Paysafe SPAC Presentation Deck

Note:

(1)

(2)

(3)

(4)

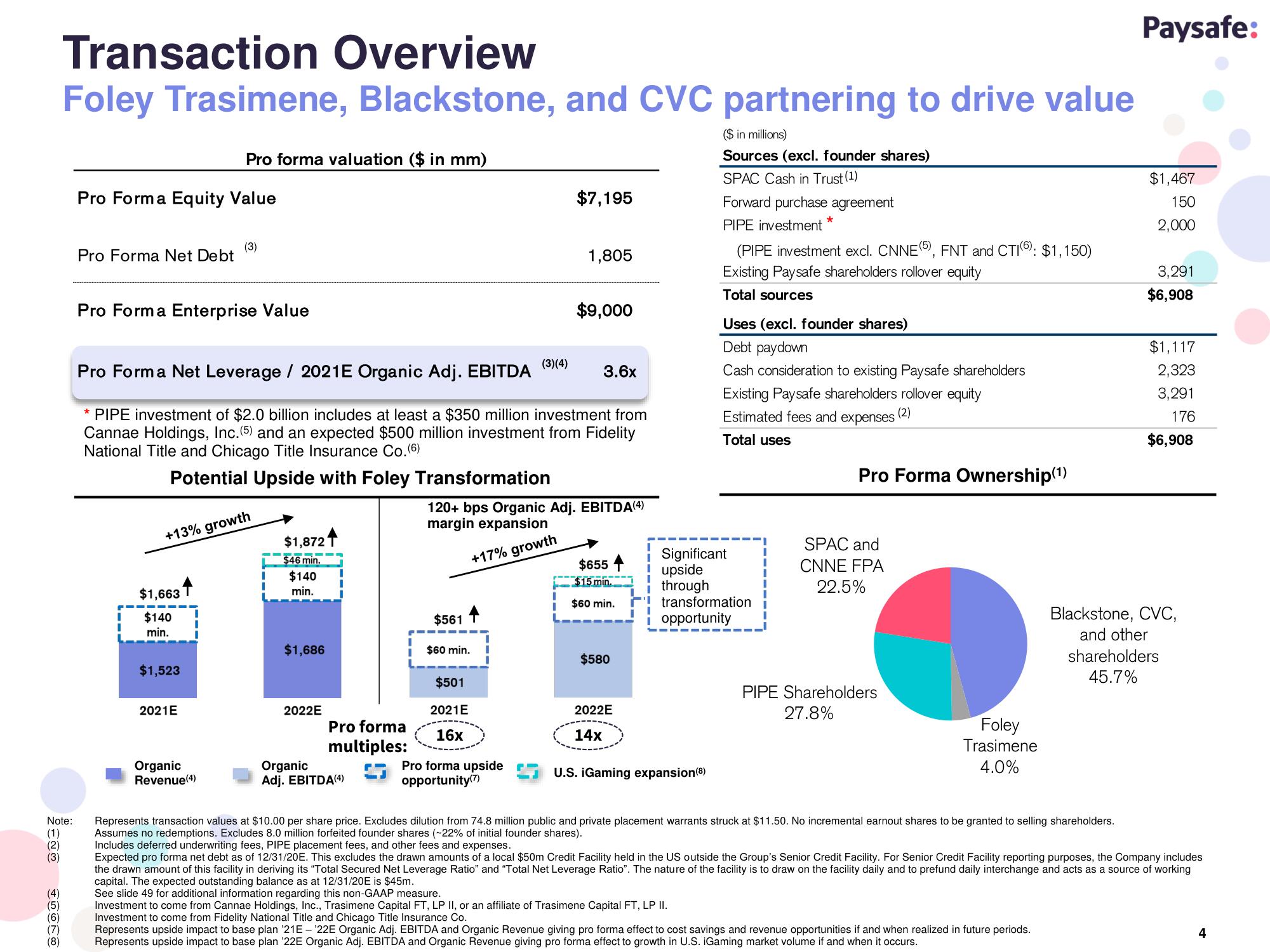

Transaction Overview

Foley Trasimene, Blackstone, and CVC partnering to drive value

(8)

Pro Forma Equity Value

Pro Forma Net Debt

Pro Forma Enterprise Value

Pro forma valuation ($ in mm)

$1,663

$140

min.

+13% growth

$1,523

(3)

2021E

Organic

Revenue (4)

Pro Forma Net Leverage / 2021E Organic Adj. EBITDA

* PIPE investment of $2.0 billion includes at least a $350 million investment from

Cannae Holdings, Inc. (5) and an expected $500 million investment from Fidelity

National Title and Chicago Title Insurance Co. (6)

Potential Upside with Foley Transformation

I

I

$1,8721

~

$46 min.

$140

min.

$1,686

2022E

I

Pro forma

multiples:

Organic

Adj. EBITDA(4)

$561

$60 min.

(3)(4)

$501

2021E

16x

$7,195

Pro forma upside

opportunity(7)

1,805

120+ bps Organic Adj. EBITDA(4)

margin expansion

+17% growth

$9,000

3.6x

$655

$15 min.

$60 min.

$580

2022E

14x

($ in millions)

Sources (excl. founder shares)

SPAC Cash in Trust (¹)

Forward purchase agreement

PIPE investment

U.S. ¡Gaming expansion (8)

*

(PIPE investment excl. CNNE(5), FNT and CTI (6): $1,150)

Existing Paysafe shareholders rollover equity

Total sources

Significan

upside

through

transformation

opportunity

Uses (excl. founder shares)

Debt paydown

Cash consideration to existing Paysafe shareholders

Existing Paysafe shareholders rollover equity

Estimated fees and expenses (2)

Total uses

Pro Forma Ownership(¹)

SPAC and

CNNE FPA

22.5%

PIPE Shareholders

27.8%

Foley

Trasimene

4.0%

Paysafe:

Represents transaction values at $10.00 per share price. Excludes dilution from 74.8 million public and private placement warrants struck at $11.50. No incremental earnout shares to be granted to selling shareholders.

Assumes no redemptions. Excludes 8.0 million forfeited founder shares (~22% of initial founder shares).

$1,467

150

2,000

3,291

$6,908

$1,117

2,323

3,291

176

$6,908

Blackstone, CVC,

and other

shareholders

45.7%

Includes deferred underwriting fees, PIPE placement fees, and other fees and expenses.

Expected pro forma net debt as of 12/31/20E. This excludes the drawn amounts of a local $50m Credit Facility held in the US outside the Group's Senior Credit Facility. For Senior Credit Facility reporting purposes, the Company includes

the drawn amount of this facility in deriving its "Total Secured Net Leverage Ratio" and "Total Net Leverage Ratio". The nature of the facility is to draw on the facility daily and to prefund daily interchange and acts as a source of working

capital. The expected outstanding balance as at 12/31/20E is $45m.

See slide 49 for additional information regarding this non-GAAP measure.

Investment to come from Cannae Holdings, Inc., Trasimene Capital FT, LP II, or an affiliate of Trasimene Capital FT, LP II.

Investment to come from Fidelity National Title and Chicago Title Insurance Co.

Represents upside impact to base plan '21E - '22E Organic Adj. EBITDA and Organic Revenue giving pro forma effect to cost savings and revenue opportunities if and when realized in future periods.

Represents upside impact to base plan '22E Organic Adj. EBITDA and Organic Revenue giving pro forma effect to growth in U.S. iGaming market volume if and when it occurs.

4View entire presentation