J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

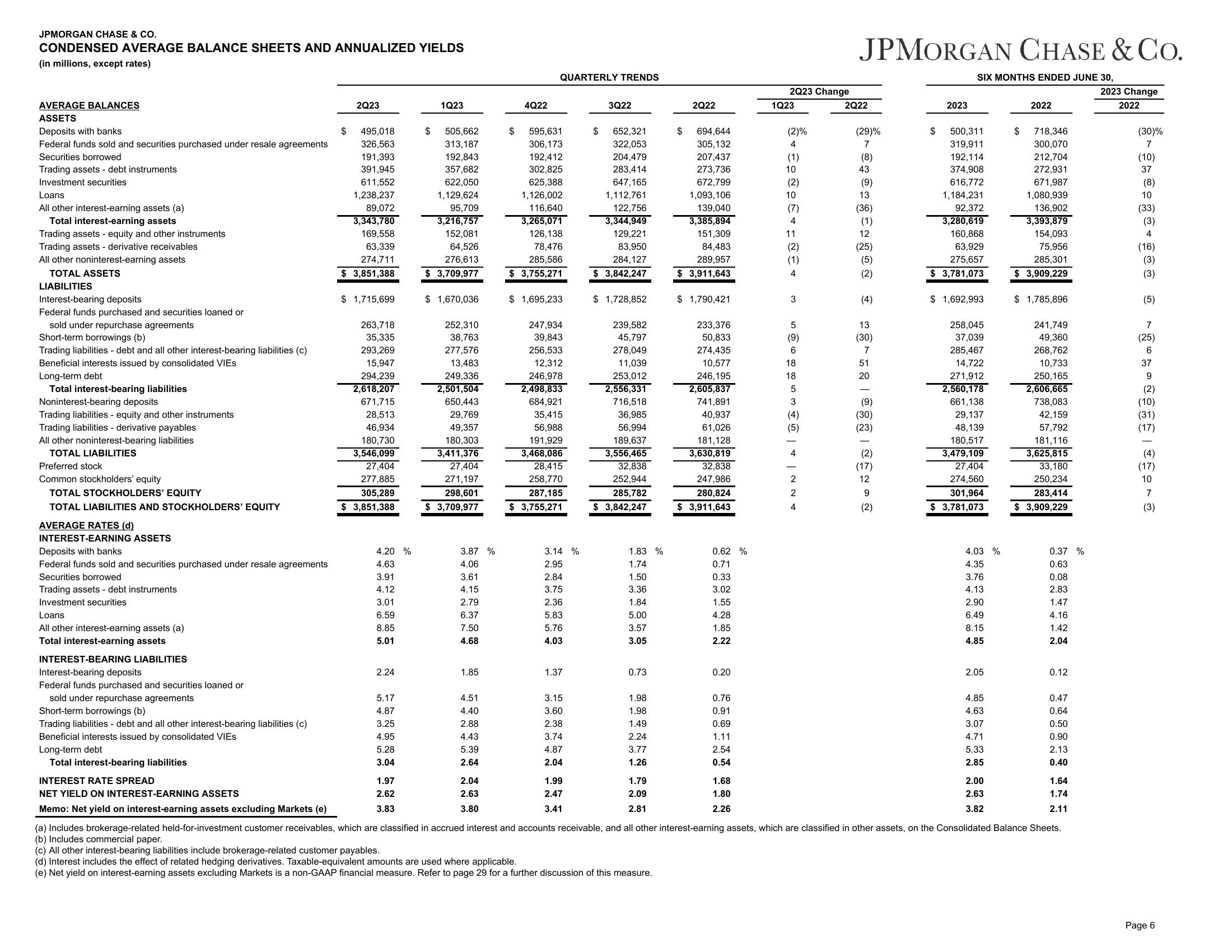

CONDENSED AVERAGE BALANCE SHEETS AND ANNUALIZED YIELDS

(in millions, except rates)

AVERAGE BALANCES

ASSETS

Deposits with banks

Federal funds sold and securities purchased under resale agreements

Securities borrowed

Trading assets - debt instruments

Investment securities

Loans

All other interest-earning assets (a)

Total interest-earning assets

Trading assets - equity and other instruments

Trading assets - derivative receivables

All other noninterest-earning assets

TOTAL ASSETS

LIABILITIES

Interest-bearing deposits

Federal funds purchased and securities loaned or

sold under repurchase agreements

Short-term borrowings (b)

Trading liabilities - debt and all other interest-bearing liabilities (c)

Beneficial interests issued by consolidated VIES

Long-term debt

Total interest-bearing liabilities

Noninterest-bearing deposits

Trading liabilities - equity and other instruments

Trading liabilities - derivative payables

All other noninterest-bearing liabilities

TOTAL LIABILITIES

Preferred stock

Common stockholders' equity

TOTAL STOCKHOLDERS' EQUITY

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

AVERAGE RATES (d)

INTEREST-EARNING ASSETS

Deposits with banks

Federal funds sold and securities purchased under resale agreements

Securities borrowed

Trading assets - debt instruments

Investment securities

Loans

All other interest-earning assets (a)

Total interest-earning assets

INTEREST-BEARING LIABILITIES

Interest-bearing deposits

Federal funds purchased and securities loaned or

sold under repurchase agreements

Short-term borrowings (b)

Trading liabilities - debt and all other interest-bearing liabilities (c)

Beneficial interests issued by consolidated VIES

Long-term debt

Total interest-bearing liabilities

INTEREST RATE SPREAD

NET YIELD ON INTEREST-EARNING ASSETS

Memo: Net yield on interest-earning assets excluding Markets (e)

$

2Q23

495,018

326,563

191,393

391,945

611,552

1,238,237

89,072

3,343,780

169,558

63,339

274,711

$ 3,851,388

$ 1,715,699

263,718

35,335

293,269

15,947

294,239

2,618,207

671,715

28,513

46,934

180,730

3,546,099

27,404

277,885

305,289

$ 3,851,388

4.20 %

4.63

3.91

4.12

3.01

6.59

8.85

5.01

2.24

5.17

4.87

3.25

4.95

5.28

3.04

1.97

2.62

3.83

$

1Q23

505,662

313,187

192,843

357,682

622,050

1,129,624

95,709

3,216,757

152,081

64,526

276,613

$ 3,709,977

$ 1,670,036

252,310

38,763

277,576

13,483

249,336

2,501,504

650,443

29,769

49,357

180,303

3,411,376

27,404

271,197

298,601

$ 3,709,977

3.87%

4.06

3.61

4.15

2.79

6.37

7.50

4.68

1.85

4.51

4.40

2.88

4.43

5.39

2.64

2.04

2.63

3.80

$

4Q22

QUARTERLY TRENDS

595,631

306,173

192,412

302,825

625,388

1,126,002

116,640

3,265,071

126,138

78,476

285,586

$ 3,755,271

$ 1,695,233

247,934

39,843

256,533

12,312

246,978

2,498,833

684,921

35,415

56,988

191,929

3,468,086

28,415

258,770

287,185

$ 3,755,271

3.14 %

2.95

2.84

3.75

2.36

5.83

5.76

4.03

1.37

3.15

3.60

2.38

3.74

4.87

2.04

1.99

2.47

3.41

3Q22

$

652,321

322,053

204,479

283,414

647,165

1,112,761

122,756

3,344,949

129,221

83,950

284,127

$ 3,842,247

$ 1,728,852

239,582

45,797

278,049

11,039

253,012

2,556,331

716,518

36,985

56,994

189,637

3,556,465

32,838

252,944

285,782

$ 3,842,247

1.83 %

1.74

1.50

3.36

1.84

5.00

3.57

3.05

0.73

1.98

1.98

1.49

2.24

3.77

1.26

1.79

2.09

2.81

2Q22

$ 694,644

305,132

207,437

273,736

672,799

1,093,106

139,040

3,385,894

151,309

84,483

289,957

$ 3,911,643

$ 1,790,421

233,376

50,833

274,435

10,577

246,195

2,605,837

741,891

40,937

61,026

181,128

3,630,819

32,838

247,986

280,824

$ 3,911,643

0.62%

0.71

0.33

3.02

1.55

4.28

1.85

2.22

0.20

0.76

0.91

0.69

1.11

2.54

0.54

1.68

1.80

2.26

2Q23 Change

1Q23

✩ ✦ €ọ @ọ € + ‡ Ñ€ +

(2)%

4

(1)

10

(2)

10

(7)

4

11

(2)

(1)

3

5

(9)

6

18

18

5

3

(4)

4

2

2

4

JPMORGAN CHASE & CO.

SIX MONTHS ENDED JUNE 30,

2Q22

(29)%

7

- @❤æ❤§¤ƒˆˆ € 85ˆˆˆˆˆ ª • ª

$

2023

500,311

319,911

192,114

374,908

616,772

1,184,231

92,372

3,280,619

160,868

63,929

275,657

$ 3,781,073

$ 1,692,993

258,045

37,039

285,467

14,722

271,912

2,560,178

661,138

29,137

48,139

180,517

3,479,109

27,404

274,560

301,964

$ 3,781,073

4.03 %

4.35

3.76

4.13

2.90

6.49

8.15

4.85

2.05

4.85

4.63

3.07

4.71

5.33

2.85

2.00

2.63

3.82

$

2022

718,346

300,070

212,704

272,931

671,987

1,080,939

136,902

3,393,879

154,093

75,956

285,301

$ 3,909,229

$ 1,785,896

241,749

49,360

268,762

10,733

250,165

2,606,665

738,083

42,159

57,792

181,116

3,625,815

33,180

250,234

283,414

$ 3,909,229

0.37 %

0.63

0.08

2.83

1.47

4.16

1.42

2.04

0.12

0.47

0.64

0.50

0.90

2.13

0.40

1.64

1.74

2.11

(a) Includes brokerage-related held-for-investment customer receivables, which are classified in accrued interest and accounts receivable, and all other interest-earning assets, which are classified in other assets, on the Consolidated Balance Sheets.

(b) Includes commercial paper.

(c) All other interest-bearing liabilities include brokerage-related customer payables.

(d) Interest includes the effect of related hedging derivatives. Taxable-equivalent amounts are used where applicable.

(e) Net yield on interest-earning assets excluding Markets is a non-GAAP financial measure. Refer to page 29 for a further discussion of this measure.

2023 Change

2022

(30)%

7

(10)

37

(8)

10

(33)

(3)

4

(16)

(3)

(3)

(5)

7

(25)

6

37

9

(2)

(10)

(31)

(17)

(4)

(17)

10

7

(3)

Page 6View entire presentation