Inovalon Results Presentation Deck

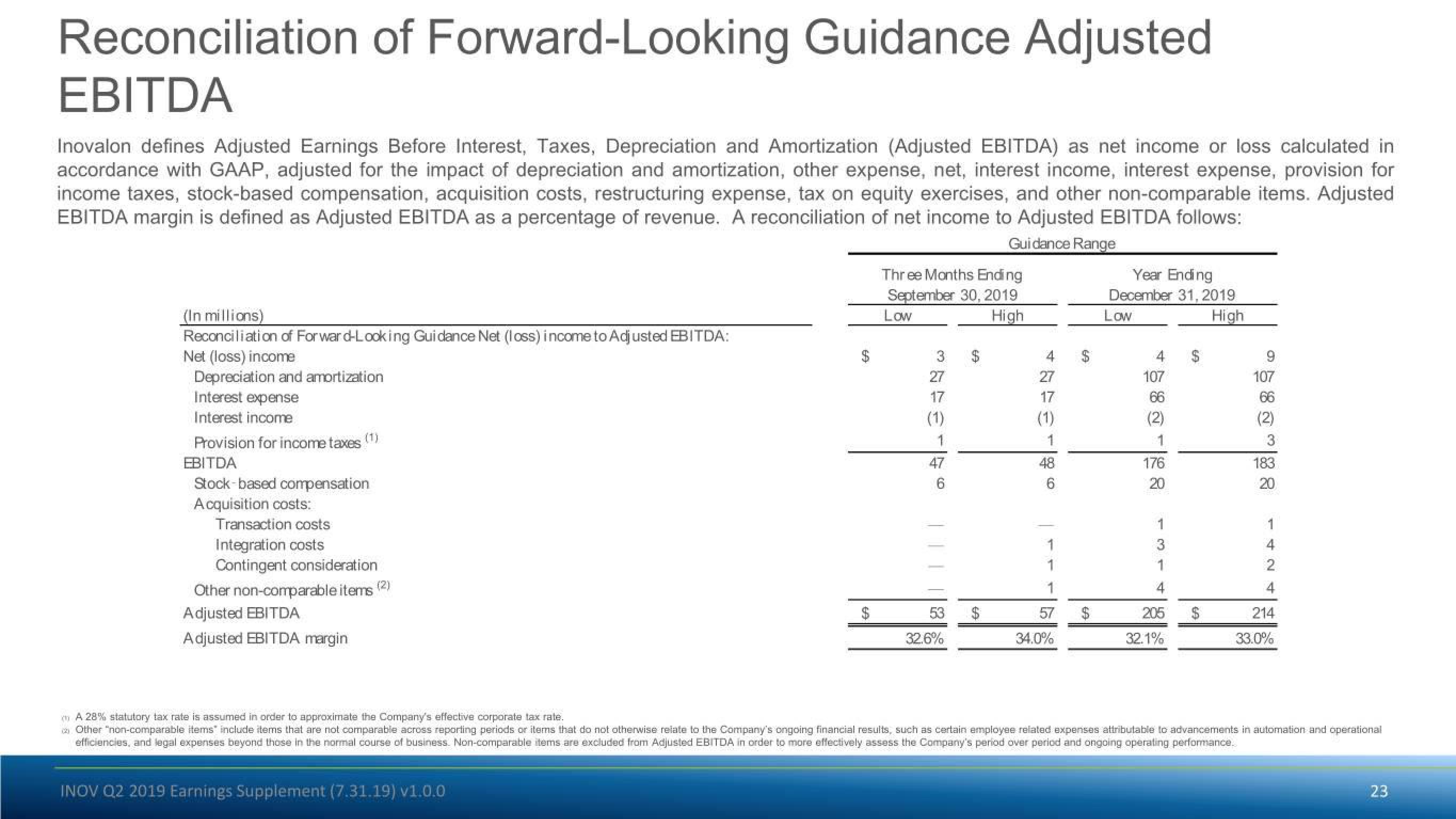

Reconciliation of Forward-Looking Guidance Adjusted

EBITDA

Inovalon defines Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) as net income or loss calculated in

accordance with GAAP, adjusted for the impact of depreciation and amortization, other expense, net, interest income, interest expense, provision for

income taxes, stock-based compensation, acquisition costs, restructuring expense, tax on equity exercises, and other non-comparable items. Adjusted

EBITDA margin is defined as Adjusted EBITDA as a percentage of revenue. A reconciliation of net income to Adjusted EBITDA follows:

Guidance Range

(In millions)

Reconciliation of Forward-Looking Guidance Net (loss) income to Adjusted EBITDA:

Net (loss) income

Depreciation and amortization

Interest expense

Interest income

Provision for income taxes (¹)

EBITDA

Stock-based compensation

Acquisition costs:

Transaction costs

Integration costs

Contingent consideration

Other non-comparable items (2)

Adjusted EBITDA

Adjusted EBITDA margin

Three Months Ending

September 30, 2019

Low

High

INOV Q2 2019 Earnings Supplement (7.31.19) v1.0.0

3

27

17

(1)

47

6

53

32.6%

GA

$

27

17

(1)

48

6

57

34.0%

69

$

Year Ending

December 31, 2019

Low

High

107

66

(2)

176

20

1

3

4

205

32.1%

GA

69

$

9

107

(2)

3

183

20

1

42

214

33.0%

A 28% statutory tax rate is assumed in order to approximate the Company's effective corporate tax rate.

Other "non-comparable items include items that are not comparable across reporting periods or items that do not otherwise relate to the Company's ongoing financial results, such as certain employee related expenses attributable to advancements in automation and operational

efficiencies, and legal expenses beyond those in the normal course of business. Non-comparable items are excluded from Adjusted EBITDA in order to more effectively assess the Company's period over period and ongoing operating performance.

23View entire presentation