Cameco IPO Presentation Deck

Historical Non-GAAP and Non-IFRS

Reconciliations

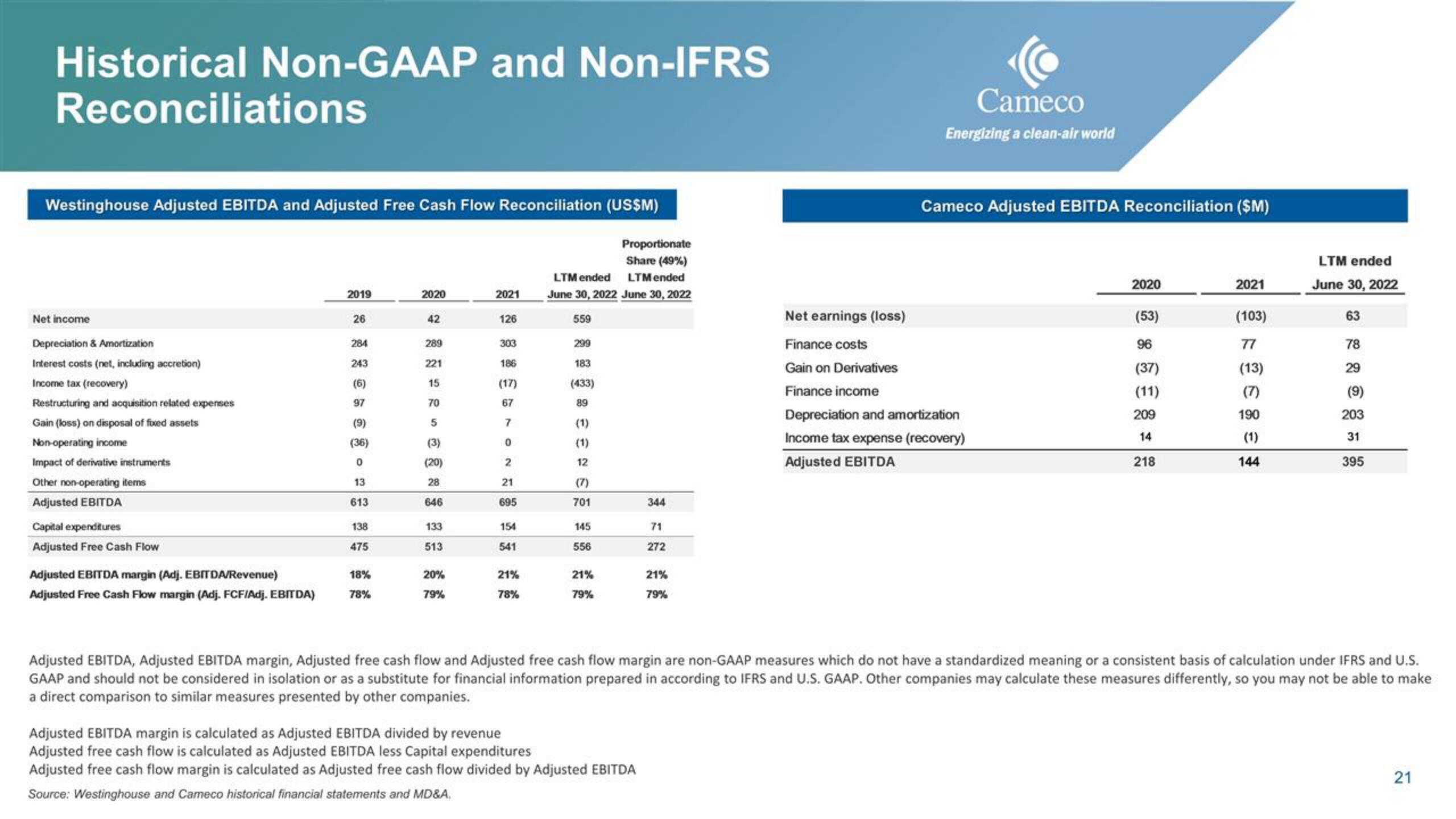

Westinghouse Adjusted EBITDA and Adjusted Free Cash Flow Reconciliation (US$M)

Proportionate

Share (49%)

LTM ended

LTM ended

June 30, 2022 June 30, 2022

559

Net income

Depreciation & Amortization

Interest costs (net, including accretion)

Income tax (recovery)

Restructuring and acquisition related expenses

Gain (loss) on disposal of fixed assets

Non-operating income

Impact of derivative instruments

Other non-operating items

Adjusted EBITDA

Capital expenditures

Adjusted Free Cash Flow

Adjusted EBITDA margin (Adj. EBITDA/Revenue)

Adjusted Free Cash Flow margin (Adj. FCF/Adj. EBITDA)

2019

26

284

243

(6)

97

(9)

(36)

0

13

613

138

475

18%

78%

2020

42

289

221

15

70

5

(3)

(20)

28

646

133

513

20%

79%

2021

126

303

186

(17)

67

7

0

2

21

695

154

541

21%

78%

299

183

(433)

89

(1)

(1)

12

(7)

701

145

556

21%

79%

344

Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by revenue

Adjusted free cash flow is calculated as Adjusted EBITDA less Capital expenditures

Adjusted free cash flow margin is calculated as Adjusted free cash flow divided by Adjusted EBITDA

Source: Westinghouse and Cameco historical financial statements and MD&A.

71

272

21%

79%

Net earnings (loss)

Finance costs

Gain on Derivatives

Finance income

Cameco

Energizing a clean-air world

Cameco Adjusted EBITDA Reconciliation ($M)

Depreciation and amortization

Income tax expense (recovery)

Adjusted EBITDA

2020

(53)

96

(37)

(11)

209

14

218

2021

(103)

77

(13)

(7)

190

(1)

144

LTM ended

June 30, 2022

63

78

29

(9)

203

31

395

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted free cash flow and Adjusted free cash flow margin are non-GAAP measures which do not have a standardized meaning or a consistent basis of calculation under IFRS and U.S.

GAAP and should not be considered in isolation or as a substitute for financial information prepared in according to IFRS and U.S. GAAP. Other companies may calculate these measures differently, so you may not be able to make

a direct comparison to similar measures presented by other companies.

21View entire presentation