Rocket Companies IPO Presentation Deck

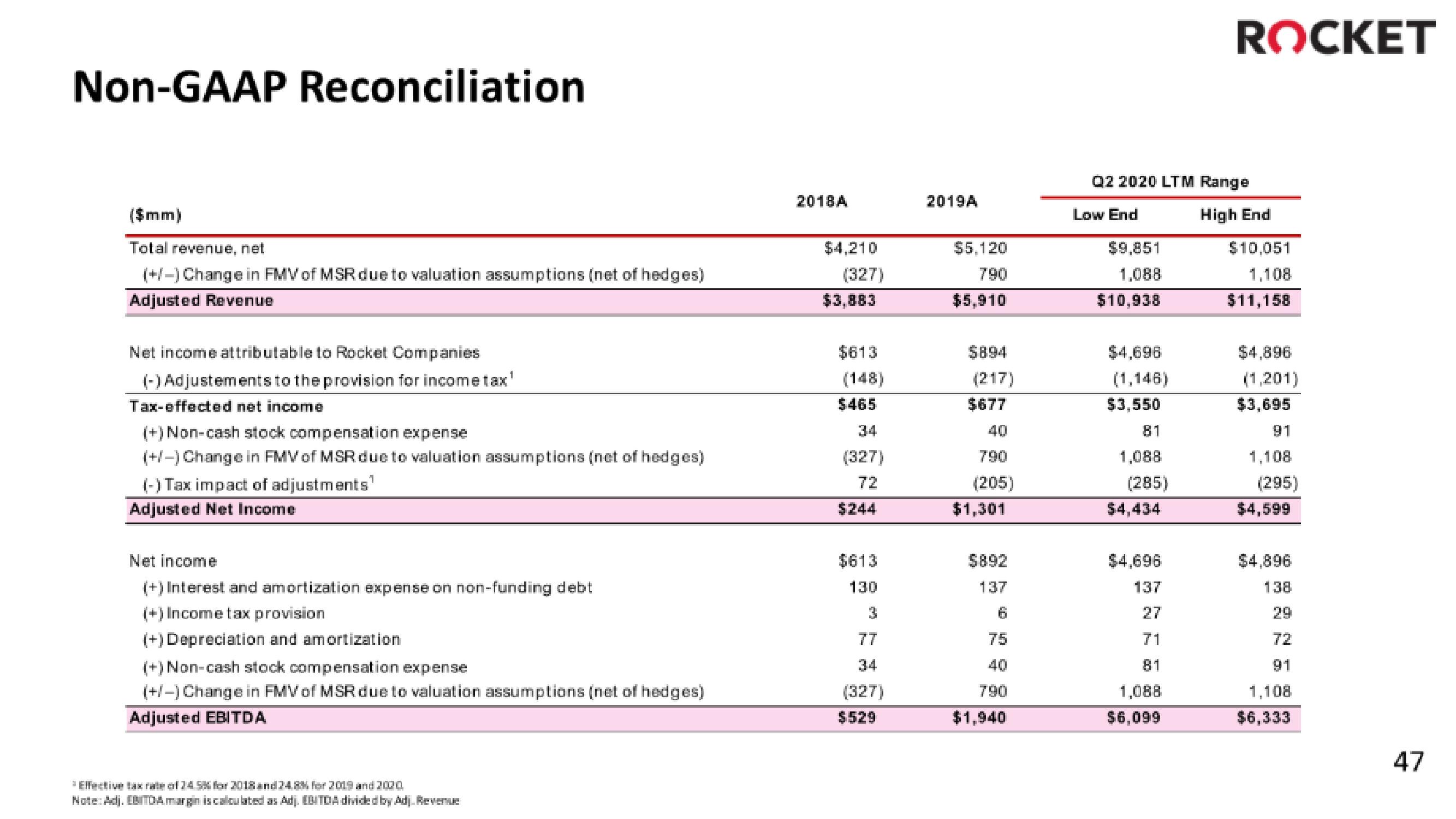

Non-GAAP Reconciliation

($mm)

Total revenue, net

(+/-) Change in FMV of MSR due to valuation assumptions (net of hedges)

Adjusted Revenue

Net income attributable to Rocket Companies

(-) Adjustements to the provision for income tax¹

Tax-effected net income

(+) Non-cash stock compensation expense

(+/-) Change in FMV of MSR due to valuation assumptions (net of hedges)

(-) Tax impact of adjustments¹

Adjusted Net Income

Net income

(+) Interest and amortization expense on non-funding debt

(+) Income tax provision

(+) Depreciation and amortization

(+) Non-cash stock compensation expense

(+/-) Change in FMV of MSR due to valuation assumptions (net of hedges)

Adjusted EBITDA

Effective tax rate of 24 5% for 2018 and 24.8% for 2019 and 2020

Note: Adj. EBITDA margin is calculated as Adj. EBITDA divided by Adj. Revenue

2018A

$4,210

(327)

$3,883

$613

$465

(327)

72

$244

$613

130

77

(327)

$529

2019A

$5,120

790

$5,910

$894

(217)

$677

40

790

(205)

$1,301

$892

137

75

40

790

$1,940

Q2 2020 LTM Range

Low End

$9,851

1.088

$10,938

$4,696

(1,146)

$3,550

81

1,088

(285)

$4,434

$4,696

137

71

ROCKET

1,088

$6,099

High End

$10,051

1,108

$11,158

$4,896

(1,201)

$3,695

91

1,108

(295)

$4,599

$4,896

138

72

91

1,108

$6,333

47View entire presentation