Main Street Capital Investor Day Presentation Deck

●

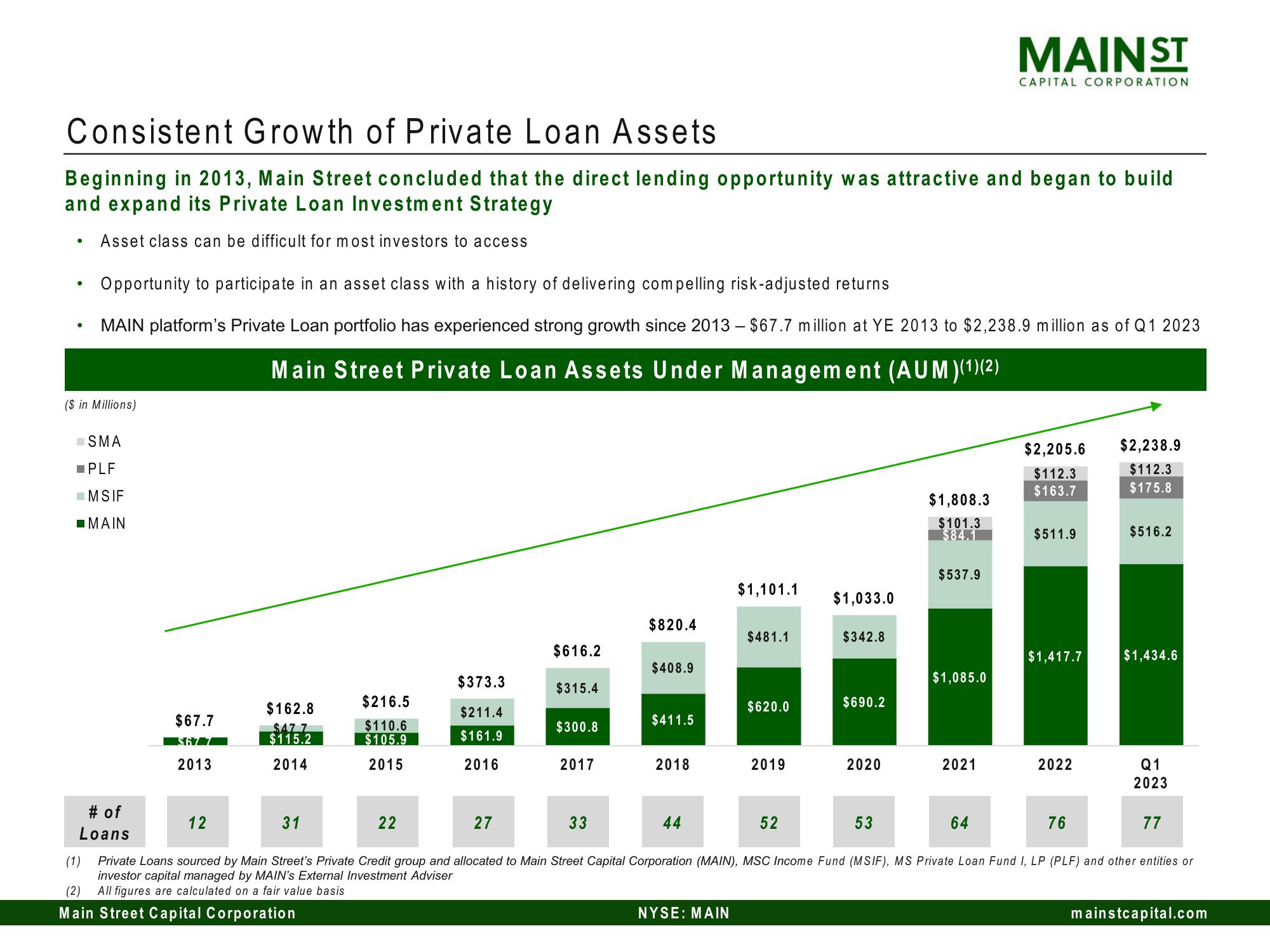

Consistent Growth of Private Loan Assets

Beginning in 2013, Main Street concluded that the direct lending opportunity was attractive and began to build

and expand its Private Loan Investment Strategy

Asset class can be difficult for most investors to access

●

●

($ in Millions)

Opportunity to participate in an asset class with a history of delivering compelling risk-adjusted returns

MAIN platform's Private Loan portfolio has experienced strong growth since 2013 - $67.7 million at YE 2013 to $2,238.9 million as of Q1 2023

Main Street Private Loan Assets Under Management (AUM)(1)(2)

SMA

■PLF

MSIF

■MAIN

# of

Loans

$67.7

$677

2013

12

$162.8

$477

$115.2

2014

31

$216.5

$110.6

$105.9

2015

22

$373.3

$211.4

$161.9

2016

27

$616.2

$315.4

$300.8

2017

33

$820.4

$408.9

$411.5

2018

44

$1,101.1

NYSE: MAIN

$481.1

$620.0

2019

52

$1,033.0

$342.8

$690.2

2020

53

$1,808.3

$101.3

$84.1

$537.9

$1,085.0

MAIN ST

2021

CAPITAL CORPORATION

64

$2,205.6

$112.3

$163.7

$511.9

$1,417.7

2022

76

$2,238.9

$112.3

$175.8

$516.2

$1,434.6

Q1

2023

77

(1) Private Loans sourced by Main Street's Private Credit group and allocated to Main Street Capital Corporation (MAIN), MSC Income Fund (MSIF), MS Private Loan Fund I, LP (PLF) and other entities or

investor capital managed by MAIN's External Investment Adviser

(2) All figures are calculated on a fair value basis

Main Street Capital Corporation

mainstcapital.comView entire presentation