Masterworks Investor Presentation Deck

Index (1995 = 1)

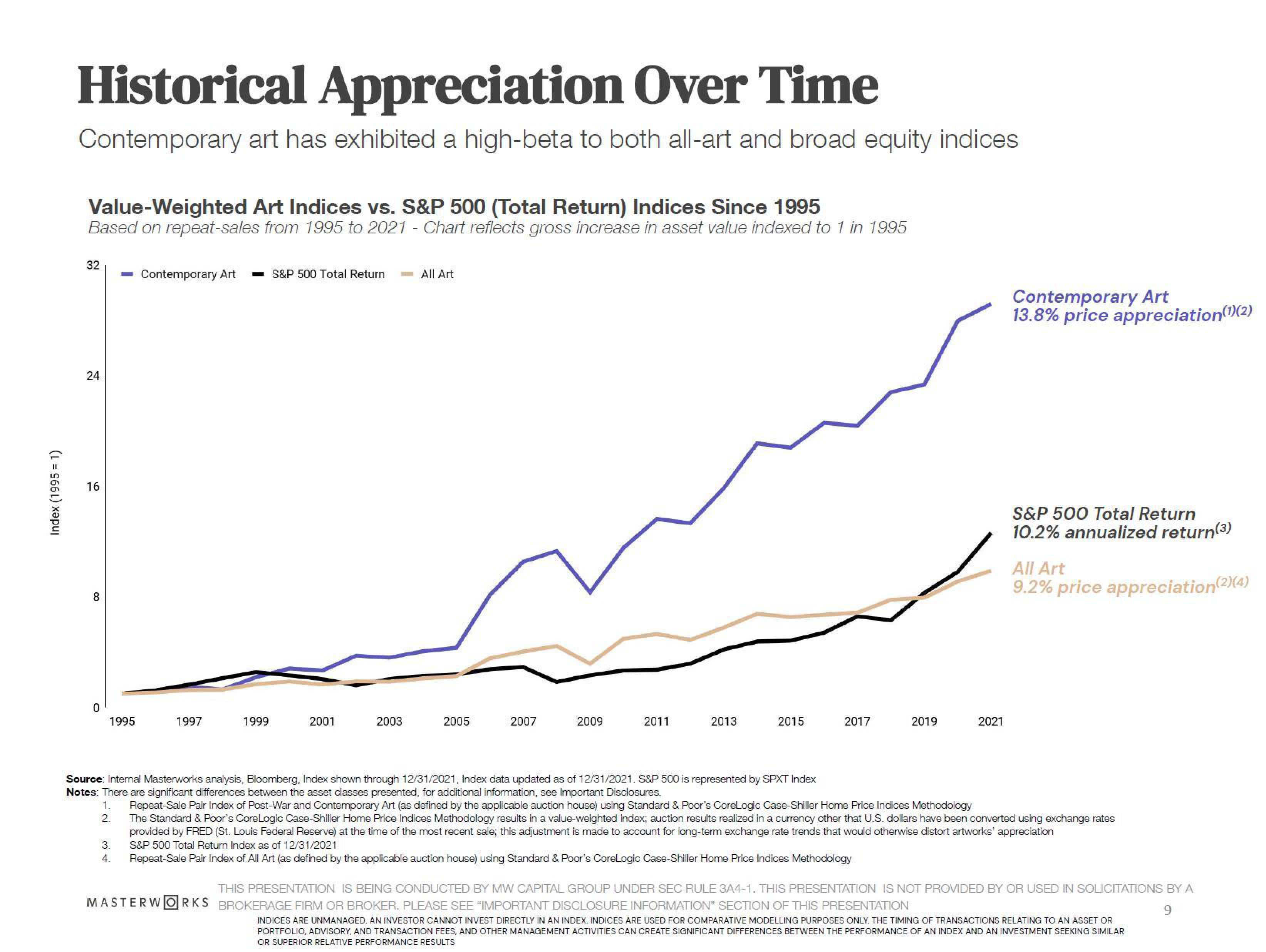

Historical Appreciation Over Time

Contemporary art has exhibited a high-beta to both all-art and broad equity indices

Value-Weighted Art Indices vs. S&P 500 (Total Return) Indices Since 1995

Based on repeat-sales from 1995 to 2021 - Chart reflects gross increase in asset value indexed to 1 in 1995

32

24

16

8

0

1995

Contemporary Art - S&P 500 Total Return

3.

4

1997

1999

2001

2003

All Art

2005

2007

2009

2011

2013

2015

2017

2019

Source: Internal Masterworks analysis, Bloomberg, Index shown through 12/31/2021, Index data updated as of 12/31/2021. S&P 500 is represented by SPXT Index

Notes: There are significant differences between the asset classes presented, for additional information, see Important Disclosures.

1. Repeat-Sale Pair Index of Post-War and Contemporary Art (as defined by the applicable auction house) using Standard & Poor's CoreLogic Case-Shiller Home Price Indices Methodology

2.

2021

Contemporary Art

13.8% price appreciation(1)(2)

S&P 500 Total Return

10.2% annualized return(3)

All Art

9.2% price appreciation (2)(4)

The Standard & Poor's CoreLogic Case-Shiller Home Price Indices Methodology results in a value-weighted index; auction results realized in a currency other that U.S. dollars have been converted using exchange rates

provided by FRED (St. Louis Federal Reserve) at the time of the most recent sale; this adjustment is made to account for long-term exchange rate trends that would otherwise distort artworks' appreciation

S&P 500 Total Return Index as of 12/31/2021

Repeat-Sale Pair Index of All Art (as defined by the applicable auction house) using Standard & Poor's CoreLogic Case-Shiller Home Price Indices Methodology

THIS PRESENTATION IS BEING CONDUCTED BY MW CAPITAL GROUP UNDER SEC RULE 3A4-1. THIS PRESENTATION IS NOT PROVIDED BY OR USED IN SOLICITATIONS BY A

MASTERWORKS BROKERAGE FIRM OR BROKER. PLEASE SEE "IMPORTANT DISCLOSURE INFORMATION" SECTION OF THIS PRESENTATION

9

INDICES ARE UNMANAGED. AN INVESTOR CANNOT INVEST DIRECTLY IN AN INDEX. INDICES ARE USED FOR COMPARATIVE MODELLING PURPOSES ONLY. THE TIMING OF TRANSACTIONS RELATING TO AN ASSET OR

PORTFOLIO, ADVISORY, AND TRANSACTION FEES, AND OTHER MANAGEMENT ACTIVITIES CAN CREATE SIGNIFICANT DIFFERENCES BETWEEN THE PERFORMANCE OF AN INDEX AND AN INVESTMENT SEEKING SIMILAR

OR SUPERIOR RELATIVE PERFORMANCE RESULTSView entire presentation