CorpAcq SPAC Presentation Deck

37

3C

TEV / 2023E EBITDA

20x

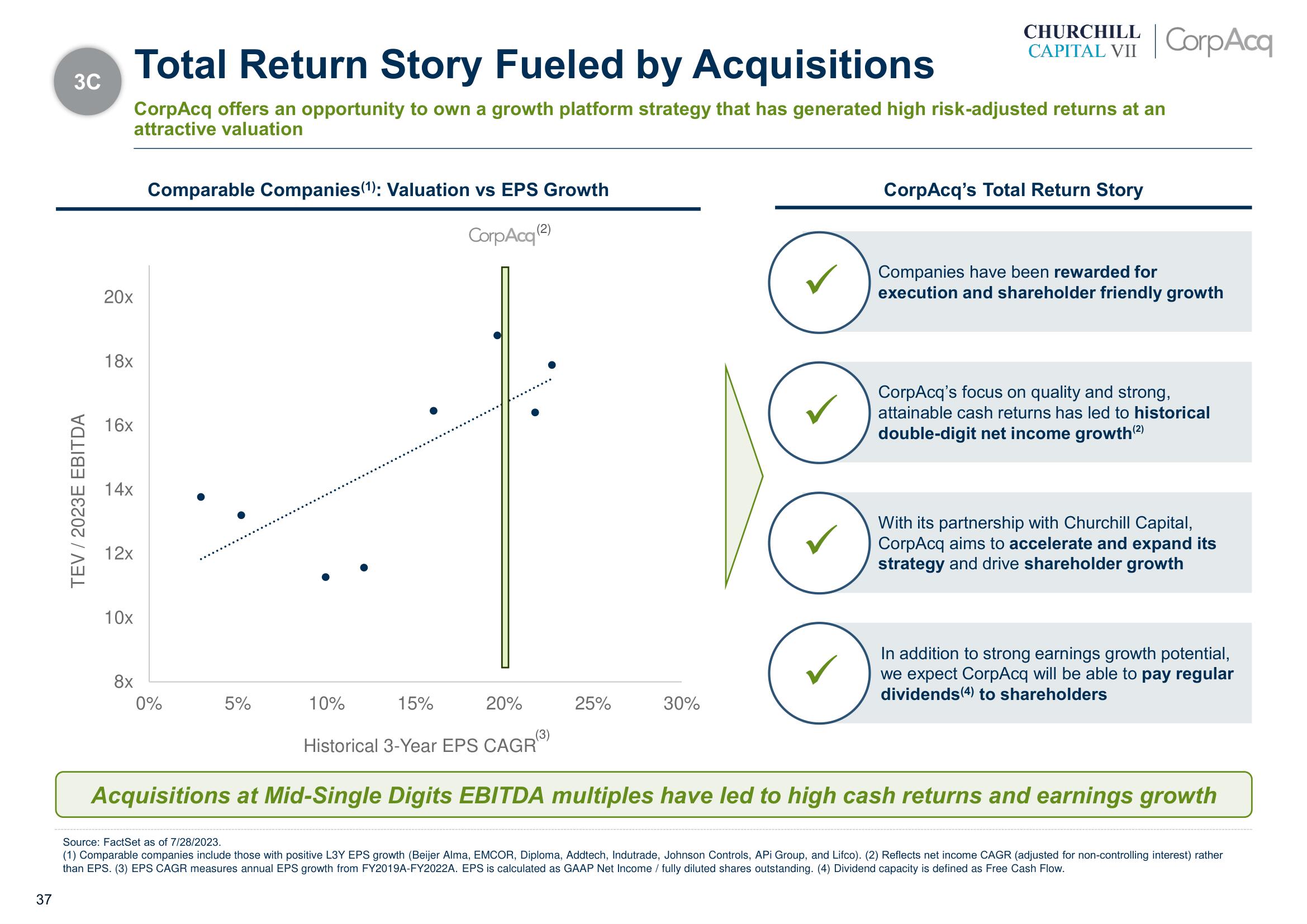

Total Return Story Fueled by Acquisitions

CorpAcq offers an opportunity to own a growth platform strategy that has generated high risk-adjusted returns at an

attractive valuation

18x

16x

14x

12x

10x

8x

Comparable Companies (1): Valuation vs EPS Growth

Corp Acq(2)

0%

5%

10%

15%

20%

(3)

Historical 3-Year EPS CAGR

25%

CHURCHILL

CAPITAL

30%

CorpAcq

VII C

CorpAcq's Total Return Story

Companies have been rewarded for

execution and shareholder friendly growth

CorpAcq's focus on quality and strong,

attainable cash returns has led to historical

double-digit net income growth (²)

With its partnership with Churchill Capital,

CorpAcq aims to accelerate and expand its

strategy and drive shareholder growth

In addition to strong earnings growth potential,

we expect CorpAcq will be able to pay regular

dividends (4) to shareholders

Acquisitions at Mid-Single Digits EBITDA multiples have led to high cash returns and earnings growth

Source: FactSet as of 7/28/2023.

(1) Comparable companies include those with positive L3Y EPS growth (Beijer Alma, EMCOR, Diploma, Addtech, Indutrade, Johnson Controls, API Group, and Lifco). (2) Reflects net income CAGR (adjusted for non-controlling interest) rather

than EPS. (3) EPS CAGR measures annual EPS growth from FY2019A-FY2022A. EPS is calculated as GAAP Net Income / fully diluted shares outstanding. (4) Dividend capacity is defined as Free Cash Flow.View entire presentation