Frontier IPO Presentation Deck

(d)

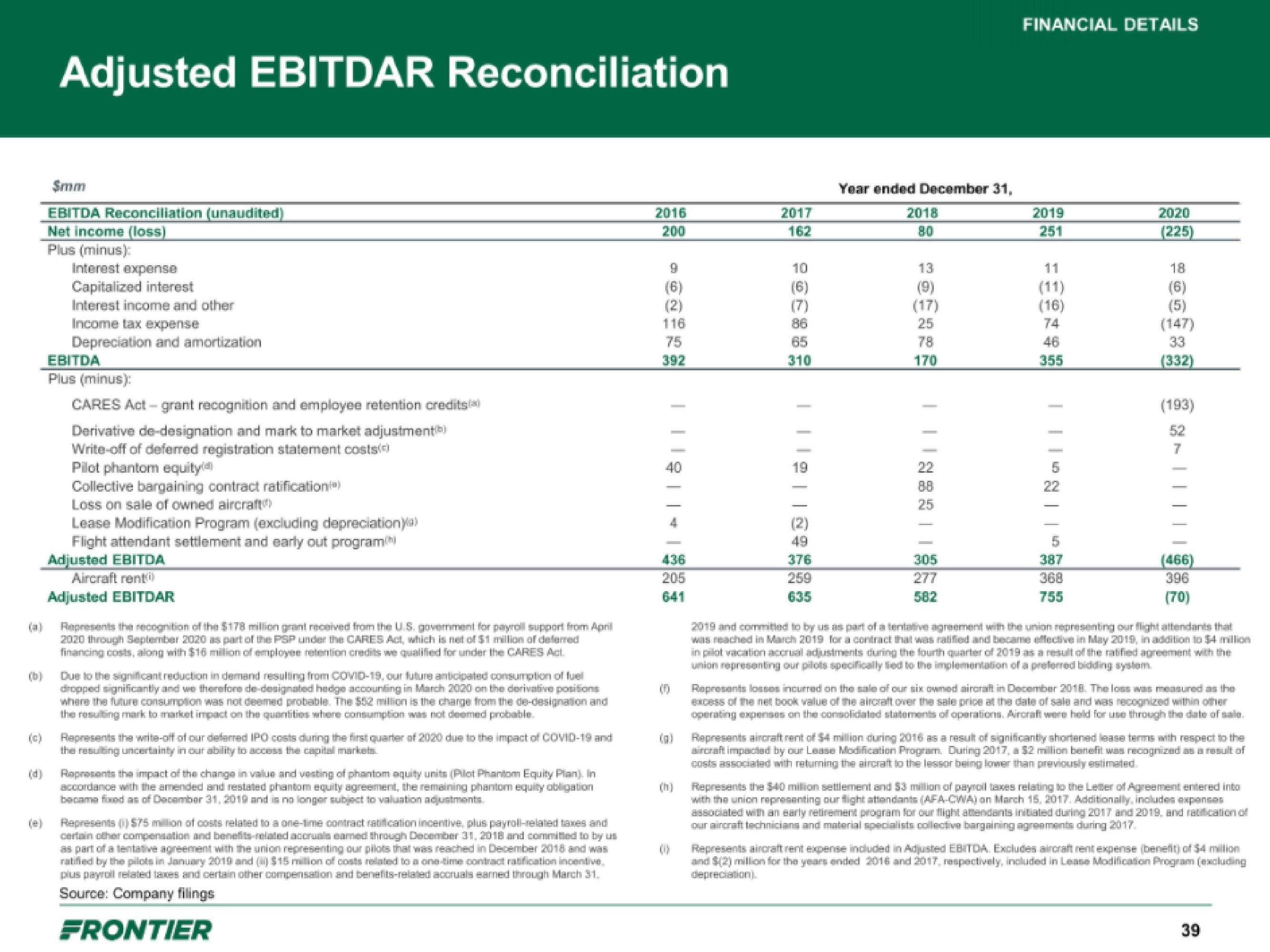

Adjusted EBITDAR Reconciliation

$mm

EBITDA Reconciliation (unaudited)

Net income (loss)

Plus (minus):

Interest expense

Capitalized interest

Interest income and other

Income tax expense

Depreciation and amortization

EBITDA

Plus (minus):

CARES Act-grant recognition and employee retention credits

Derivative de-designation and mark to market adjustment bi

Write-off of deferred registration statement costs()

Pilot phantom equity)

Collective bargaining contract ratification)

Loss on sale of owned aircraft

Lease Modification Program (excluding depreciational

Flight attendant settlement and early out programih

Adjusted EBITDA

Aircraft renti

Adjusted EBITDAR

Represents the recognition of the $178 million grant received from the U.S. government for payroll support from Aprili

2020 through September 2020 as part of the PSP under the CARES Act, which is net of $1 million of deferred

financing costs, along with $16 million of employee retention credits we qualified for under the CARES Act.

Due to the significant reduction in demand resulting from COVID-19, our future anticipated consumption of fuel

dropped significantly and we therefore de-designated hedge accounting in March 2020 on the derivative positions

where the future consumption was not deemed probable. The $52 million is the charge from the de-designation and

the resulting mark to market impact on the quantities where consumption was not deemed probable

Represents the write-off of our deferred IPO costs during the first quarter of 2020 due to the impact of COVID-19 and

the resulting uncertainty in our ability to access the capital markets.

Represents the impact of the change in value and vesting of phantom aquity units (Pilot Phantom Equity Plan). In

accordance with the amended and restated phantom equity agreement, the remaining phantom equity obligation

became fixed as of December 31, 2019 and is no longer subject to valuation adjustments.

Represents () $75 million of costs related to a one-time contract ratification incentive, plus payroll-related taxes and

certain other compensation and benefits-related accruals eamed through December 31, 2018 and committed to by us

as part of a tentative agreement with the union representing our pilots that was reached in December 2018 and was

ratified by the pilots in January 2019 and () $15 million of costs related to a one-time contract ratification incentive,

plus payroll related taxes and certain other compensation and benefits-related accruals earned through March 31.

Source: Company filings

FRONTIER

2016

200

(6)

(2)

116

392

| | | g || + |

40

436

205

641

2017

162

10

(6)

(7)

310

60||||||

376

259

635

Year ended December 31,

2018

80

13

(17)

25

78

170

25

305

277

582

FINANCIAL DETAILS

2019

251

11

(11)

(16)

46

355

|||||

387

368

755

2020

(225)

18

(6)

(147)

33

(332)

(193)

52

T

(466)

(70)

2019 and committed to by us as part of a tentative agreement with the union representing our flight attendants that

was reached in March 2019 for a contract that was ratified and became effective in May 2019, in addition to $4 million

in pilot vacation accrual adjustments during the fourth quarter of 2019 as a result of the ratified agreement with the

union representing our pilots specifically tied to the implementation of a preferred bidding system.

Represents losses incurred on the sale of our six owned aircraft in December 2018. The loss was measured as the

excess of the net book value of the aircraft over the sale price at the date of sale and was recognized within other

operating expenses on the consolidated statements of operations. Aircraft were held for use through the date of sale.

Represents aircraft rent of $4 million during 2016 as a result of significantly shortened lease terms with respect to the

aircraft impacted by our Lease Modification Program. During 2017, a $2 million benefit was recognized as a result of

costs associated with returning the aircraft to the lessor being lower than previously estimated.

Represents the $40 million settlement and $3 million of payroll taxes relating to the Letter of Agreement entered into

with the union representing our flight attendants (AFA-CWA) on March 15, 2017. Additionally, includes expenses

associated with an early retirement program for our flight attendants initiated during 2017 and 2019, and ratification of

our aircraft technicians and material specialists collective bargaining agreements during 2017.

Represents aircraft rent expense included in Adjusted EBITDA. Excludes aircraft rent expense (benefit) of $4 million

and $(2) million for the years ended 2016 and 2017, respectively, included in Lease Modification Program (excluding

depreciation).

39View entire presentation