Q4 2022 Fiscal Achievements

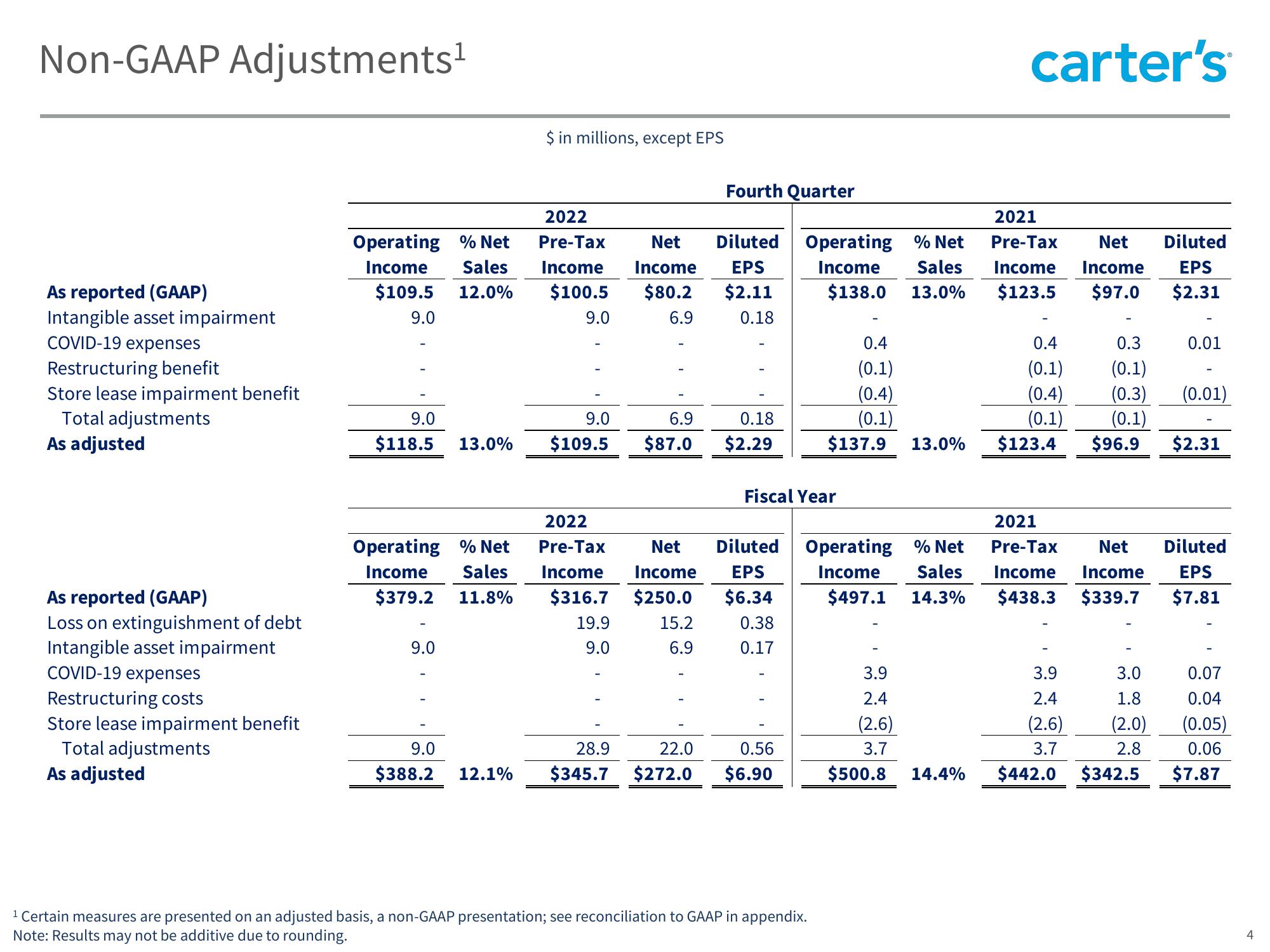

Non-GAAP Adjustments¹

As reported (GAAP)

Intangible asset impairment

COVID-19 expenses

Restructuring benefit

Store lease impairment benefit

Total adjustments

As adjusted

As reported (GAAP)

Loss on extinguishment of debt

Intangible asset impairment

COVID-19 expenses

Restructuring costs

Store lease impairment benefit

Total adjustments

As adjusted

9.0

$118.5 13.0%

Operating % Net

2022

Pre-Tax Net Diluted

Income Sales Income Income EPS

$109.5 12.0% $100.5 $80.2 $2.11

0.18

9.0

9.0

6.9

Operating % Net

Income Sales

$379.2 11.8%

9.0

$ in millions, except EPS

9.0

$388.2

9.0

$109.5

2022

Pre-Tax

Income

$316.7

19.9

9.0

28.9

12.1% $345.7

6.9

$87.0

Fourth Quarter

15.2

6.9

0.18

$2.29

Net Diluted

Income EPS

$250.0 $6.34

0.38

0.17

Operating % Net

Income Sales

$138.0 13.0%

Fiscal Year

22.0 0.56

$272.0 $6.90

-

¹ Certain measures are presented on an adjusted basis, a non-GAAP presentation; see reconciliation to GAAP in appendix.

Note: Results may not be additive due to rounding.

0.4

(0.1)

(0.4)

(0.1)

$137.9

Operating % Net

Income Sales

$497.1 14.3%

3.9

2.4

(2.6)

3.7

13.0%

$500.8

carter's

2021

Pre-Tax

Net Diluted

Income Income EPS

$123.5

$97.0 $2.31

-

0.4

0.3

(0.1)

(0.1)

(0.4)

(0.3)

(0.1) (0.1)

$123.4

0.01

(0.01)

$96.9 $2.31

3.9

3.0

2.4

1.8

(2.6)

(2.0)

2.8

3.7

14.4% $442.0 $342.5

2021

Pre-Tax Net Diluted

Income Income EPS

$438.3 $339.7 $7.81

0.07

0.04

(0.05)

0.06

$7.87

4View entire presentation