Capri Holdings Results Presentation Deck

Gross profit

Operating expenses

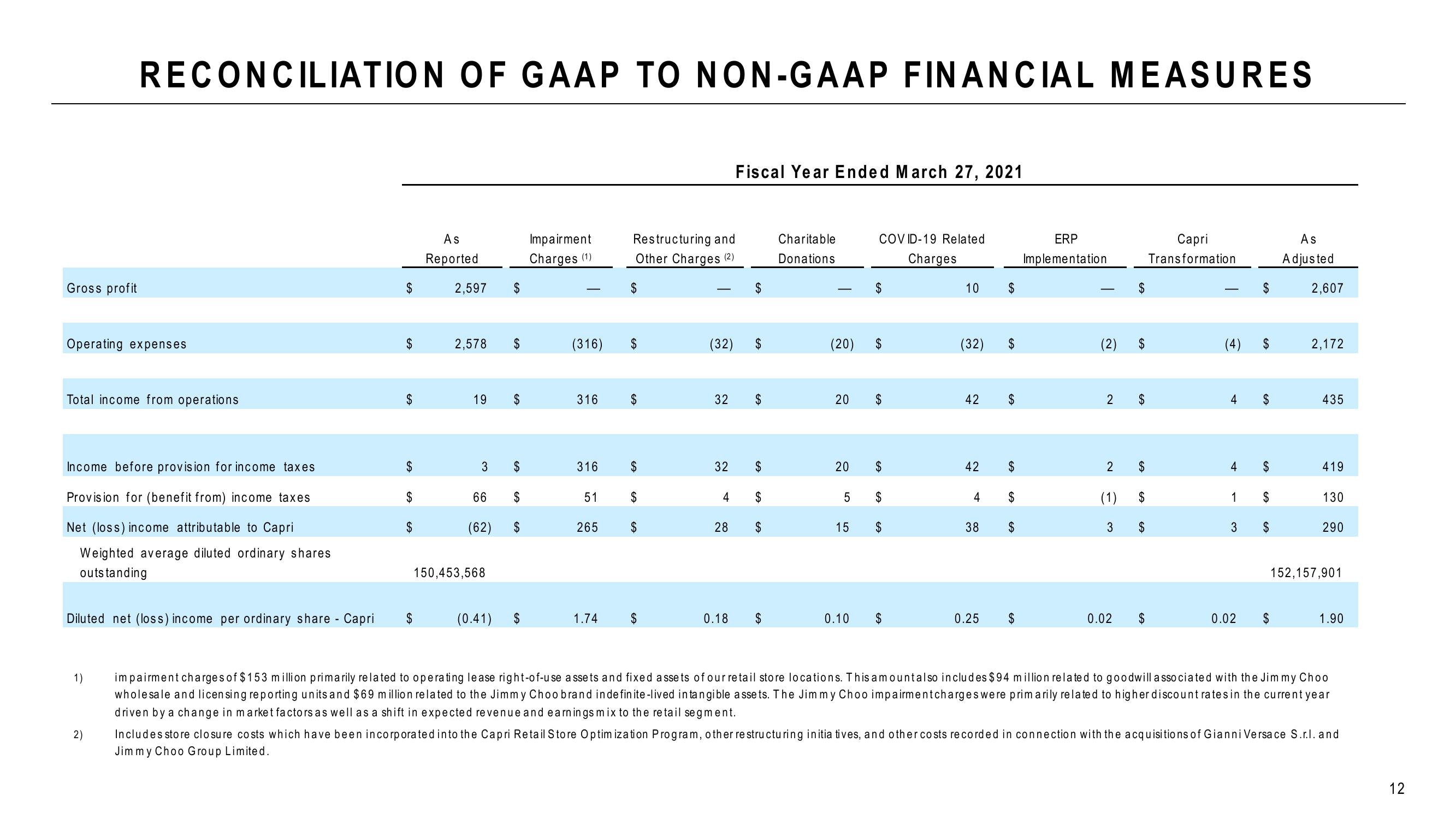

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

Total income from operations

Income before provision for income taxes

Provision for (benefit from) income taxes

Net (loss) income attributable to Capri

Weighted average diluted ordinary shares

outstanding

Diluted net (loss) income per ordinary share - Capri

1)

2)

$

$

GA

$

$

$

$

$

As

Reported

2,597

2,578

19

3

(62)

$

$

66 $

$

150,453,568

$

$

(0.41) $

Impairment

Charges (1)

(316)

316

316

51

265

1.74

Restructuring and

Other Charges (2)

$

CA

$

$

(32)

32

4

Fiscal Year Ended March 27, 2021

32 $

28

0.18

GA

GA

CA

Charitable

Donations

(20) $

20 $

20

COV ID-19 Related

Charges

5

$

15 $

0.10

$

$

10

(32)

42

42

4

38

0.25

$

$

$

$

GA

$

$

SA

$

ERP

Implementation

(2)

2

2

$

0.02

$

$

(1) $

3

$

$

$

Capri

Transformation

(4)

4

4

1

3

0.02

$

$

$

$

$

$

$

As

Adjusted

2,607

2,172

435

419

130

290

152,157,901

1.90

impairment charges of $153 million primarily related to operating lease right-of-use assets and fixed assets of our retail store locations. This amount also includes $94 million related to goodwill associated with the Jimmy Choo

wholesale and licensing reporting units and $69 million related to the Jimmy Choo brand in de finite-lived in tangible assets. The Jimmy Choo impairment charges were primarily related to higher discount rates in the current year

driven by a change in market factors as well as a shift in expected revenue and earnings mix to the retail segment.

Includes store closure costs which have been incorporated into the Capri Retail Store Optimization Program, other re structuring initia tives, and other costs recorded in connection with the acquisitions of Gianni Versace S.r.l. and

Jimmy Choo Group Limited.

12View entire presentation