.21

Q1'22

$0.22

$(0.22)

$0.20

Q2'22

$0.02

$(0.26)

$0.24

Q3'22

$(0.02)

$(0.22)

$0.30

$0.08

COMMON SHARES OUTSTANDING PLUS SHARES

UNDERLYING STOCK-BASED AWARDS

Common Shares Outstanding

YOY Change

YOY Change

excluding

exchange

shares4

1,681

104

1,577

Q2'21

4.0%

1,698

93

1.7%

1,605

Total Non-GAAP

Exclusions²

Non-GAAP

diluted net (loss)

income per

share²

¹Diluted net income (loss) per share is calculated using weighted average shares outstanding during the period. Diluted net income per share in Q4 2021 includes 64 million shares in excess of weighted average shares outstanding during the period primarily related to unvested or unexercised stock-based awards.

2We define Non-GAAP net income (loss) as net income (loss); excluding amortization of intangible assets; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; certain other non-cash or non-recurring items impacting net income (loss) from time to time; and related income tax

adjustments. Non-GAAP net income (loss) and weighted average diluted shares are then used to calculate Non-GAAP diluted net income (loss) per share. In Q3 2022, non-recurring items included restructuring charges of $155 million. See Appendix for reconciliation of diluted net income (loss) per share to non-GAAP diluted net

income (loss) per share.

3Shares underlying stock-based awards include restricted stock units, restricted stock awards, and outstanding stock options.

4YoY change in Q2 2021 excludes approximately 38 million shares, while all other periods exclude approximately 52 million shares issued as part of the induced conversions of convertible notes.

Numbers throughout presentation may not foot due to rounding.

Q3'21

4.6%

1,702

83

1.3%

1,619

Q4'21

4.4%

1.2%

Shares Underlying Stock-Based Awards³

$500M STOCK REPURCHASE PROGRAM COMPLETED AND MORE THAN

FULLY OFFSET ALL SBC RELATED DILUTION YEAR TO DATE

1,708

75

1,633

Q1'22

4.8%

1,737

92

1.3%

1,645

Q2'22

3.3%

1,701

95

2.5%

1,606

Q3'22

0.2%

0.2%

13View entire presentation