Pershing Square Activist Presentation Deck

D

A Revised Proposal for Creating Value

at McDonald's

Based on an approximate

$48 sum-of-the-parts

value for McDonald's

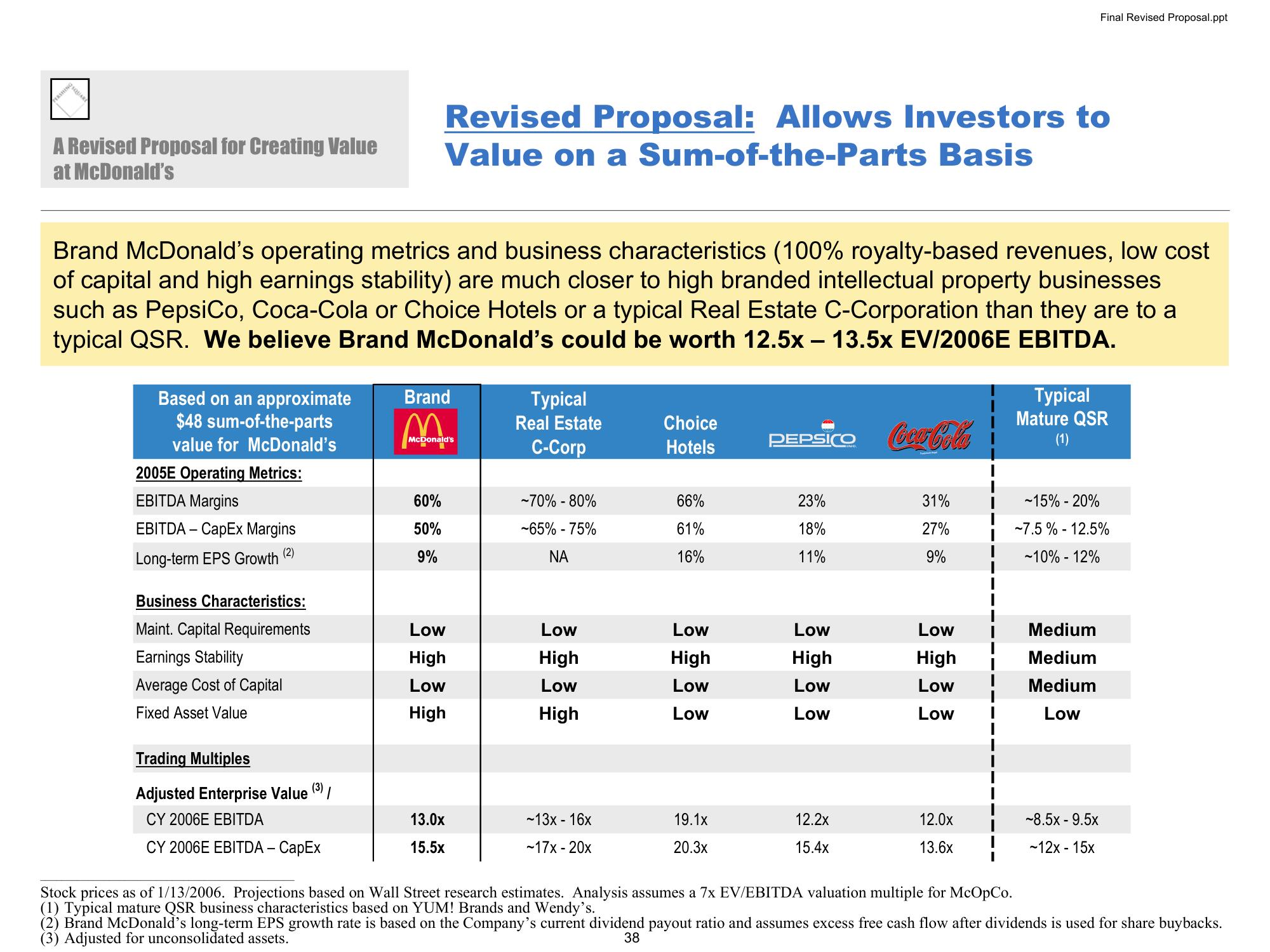

Brand McDonald's operating metrics and business characteristics (100% royalty-based revenues, low cost

of capital and high earnings stability) are much closer to high branded intellectual property businesses

such as PepsiCo, Coca-Cola or Choice Hotels or a typical Real Estate C-Corporation than they are to a

typical QSR. We believe Brand McDonald's could be worth 12.5x13.5x EV/2006E EBITDA.

2005E Operating Metrics:

EBITDA Margins

EBITDA - CapEx Margins

Long-term EPS Growth

(2)

Business Characteristics:

Maint. Capital Requirements

Earnings Stability

Average Cost of Capital

Fixed Asset Value

Trading Multiples

Adjusted Enterprise Value (³) /

CY 2006E EBITDA

CY 2006E EBITDA - CapEx

Revised Proposal: Allows Investors to

Value on a Sum-of-the-Parts Basis

Brand

McDonald's

60%

50%

9%

Low

High

Low

High

13.0x

15.5x

Typical

Real Estate

C-Corp

-70% - 80%

-65% -75%

ΝΑ

Low

High

Low

High

~13x - 16x

~17x - 20x

Choice

Hotels

66%

61%

16%

Low

High

Low

Low

19.1x

20.3x

PEPSICO

23%

18%

11%

Low

High

Low

Low

12.2x

15.4x

Coca-Cola

31%

27%

9%

Low

High

Low

Low

12.0x

13.6x

Final Revised Proposal.ppt

Typical

Mature QSR

(1)

~15% - 20%

-7.5% -12.5%

-10% -12%

Medium

Medium

Medium

Low

~8.5x - 9.5x

~12x - 15x

Stock prices as of 1/13/2006. Projections based on Wall Street research estimates. Analysis assumes a 7x EV/EBITDA valuation multiple for McOpCo.

(1) Typical mature QSR business characteristics based on YUM! Brands and Wendy's.

(2) Brand McDonald's long-term EPS growth rate is based on the Company's current dividend payout ratio and assumes excess free cash flow after dividends is used for share buybacks.

(3) Adjusted for unconsolidated assets.

38View entire presentation