Evotec Results Presentation Deck

in € m¹)

evotec

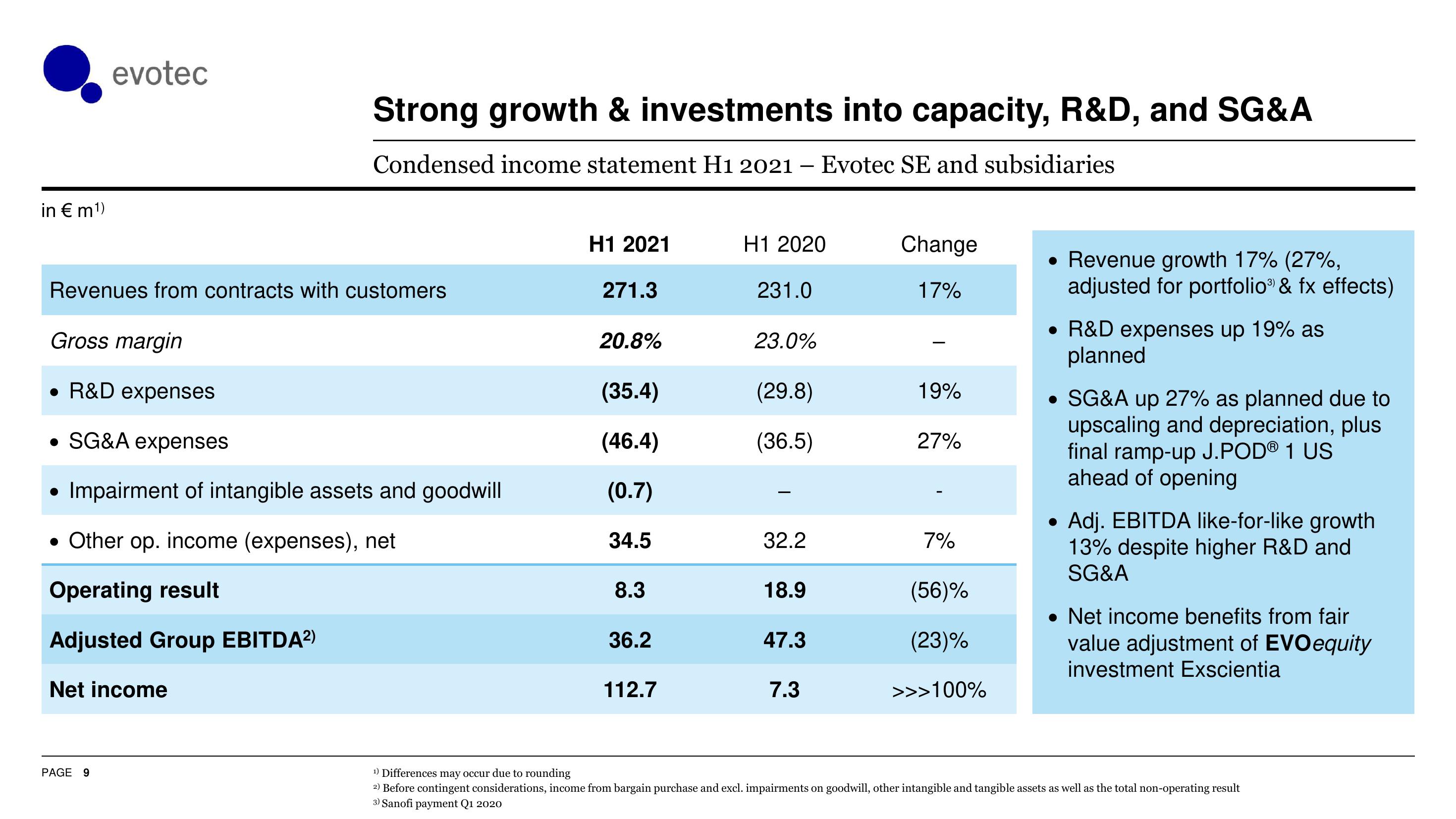

Revenues from contracts with customers

Gross margin

Strong growth & investments into capacity, R&D, and SG&A

Condensed income statement H1 2021 – Evotec SE and subsidiaries

R&D expenses

• SG&A expenses

• Impairment of intangible assets and goodwill

• Other op. income (expenses), net

Operating result

Adjusted Group EBITDA²)

Net income

PAGE 9

H1 2021

271.3

20.8%

(35.4)

(46.4)

(0.7)

34.5

8.3

36.2

112.7

H1 2020

231.0

23.0%

(29.8)

(36.5)

32.2

18.9

47.3

7.3

Change

17%

19%

27%

7%

(56)%

(23)%

>>>100%

• Revenue growth 17% (27%,

adjusted for portfolio & fx effects)

• R&D expenses up 19% as

planned

• SG&A up 27% as planned due to

upscaling and depreciation, plus

final ramp-up J.PODⓇ 1 US

ahead of opening

Adj. EBITDA like-for-like growth

13% despite higher R&D and

SG&A

• Net income benefits from fair

value adjustment of EVO equity

investment Exscientia

¹) Differences may occur due to rounding

2) Before contingent considerations, income from bargain purchase and excl. impairments on goodwill, other intangible and tangible assets as well as the total non-operating result

3) Sanofi payment Q1 2020View entire presentation