Crocs Results Presentation Deck

Cr

CS

cr

OCS

CI

OC

Cl

BRAND PERFORMANCE

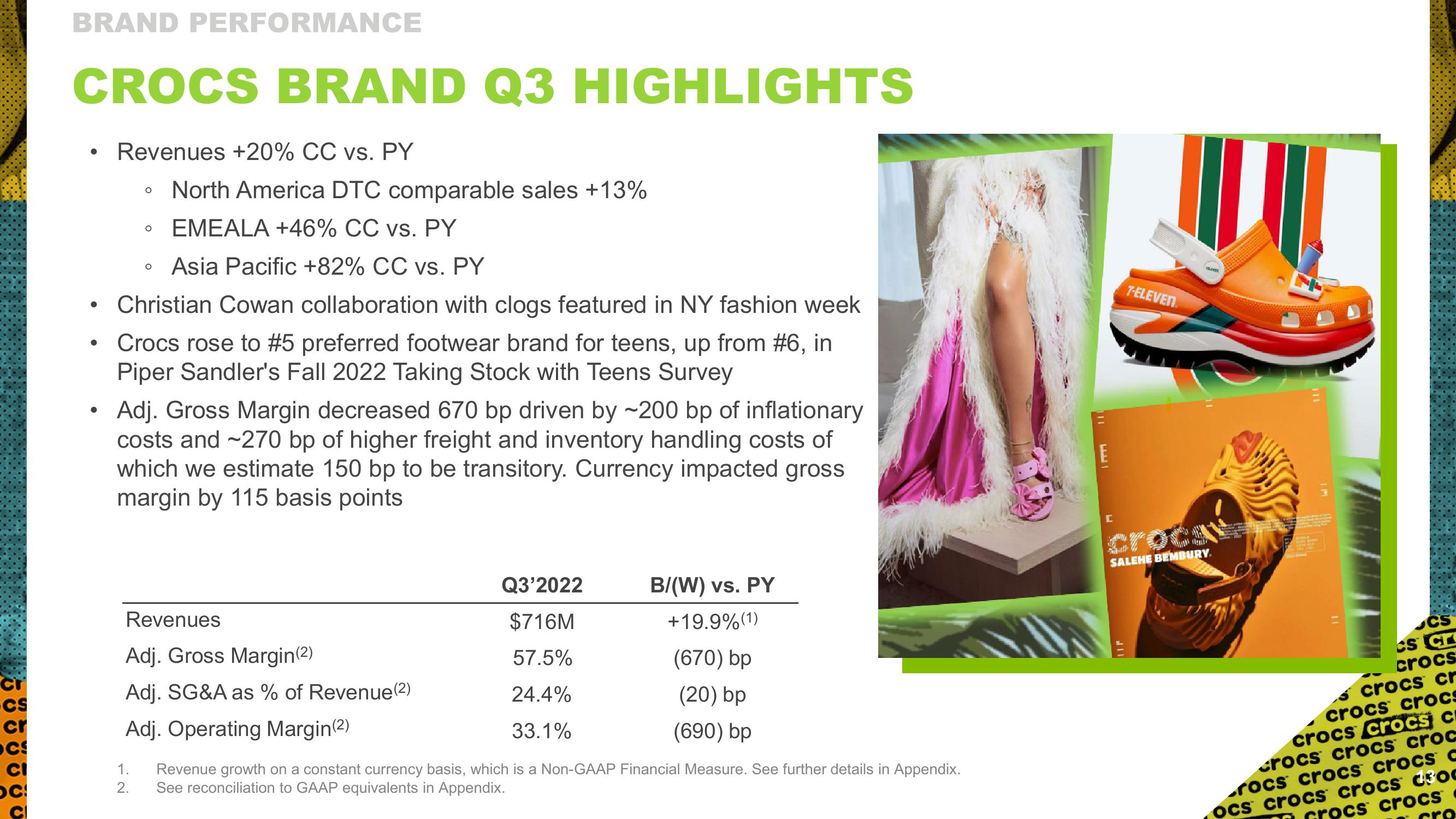

CROCS BRAND Q3 HIGHLIGHTS

●

●

●

●

Revenues +20% CC vs. PY

North America DTC comparable sales +13%

• EMEALA +46% CC vs. PY

O

O

Asia Pacific +82% CC vs. PY

Christian Cowan collaboration with clogs featured in NY fashion week

Crocs rose to #5 preferred footwear brand for teens, up from #6, in

Piper Sandler's Fall 2022 Taking Stock with Teens Survey

1.

2.

O

Adj. Gross Margin decreased 670 bp driven by ~200 bp of inflationary

costs and ~270 bp of higher freight and inventory handling costs of

which we estimate 150 bp to be transitory. Currency impacted gross

margin by 115 basis points

Revenues

Adj. Gross Margin(2)

Adj. SG&A as % of Revenue (2)

Adj. Operating Margin(2)

Q3'2022

$716M

57.5%

24.4%

33.1%

B/(W) vs. PY

+19.9% (1)

(670) bp

(20) bp

(690) bp

Revenue growth on a constant currency basis, which is a Non-GAAP Financial Measure. See further details in Appendix.

See reconciliation to GAAP equivalents in Appendix.

E

C

7-ELEVEN

HAVER

SALEHE BEMBURY.

P

CS

CS Cr

crocs

crocs cr

crocs crocs

crocs crocs C

crocs crocs croc

rocs crocs crocs c

ocs crocs crocs deoc

Grocs crocsView entire presentation