Bank of America Investment Banking Pitch Book

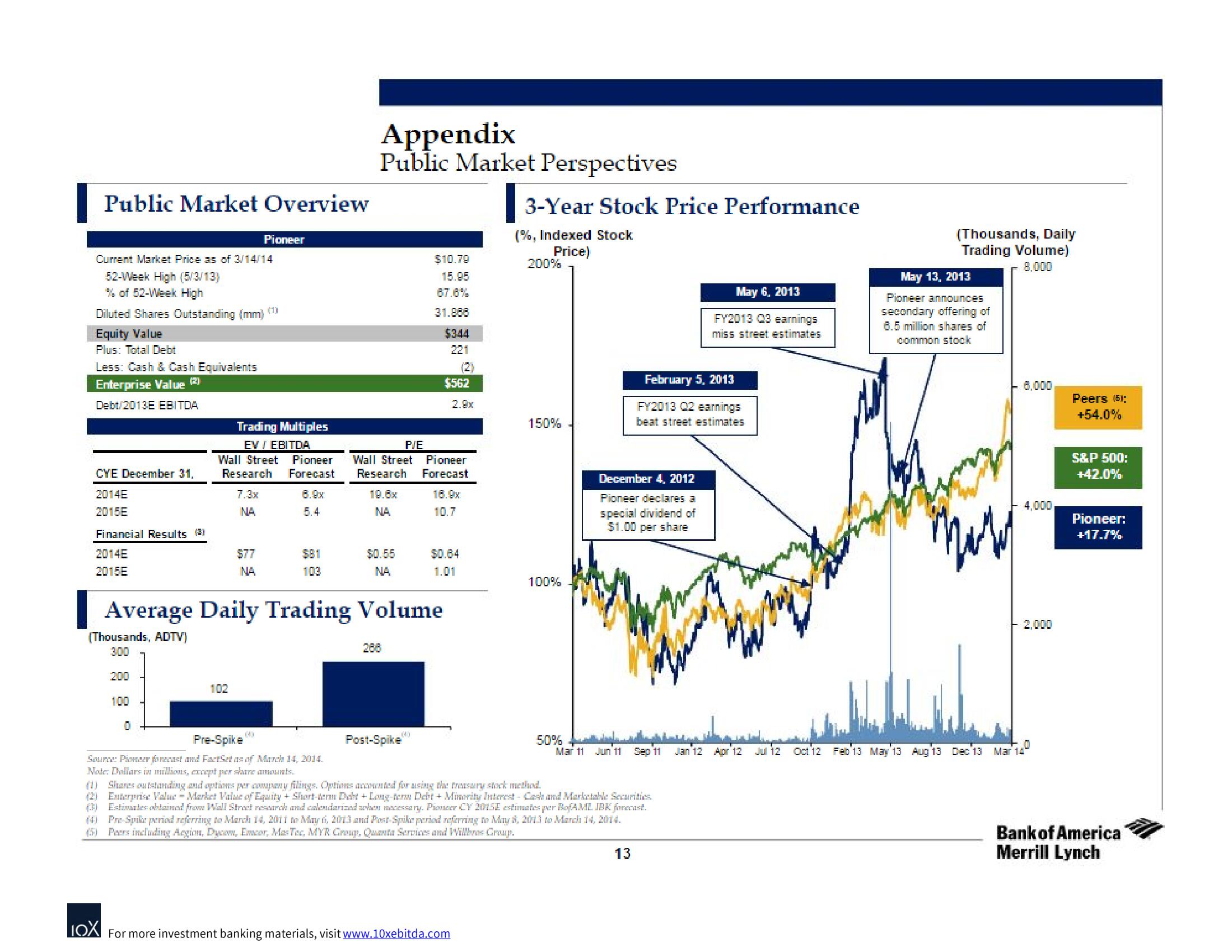

Public Market Overview

Cu

Pric as

52-Week High (5/3/13)

% of 52-Week High

Diluted Shares Outstanding (mm) (1)

Equity Value

Plus: Total Debt

Less: Cash & Cash Equivalents

Enterprise Value (2)

Debt/2013E EBITDA

CYE December 31,

2014E

2015E

Financial Results (3)

2014E

2015E

Trading Multiples

EV / EBITDA

Wall Street Pioneer

Research

7.3x

NA

Pioneer

$77

NA

co

Appendix

Public Market Perspectives

103

$0.55

NA

PIE

Pioneer

Wall Street

Forecast Research Forecast

8.9x

19.6x

16.0x

5.4

NA

10.7

$10.79

15.95

67.6%

31.888

Average Daily Trading Volume

(Thousands, ADTV)

300

200

100

0

(4)

$344

221

Post-Spike

$562

$0.64

1.01

3-Year Stock Price Performance

(%, Indexed Stock

Price)

LOX For more investment banking materials, visit www.10xebitda.com

200%

150%

100%

Pre-Spike

Source: Pioneer forecast and FactSet as of March 14, 2014.

Note: Dollars in millions, except per share amounts

(1) Shares outstanding and options per company filings. Options accounted for using the treasury stock method.

(2) Exterprise Value Market Value of Equity+ Short-teru Debt +Long-term Debt + Minority Interest - Cash and Marketable Securities

(3) Estimates obtained from Wall Street research and calendarizad when necessary. Pioneer CY 2015E estimates per BofAML JBK forecast.

(4) Pre-Spike period referring to March 14, 2011 to May 6, 2013 and Post-Spike period referring to May 8, 2013 to Manci 14, 2014.

(5) Parrs including Acgion, Dycom, Emor, Mas Tec, MYR Group, Quanta Services and Willbras Group.

50%

December 4, 2012

Pioneer declares a

special dividend of

$1.00 per share

February 5, 2013

FY2013 Q2 earnings

beat street estimates

13

May 6, 2013

FY2013 Q3 earnings

miss street estimates

wwwww

Mar 11 Jun 11 Sep '11

Jan 12 Apr 12 Ju 12

(Thousands, Daily

Trading Volume)

8,000

May 13, 2013

Pioneer announces

secondary offering of

6.5 million shares of

common stock

6,000

4,000

2,000

Oct 12 Feb'13 May 13 Aug13 Dec'13 Mar 14

Peers (51:

+54.0%

S&P 500:

+42.0%

Pioneer:

+17.7%

Bank of America

Merrill LynchView entire presentation