OppFi Results Presentation Deck

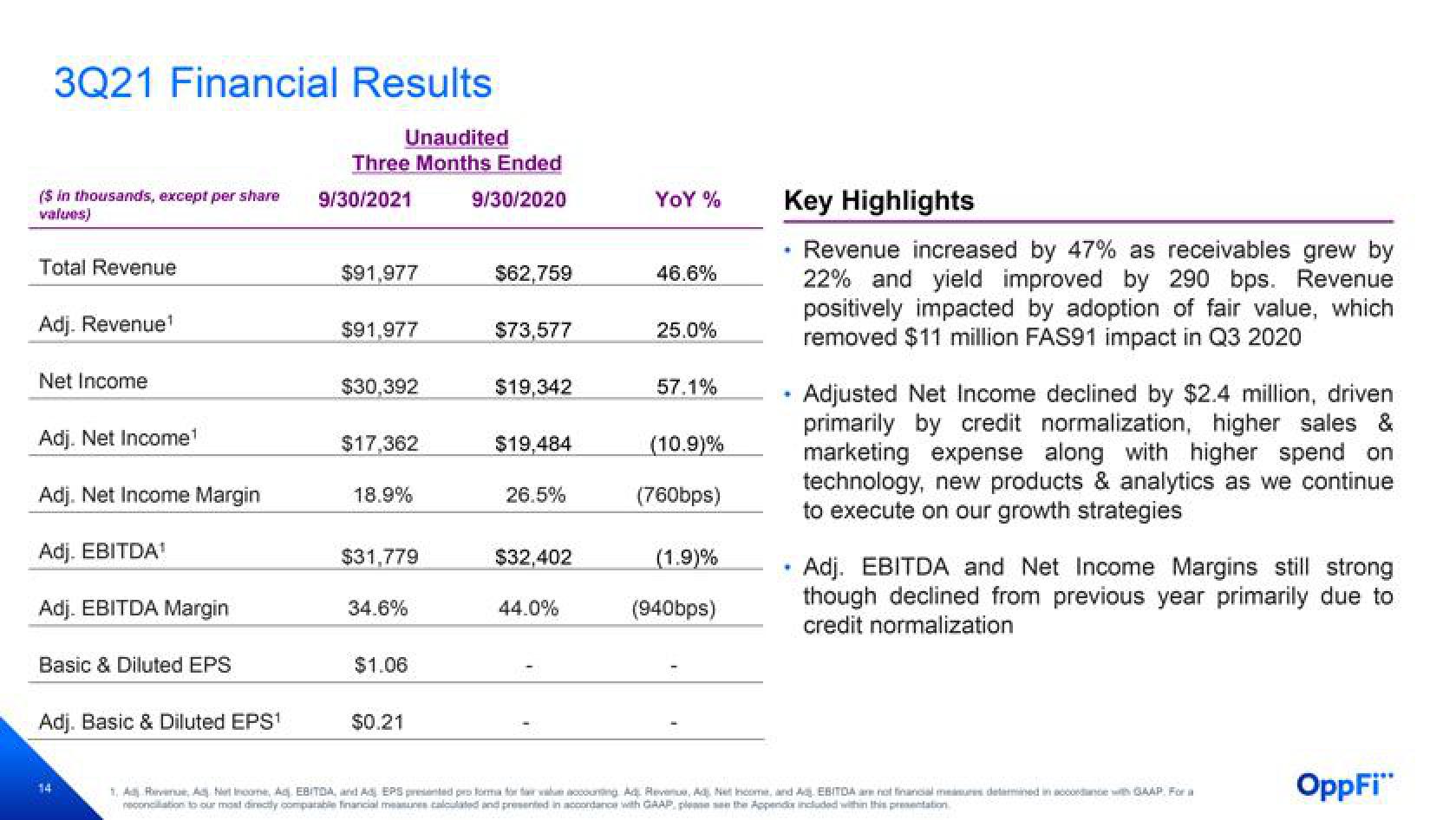

3Q21 Financial Results

($ in thousands, except per share

values)

Total Revenue

Adj. Revenue¹

Net Income

Adj. Net Income¹

Adj. Net Income Margin

Adj. EBITDA¹

Adj. EBITDA Margin

Basic & Diluted EPS

Adj. Basic & Diluted EPS¹

Unaudited

Three Months Ended

9/30/2020

9/30/2021

$91,977

$91,977

$30,392

$17,362

18.9%

$31,779

34.6%

$1.06

$0.21

$62,759

$73,577

$19,342

$19,484

26.5%

$32,402

44.0%

YOY %

46.6%

25.0%

57,1%

(10.9)%

(760bps)

(1.9)%

(940bps)

Key Highlights

Revenue increased by 47% as receivables grew by

22% and yield improved by 290 bps. Revenue

positively impacted by adoption of fair value, which

removed $11 million FAS91 impact in Q3 2020

☐

·

.

Adjusted Net Income declined by $2.4 million, driven

primarily by credit normalization, higher sales &

marketing expense along with higher spend on

technology, new products & analytics as we continue

to execute on our growth strategies

Adj. EBITDA and Net Income Margins still strong

though declined from previous year primarily due to

credit normalization

1, ARA Net Income, Adj. EBITDA, and Ad EPS presented pro form for whaccounting Ad. Revenue, A. Net Income, and Ad. EBITDA are not financialmente determined in accordance with GAAP. For a

conciliation to our most directly comparable financial measures calculated and presented in accordance with GAAP. please see the Appends included within this presentation

OppFi"View entire presentation