Topps SPAC Presentation Deck

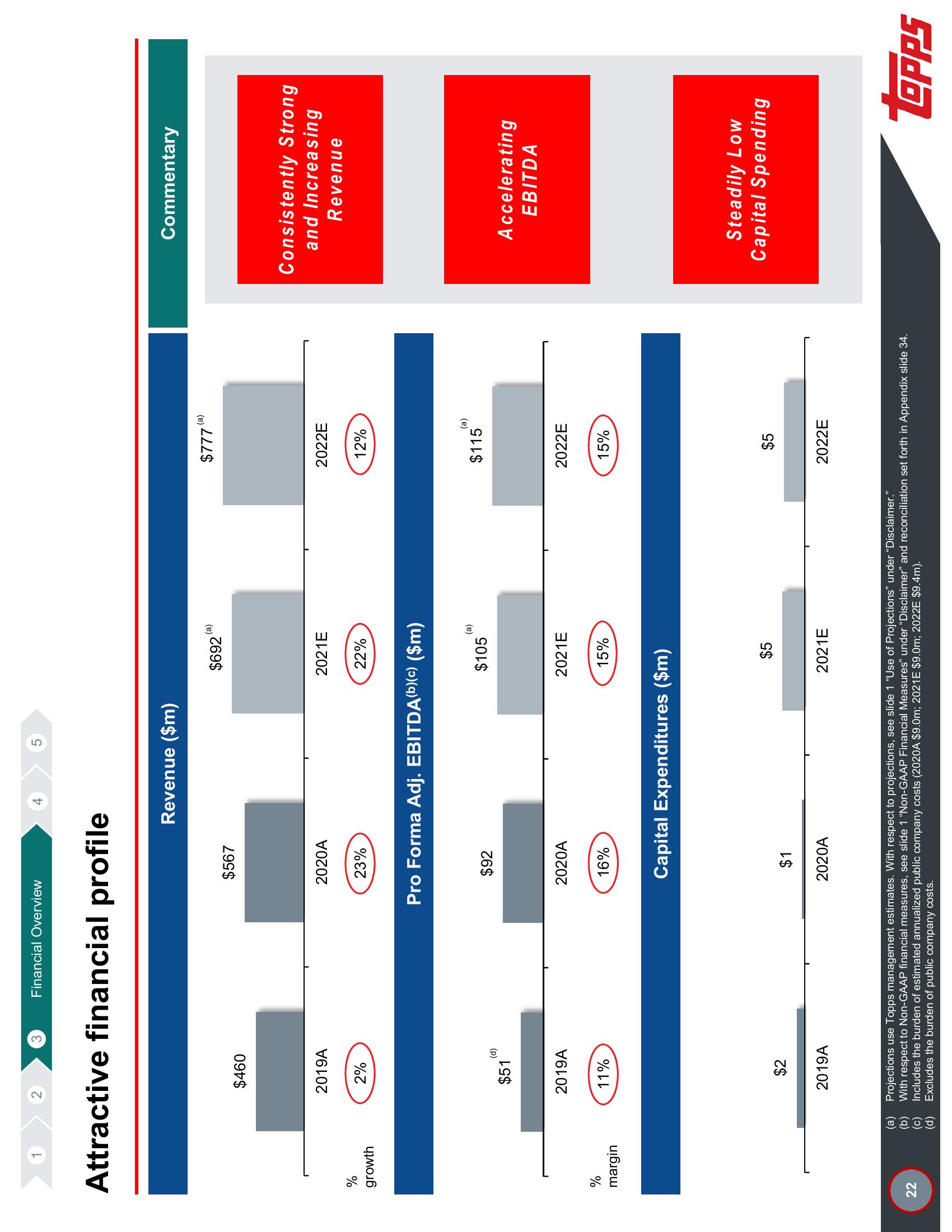

%

growth

%

margin

Attractive financial profile

22

2

(C)

(d)

$460

2019A

2%

$51

(d)

2019A

11%

$2

3

2019A

Financial Overview

$567

2020A

23%

$92

2020A

16%

4

$1

5

2020A

Revenue ($m)

Pro Forma Adj. EBITDA(b)(c) ($m)

$692

2021E

22%

$105

Capital Expenditures ($m)

(a)

15%

2021E

$5

(a)

2021E

$777

2022E

12%

$115

(a)

15%

(a)

2022E

$5

2022E

(a) Projections use Topps management estimates. With respect to projections, see slide 1 "Use of Projections" under "Disclaimer."

(b)

With respect to Non-GAAP financial measures, see slide 1 "Non-GAAP Financial Measures" under "Disclaimer" and reconciliation set forth in Appendix slide 34.

Includes the burden of estimated annualized public company costs (2020A $9.0m; 2021E $9.0m; 2022E $9.4m).

Excludes the burden of public company costs.

Commentary

Consistently Strong

and Increasing

Revenue

Accelerating

EBITDA

Steadily Low

Capital Spending

toppsView entire presentation