Taboola Investor Presentation Deck

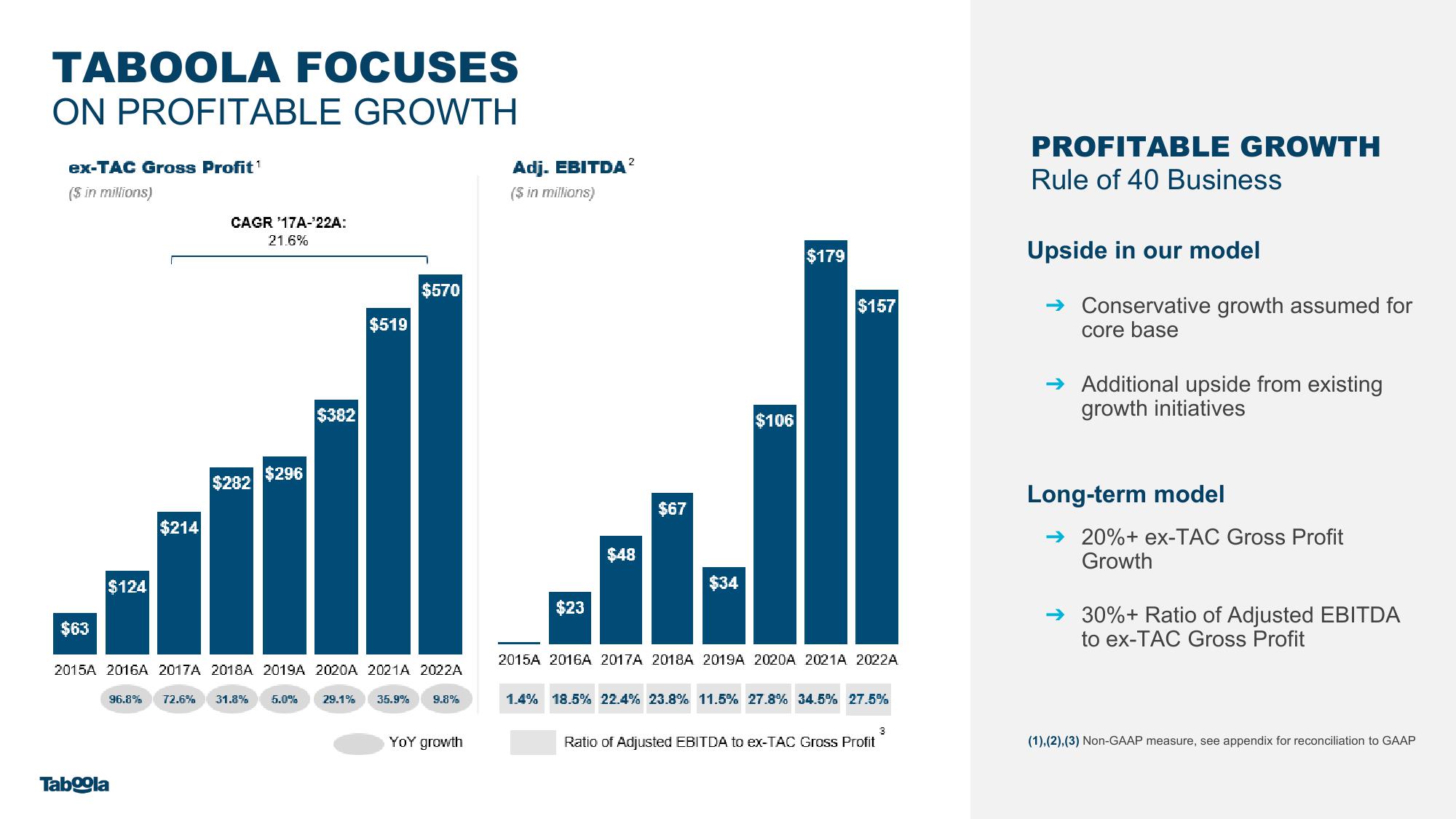

TABOOLA FOCUSES

ON PROFITABLE GROWTH

ex-TAC Gross Profit ¹

($ in millions)

$124

$214

Taboola

CAGR '17A-¹22A:

$282

21.6%

$296

$382

$519

$570

$63

2015A 2016A 2017A 2018A 2019A 2020A 2021A 2022A

96.8% 72.6% 31.8% 5.0% 29.1% 35.9% 9.8%

YOY growth

Adj. EBITDA²

($ in millions)

$23

$48

$67

$34

$106

$179

$157

2015A 2016A 2017A 2018A 2019A 2020A 2021A 2022A

1.4% 18.5% 22.4% 23.8% 11.5% 27.8% 34.5% 27.5%

Ratio of Adjusted EBITDA to ex-TAC Gross Profit

3

PROFITABLE GROWTH

Rule of 40 Business

Upside in our model

Conservative growth assumed for

core base

→ Additional upside from existing

growth initiatives

Long-term model

20%+ ex-TAC Gross Profit

Growth

→ 30% + Ratio of Adjusted EBITDA

to ex-TAC Gross Profit

(1), (2), (3) Non-GAAP measure, see appendix for reconciliation to GAAPView entire presentation